Please use a PC Browser to access Register-Tadawul

RXO's Revenue Surge and Wider Losses Raise Questions About Earnings Quality and Margin Strategy (RXO)

RXO, Inc. Common Stock RXO | 16.90 | +1.93% |

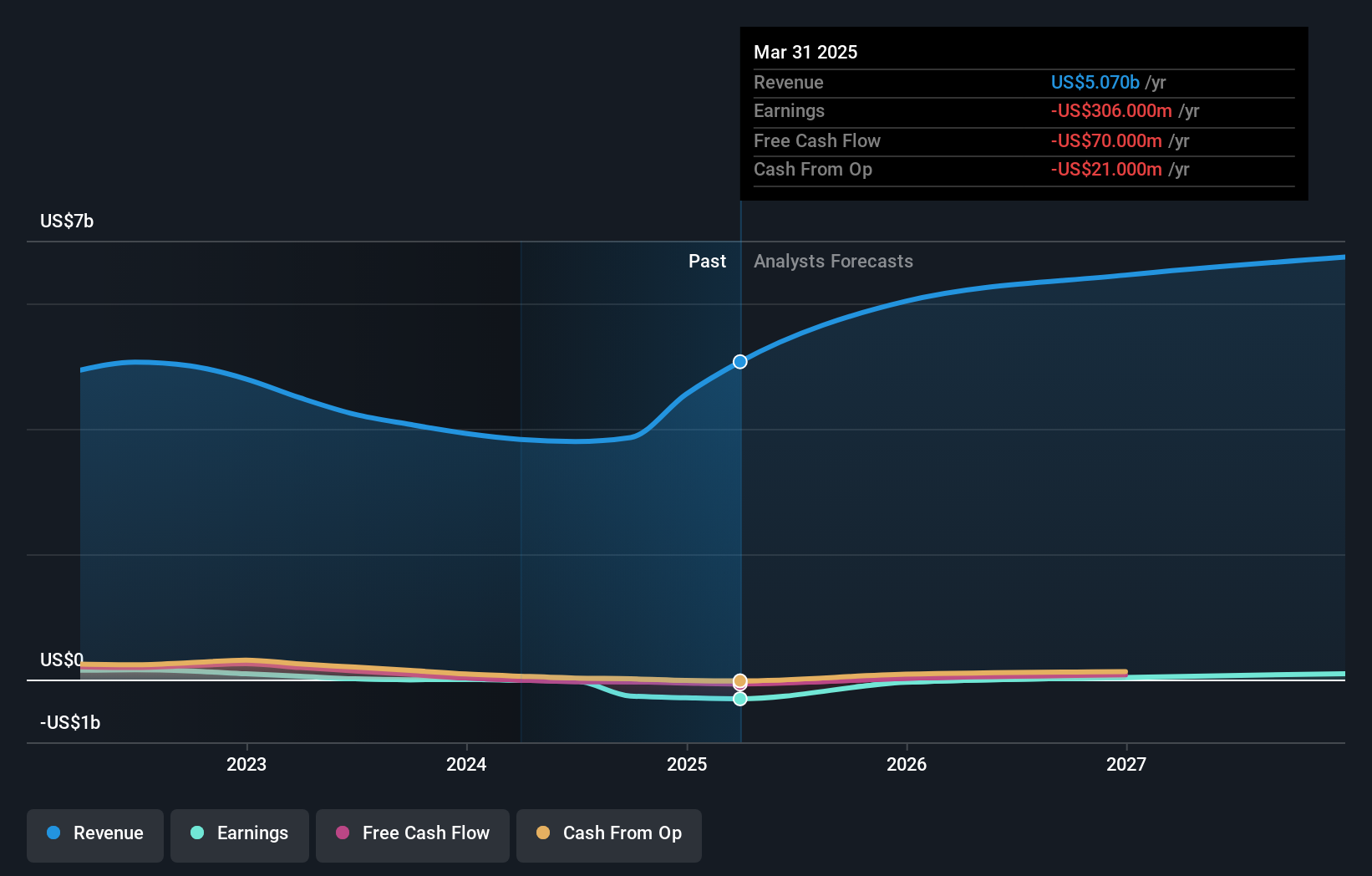

- RXO, Inc. reported its second quarter 2025 earnings on August 7, showing sales of US$1.42 billion compared to US$930 million a year earlier, while recording a net loss of US$9 million versus a US$7 million loss the previous year.

- Despite robust revenue growth, the company’s net losses widened year-over-year, highlighting ongoing profitability pressures even as sales expanded significantly.

- We'll examine how RXO's large sales increase amid continued losses could influence expectations for its earnings growth and margin outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

RXO Investment Narrative Recap

Owning RXO stock means believing in management’s ability to convert surging sales, driven by scale and digital transformation, into sustainable profits, despite ongoing sector headwinds. The latest quarterly results, while delivering impressive revenue growth, did not shift the most critical near-term catalyst: whether RXO can translate topline expansion into margin improvement, particularly as net losses widen. The biggest risk remains the persistent weakness in automotive freight, which threatens revenue consistency and earnings predictability, and the recent update does little to change this key concern for shareholders.

Of the recent company announcements, the Q2 2025 earnings release stands out as it directly underscores RXO’s fundamental challenge: rapid sales gains amid growing net losses. This news event brings renewed attention to RXO’s efforts in leveraging technology and LTL brokerage to drive operating leverage, but also amplifies the question of margin stability as the industry continues to absorb lingering demand and cost pressures.

Yet, in contrast to revenue growth, RXO’s consistent net losses are a factor investors should pay particular attention to...

RXO's narrative projects $6.9 billion revenue and $127.1 million earnings by 2028. This requires 7.3% yearly revenue growth and a $435.1 million earnings increase from -$308.0 million today.

Uncover how RXO's forecasts yield a $16.28 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members value RXO stock from US$16.28 to US$32.39, reflecting diverse growth expectations across two independent analyses. Against this broad range, recurring net losses remind you that optimism around digital freight growth is balanced by concerns about earnings volatility, explore alternative forecasts and viewpoints for deeper insight.

Explore 2 other fair value estimates on RXO - why the stock might be worth over 2x more than the current price!

Build Your Own RXO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RXO research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free RXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RXO's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.