Please use a PC Browser to access Register-Tadawul

Roper Technologies Gears Up For Q1 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Roper Technologies, Inc. ROP | 445.86 | 0.00% |

Roper Technologies, Inc. (NASDAQ:ROP) will release earnings results for the first quarter, before the opening bell on Monday, April 28.

Analysts expect the Sarasota, Florida-based company to report quarterly earnings at $4.74 per share, up from $4.41 per share in the year-ago period. Roper Technologies projects to report quarterly revenue at $1.88 billion, compared to $1.68 billion a year earlier, according to data from Benzinga Pro.

On March 24, Roper Technologies disclosed a deal to acquire CentralReach from Insight Partners for a net purchase price of around $1.65 billion.

Roper Technologies shares fell 0.4% to close at $557.70 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

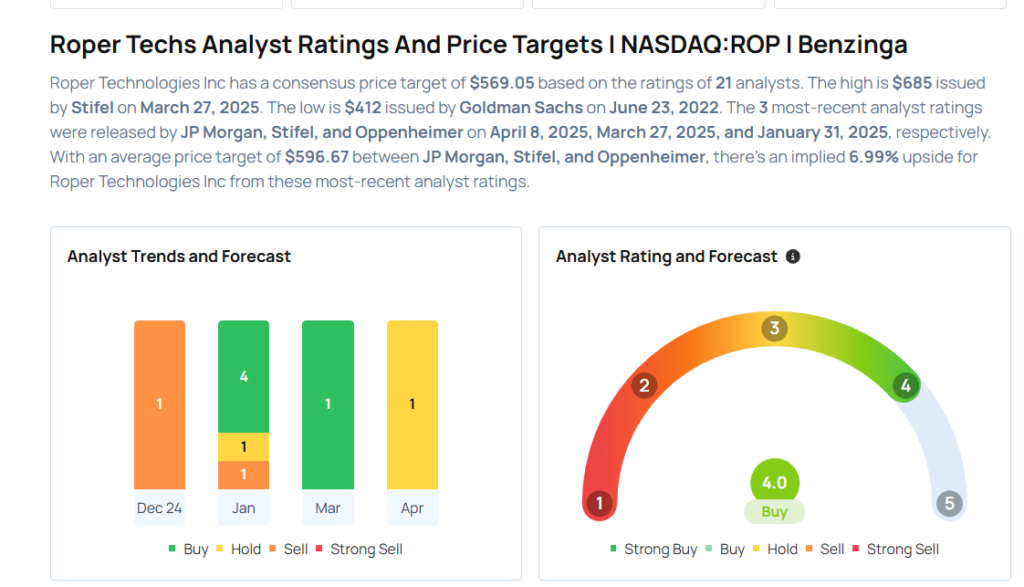

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Stephen Tusa maintained a Neutral rating and cut the price target from $558 to $465 on April 8, 2025. This analyst has an accuracy rate of 66%.

- Stifel analyst Brad Reback initiated coverage on the stock with a Buy rating and a price target of $685 on March 27, 2025. This analyst has an accuracy rate of 71%.

- Oppenheimer analyst Christopher Glynn maintained an Outperform rating and raised the price target from $630 to $640 on Jan. 31, 2025. This analyst has an accuracy rate of 77%.

- Raymond James analyst Brian Gesuale reiterated a Strong Buy rating and increased the price target from $620 to $655 on Jan. 31, 2025. This analyst has an accuracy rate of 74%.

- Barclays analyst Julian Mitchell maintained an Underweight rating and cut the price target from $569 to $562 on Jan. 8, 2025. This analyst has an accuracy rate of 72%.

Considering buying ROP stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Real Estate Stocks Delivering High-Dividend Yields

Photo via Shutterstock