Please use a PC Browser to access Register-Tadawul

Roblox (RBLX) Unveils New Licensing Platform With Netflix And Sega Partnerships

Roblox RBLX | 87.44 | +0.55% |

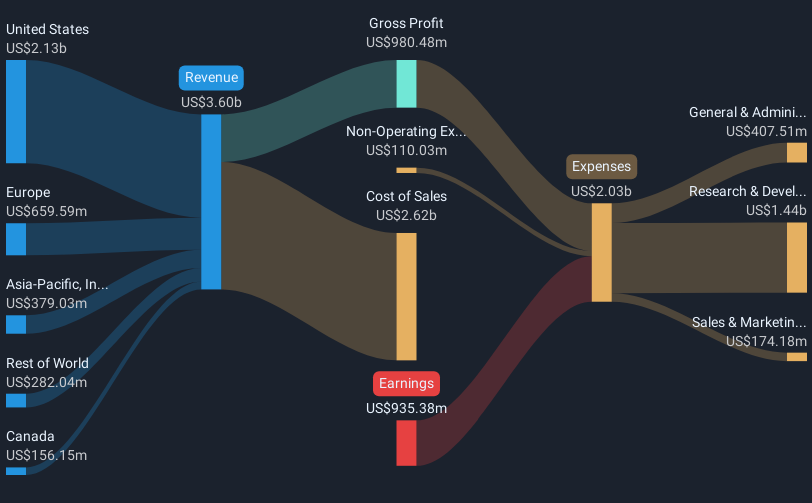

Roblox (RBLX) recently launched an innovative licensing platform that includes partners such as Netflix and Lionsgate, aiming to simplify the licensing of intellectual properties for creators. This initiative aligns with a broader tech rally, as evidenced by Nvidia and other semiconductor stocks contributing to a tech-heavy Nasdaq rise. During the last quarter, Roblox saw its stock price soar by nearly 90%, likely buoyed by these developments and the general investor confidence in tech stocks, despite a broader market that was mixed following inflation data and financial sector earnings. Such progress likely reinforced investor optimism regarding Roblox's future growth potential.

The recent launch of Roblox's licensing platform has the potential to significantly enhance user engagement through partnerships with major players like Netflix and Lionsgate, while also potentially boosting future revenue. This development aligns with key strategic initiatives such as AI-driven enhancements and international market expansions, reinforcing the narrative of potential growth through diversified revenue streams. Over the past three years, Roblox has achieved a substantial total return of 181.33%, indicating strong long-term shareholder value despite current unprofitability. Additionally, over the past year, Roblox's performance exceeded both the US market and the Entertainment industry, which saw returns of 11.4% and 67.6%, respectively.

With a current share price of US$111.83, which is above the analyst price target of US$87.04, it highlights optimism among investors about the company's growth prospects. However, the need for Roblox to address unprofitability and execution risks remains critical to meeting earnings forecasts. The anticipated developments from AI and licensing initiatives could drive substantial future growth, yet analysts project a revenue increase of 17.9% annually, slower than assumed robust industry expansion. Investors should weigh the current price premium against potential upside from growing market presence and improved operational efficiencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.