Please use a PC Browser to access Register-Tadawul

Rubrik (RBRK): Evaluating Valuation After Q2 Earnings Beat, Rapid Growth, and New AI Security Launches

Rubrik Inc. RBRK | 82.17 | +0.78% |

Rubrik (RBRK) shares attracted fresh attention this week after the company reported Q2 2026 results with 51% revenue growth and strong gains in subscription revenues, indicating a pickup in underlying business momentum.

After Rubrik’s impressive Q2 results and its rollout of the Okta Recovery platform, the stock has seen momentum pick up, with a 1-year total shareholder return of 1.57%. These moves, along with high-profile partnerships and AI-driven offerings, are feeding optimism around Rubrik’s growth strategy and long-term prospects.

If innovative security launches like these spark your curiosity, you may want to see which other tech leaders are making waves right now. See the full list for free.

But with analyst upgrades and a growing focus on its growth narrative, the real question now is whether the recent jump still leaves Rubrik undervalued, or if the market has already priced in all that future potential. Is this a genuine buying window, or are investors chasing momentum?

Most Popular Narrative: 27.1% Undervalued

With Rubrik’s last close at $83.94 and the most-followed narrative setting fair value significantly higher, there is a striking divergence in expectations. This setup puts the spotlight on what underpins the bullish outlook.

Rubrik's innovations and strategic cybersecurity focus enhance market share, revenue growth, and competitive positioning while expanding their total addressable market. Partnerships and enhanced recovery capabilities leverage enterprise needs, improving customer retention and profitability, fueling earnings growth and expanding their data security footprint.

The case for Rubrik hinges on explosive growth assumptions and a profit trajectory that is anything but typical for this sector. Want to know the underlying forecast that supports such a high fair value? There is a headline-grabbing earnings leap and a profit ratio reserved for only the most ambitious tech narratives. Click through to uncover the numbers that power this valuation story in full detail.

Result: Fair Value of $115.20 (UNDERVALUED)

However, fierce competition in cyber resilience and uncertain adoption of Rubrik's AI and cloud products could challenge these optimistic assumptions and growth targets.

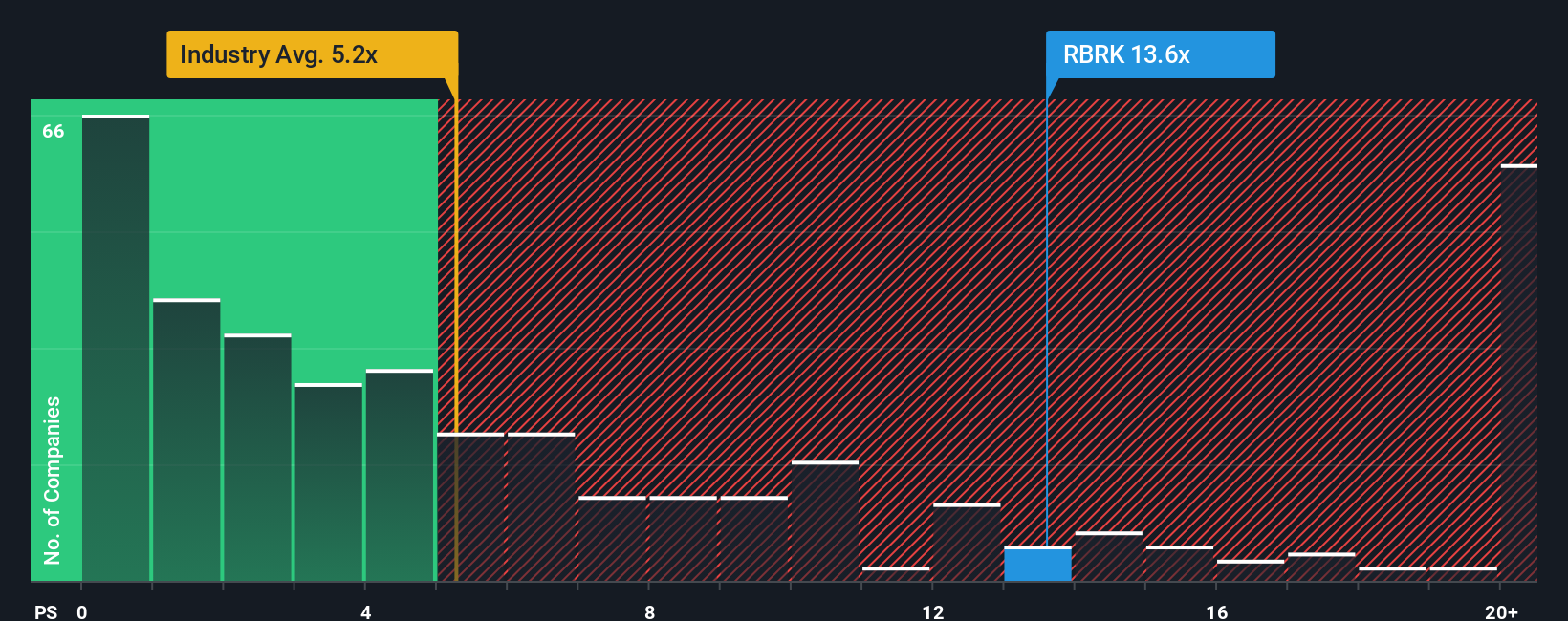

Another View: Price Ratios Signal Caution

Looking at Rubrik’s valuation through the lens of its price-to-sales ratio adds a different perspective. At 15.3 times sales, shares are trading far above both the US Software industry average of 5.3 and the peer average of 10.4. Even compared to the fair ratio of 12.2, the premium is significant. This suggests investors are paying up for growth. Does this premium leave enough margin for error if expectations fall short?

Build Your Own Rubrik Narrative

If you see the story differently or want to dive into the numbers yourself, you can shape your own view in just a few minutes, and Do it your way.

A great starting point for your Rubrik research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your search to just one opportunity when the market is full of unique trends? Give yourself an edge by checking out these handpicked ideas tailored for forward-thinking investors.

- Capitalize on growth by targeting these 24 AI penny stocks featuring groundbreaking advancements in automation, data intelligence, and next-generation computing power.

- Secure your portfolio with steady income by pursuing these 19 dividend stocks with yields > 3% that offer reliable yields and established payout histories from robust businesses.

- Ride the next financial wave by backing these 78 cryptocurrency and blockchain stocks at the center of the blockchain revolution and the evolving digital economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.