Please use a PC Browser to access Register-Tadawul

Rubrik (RBRK): Reassessing Valuation After Strong Q3 Beat, Raised 2026 Guidance and Growing AI-Driven Demand

Rubrik, Inc. Class A RBRK | 50.20 | -7.31% |

Rubrik (RBRK) has been in the spotlight after its stronger than expected Q3 results. Subscription ARR is jumping, margins are improving, and management has lifted 2026 guidance, all while investor buzz keeps building.

That upbeat Q3 update seems to be feeding into the story, with Rubrik’s 30 day share price return of 16.93 percent lifting the stock to 78.80 dollars. Year to date momentum looks solid, even though the one year total shareholder return sits at 16 percent.

If Rubrik’s move has you thinking about where growth sentiment could go next, it might be worth scanning other high growth tech and AI names using high growth tech and AI stocks.

With upbeat guidance, bullish analysts, and a stock still trading at a discount to targets, is Rubrik quietly undervalued after its post earnings jump, or is the market already baking in years of high octane growth?

Most Popular Narrative Narrative: 30.9% Undervalued

Rubrik’s most followed valuation narrative pegs fair value well above the recent 78.80 dollars close, implying meaningful upside if its long range assumptions land.

The company's pivotal role at the intersection of data security and AI, especially through products like Annapurna, can expand their total addressable market (TAM), potentially driving future revenue growth and enhancing their market position in this expanding field.

Curious how a fast expanding TAM, rising margins, and premium future earnings multiples all intersect to produce that upside gap? The full narrative lays out the aggressive revenue ramp, the margin makeover, and the bold valuation multiple that have to come together for this pricing gap to close.

Result: Fair Value of $114.05 (UNDERVALUED)

However, fierce cyber resilience competition and slower than expected AI or cloud adoption could derail Rubrik’s growth thesis and challenge the current undervaluation case.

Another Lens On Valuation

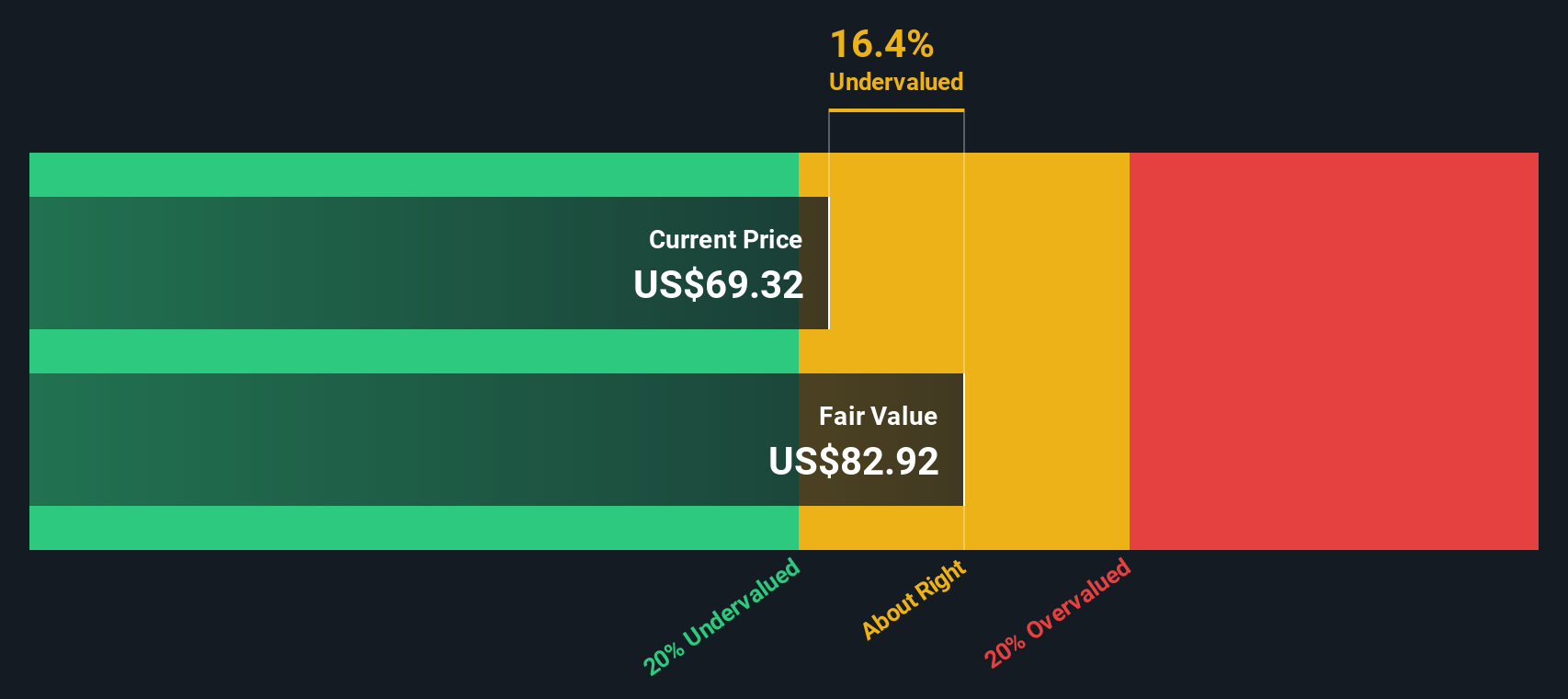

While the narrative sees Rubrik as about 30 percent undervalued, our SWS DCF model is more restrained, putting fair value near 86.02 dollars, only around 8 percent above today’s price. If the cash flows are closer to this path, is the upside really as large as the story suggests, or is it tighter?

Build Your Own Rubrik Narrative

If this framework does not quite fit your view, or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Rubrik might be compelling, but do not stop there. Use the Simply Wall Street Screener to pinpoint other focused opportunities before the rest of the market catches on.

- Target income focused opportunities by reviewing companies in these 10 dividend stocks with yields > 3% that offer attractive yields without abandoning balance sheet strength.

- Capitalize on structural growth by scanning these 24 AI penny stocks for businesses building real revenue momentum from artificial intelligence, not just buzzwords.

- Position yourself early in the next financial revolution by assessing these 80 cryptocurrency and blockchain stocks for listed plays tied to blockchain infrastructure and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.