Rocket Companies (NYSE:RKT) Reports Revenue Decline And Net Loss For Q1 2025

Rocket Companies RKT | 0.00 |

Rocket Companies (NYSE:RKT) reported a challenging first quarter in 2025, with revenue declining to $1,037 million from $1,384 million in the previous year, alongside a net loss of $10 million. These financial results, revealing a marked shift from profit to loss, likely contributed to the company's 8% share price decline over the last quarter. Additionally, broader market trends showed a mild uplift, with stock indexes gradually increasing, albeit tempered by geopolitical uncertainties around U.S.-China tariff talks. This context highlights how Rocket's specific challenges may have weighed more heavily on its performance relative to an overall slightly positive market environment.

The recent news of Rocket Companies (NYSE:RKT) experiencing a challenging first quarter in 2025, with revenue declining to US$1.04 billion and posting a net loss of US$10 million, could compound issues outlined in the overall company narrative. While efforts in AI-driven automation aim to enhance efficiency and boost margins, the immediate impact of these financial results may cause investors to reassess the company's ability to realize this potential in the near term, given the increased marketing spend and competitive pressures. The price target of US$14.50 compared to a current share price of US$15.77 suggests market expectations may be optimistic.

Over the past three years, Rocket Companies' total shareholder return, including share price increases and dividends, reached a significant 55.25%. However, in the last year, RKT underperformed both the US Diversified Financial industry and the broader US market, with industry and market returns at 20% and 8.2% respectively. This underscores a disconnect between the company’s recent performance compared to its past longer-term gains.

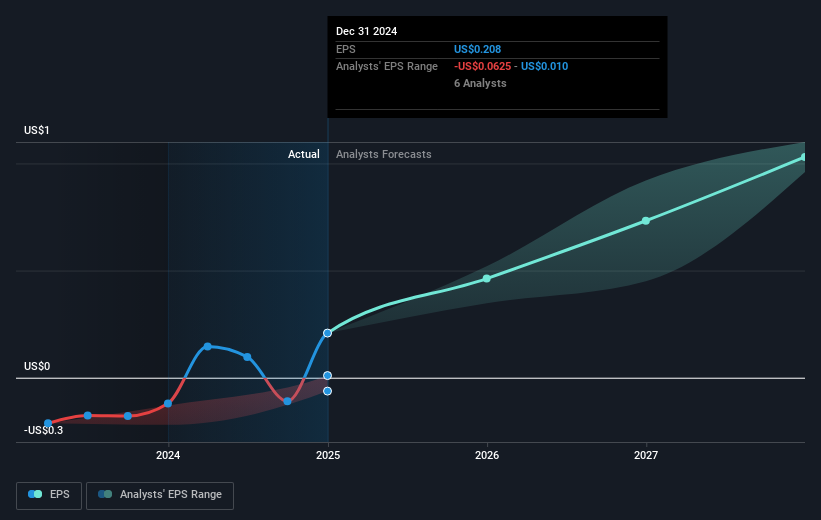

The recent first quarter results could influence revenue and earnings forecasts, emphasizing the importance of new product launches and increased market share. Analysts expect revenue to grow 14.9% annually, with earnings set to increase by 37.8% yearly over the next three years, indicating optimism despite current financial challenges. This optimism hinges on the effective implementation of their AI and marketing strategies to sustain growth. With a current price exceeding the analyst consensus of US$13.71, the market may need a reassessment to align expectations with the company's financial realities and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Sahm Platform 02/12 07:10

TJX Companies Q3 International Segment Profit Margin Rises to 9.2%, Up 1.9 Points

Reuters 02/12 16:20Lument Finance Trust CFO James A. Briggs Reports Acquisition of Common Shares

Reuters 02/12 21:10Director Matthew Rizik Reports Disposal of Rocket Companies Inc. Common Shares

Reuters 02/12 21:10PennyMac Mortgage Investment Trust (PMT): Assessing Valuation After Recent Share Price Rebound

Simply Wall St 03/12 15:26Starwood Property Trust Inc. Publishes Third Quarter 2025 Earnings Call Transcript

Reuters 03/12 18:34Director Ralph F. Rosenberg Reports Sale of KKR Real Estate Finance Trust Inc. Common Shares

Reuters 03/12 22:14Director and 10% Owner Leonard M. Tannenbaum Reports Acquisition of Advanced Flower Capital Inc. Common Shares

Reuters Today 00:56