Please use a PC Browser to access Register-Tadawul

RTX (NYSE:RTX) Stock Surges 10% Over Last Week

RAYTHEON TECHNOLOGIES CORPORATION RTX | 196.74 196.00 | -3.32% -0.38% Pre |

RTX (NYSE:RTX) recently made waves with key developments from Pratt & Whitney introducing an innovative repair method using Directed Energy Deposition 3D printing, along with Raytheon securing contracts for rocket motor development. These moves underscore RTX's commitment to technological advancements and strategic partnerships in aerospace and defense. Over the past week, RTX experienced a 10% price increase, compared to the market's 7% rise. In parallel, broader market trends showed banking and tech stocks pushing indexes higher, signaling optimism despite ongoing U.S.-China trade tensions. Pratt & Whitney's advancements and Raytheon's contracts likely complemented these broader upswings.

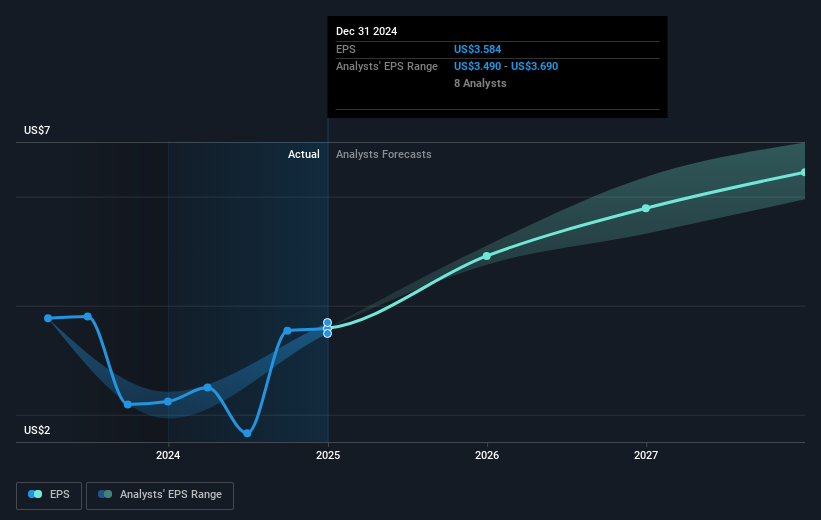

The advancements at Pratt & Whitney and the Raytheon contracts bolster RTX's narrative of focusing on technological improvements and expanding its share in aerospace and defense markets. These developments could potentially enhance future revenue streams and earnings by strengthening its product offerings and operational efficiency. The introduction of innovative repair methods, like the Directed Energy Deposition 3D printing, could cut production costs, thereby supporting RTX's long-term investment in operational efficiency and bolstering future earnings margins. Raytheon's contract wins further reinforce the company's defense segment growth as global defense spending ramps up, creating positive momentum for RTX's projected annual revenue growth of 5.4% over the next few years.

Over the past five years, RTX achieved a total shareholder return of 125.15%, highlighting its historical performance strength. In comparison, RTX's gains in the last year outpaced both the overall US market, which posted a 5.9% return, and the US Aerospace & Defense industry, which returned 21.1%. This superior shorter-term performance may indicate effective alignment with market opportunities and internal operational improvements. The company's current share price of US$120.46 sits approximately 15% below the consensus price target of US$141.79, indicating analysts may expect continued positive developments to drive further growth. As such, the implementation of key technological advancements and strategic contract acquisitions remains crucial for meeting or exceeding these forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.