Please use a PC Browser to access Register-Tadawul

RTX (RTX) Secures US$205 Million Contract for Navy's Phalanx CIWS Production

RAYTHEON TECHNOLOGIES CORPORATION RTX | 196.74 196.00 | -3.32% -0.38% Pre |

Raytheon Technologies (RTX) recently secured a $205 million contract with the U.S. Navy for the Phalanx Close-In Weapon System, a noteworthy development amid the recent 14% rise in RTX's stock price over the past quarter. This contract, alongside a $250 million deal with Japan's Mitsubishi Electric Corporation for missile kit production, likely supported this upward trend. Concurrently, the broader market saw modest gains, buoyed by expectations of Federal Reserve interest rate cuts. RTX's performance aligns with these trends, as positive client announcements and market conditions likely contributed to the company's robust price movement.

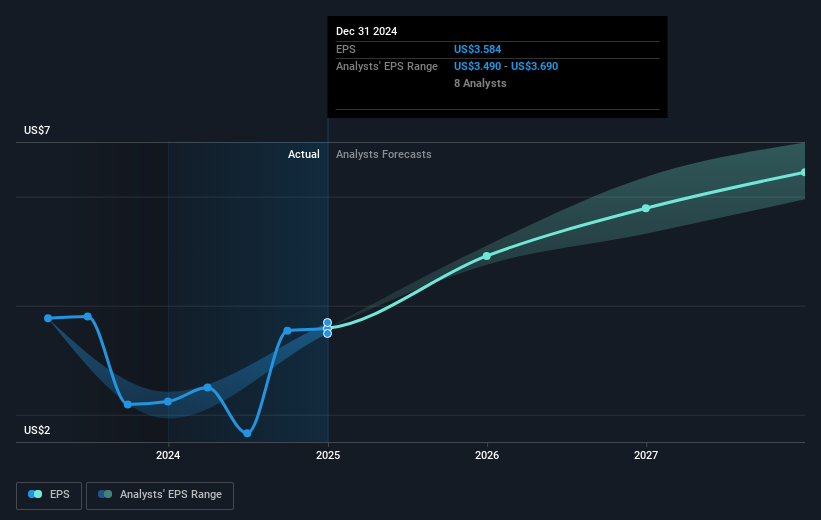

The recent contracts secured by Raytheon Technologies (RTX) with the U.S. Navy and Japan's Mitsubishi Electric Corporation provide a favorable backdrop to the company's narrative, emphasizing its expanding defense portfolio and robust international presence. Such agreements enhance RTX's revenue visibility and may contribute positively to its earnings forecasts. Given the $205 million and $250 million deal sizes, these contracts should drive incremental revenue growth and support profit margin improvement, aligning with analysts' expectations of gradual revenue and profit expansion over the coming years.

Over the past five years, RTX's total shareholder returns, including share price appreciation and dividends, reached 186.03%, underscoring its strong long-term performance. This significant upward trend indicates the value shareholders have realized as the company has maneuvered through industry and market challenges. In the past year, however, RTX's performance lagged behind the broader Aerospace & Defense industry, which saw a return of 33.7%, while RTX underperformed.

The current share price of $157.52 positions RTX slightly below the analyst consensus price target of $163.68. This indicates a slight discount, suggesting potential upside if the company continues to meet or exceed growth expectations. With its substantial revenue backlog and a focus on technology and portfolio optimization, RTX is poised to leverage these defense contracts for sustained growth, even as analysts express a relatively modest expectation for stock price appreciation in the short term. By aligning with long-term defense spending trends, RTX can potentially achieve forecasts and bridge the gap towards its price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.