Please use a PC Browser to access Register-Tadawul

Ryan Specialty Reshapes Canada Operations As Cash Returns Take Center Stage

Ryan Specialty Holdings, Inc. Class A RYAN | 41.30 | -0.07% |

- Ryan Specialty Holdings (NYSE:RYAN) has created Ryan Specialty Canada Limited, combining several Canadian managing general underwriters into one platform.

- Stephen Stewart has been appointed CEO of the unified Canadian business as part of a broader restructuring of the company’s operations in Canada.

- The board has approved a $300 million share repurchase program alongside an increase to the quarterly dividend.

- These steps follow a period of acquisition driven expansion and ongoing integration of newly acquired businesses.

Ryan Specialty focuses on specialty insurance products and services, sitting between retail brokers, carriers and insured clients. By grouping its Canadian managing general underwriters under Ryan Specialty Canada Limited and naming a single CEO, the company is reshaping how it runs a key geography, while at the same time working through the operational effects of recent acquisitions.

For investors watching NYSE:RYAN, the combination of a unified Canadian platform, leadership changes and fresh capital return plans marks a meaningful reset in how the business is organized and how cash is being used. The way these moves play out over time, including how effectively acquisitions are integrated into the new structure, may be central to any changes in the company’s risk profile and shareholder appeal.

Stay updated on the most important news stories for Ryan Specialty Holdings by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Ryan Specialty Holdings.

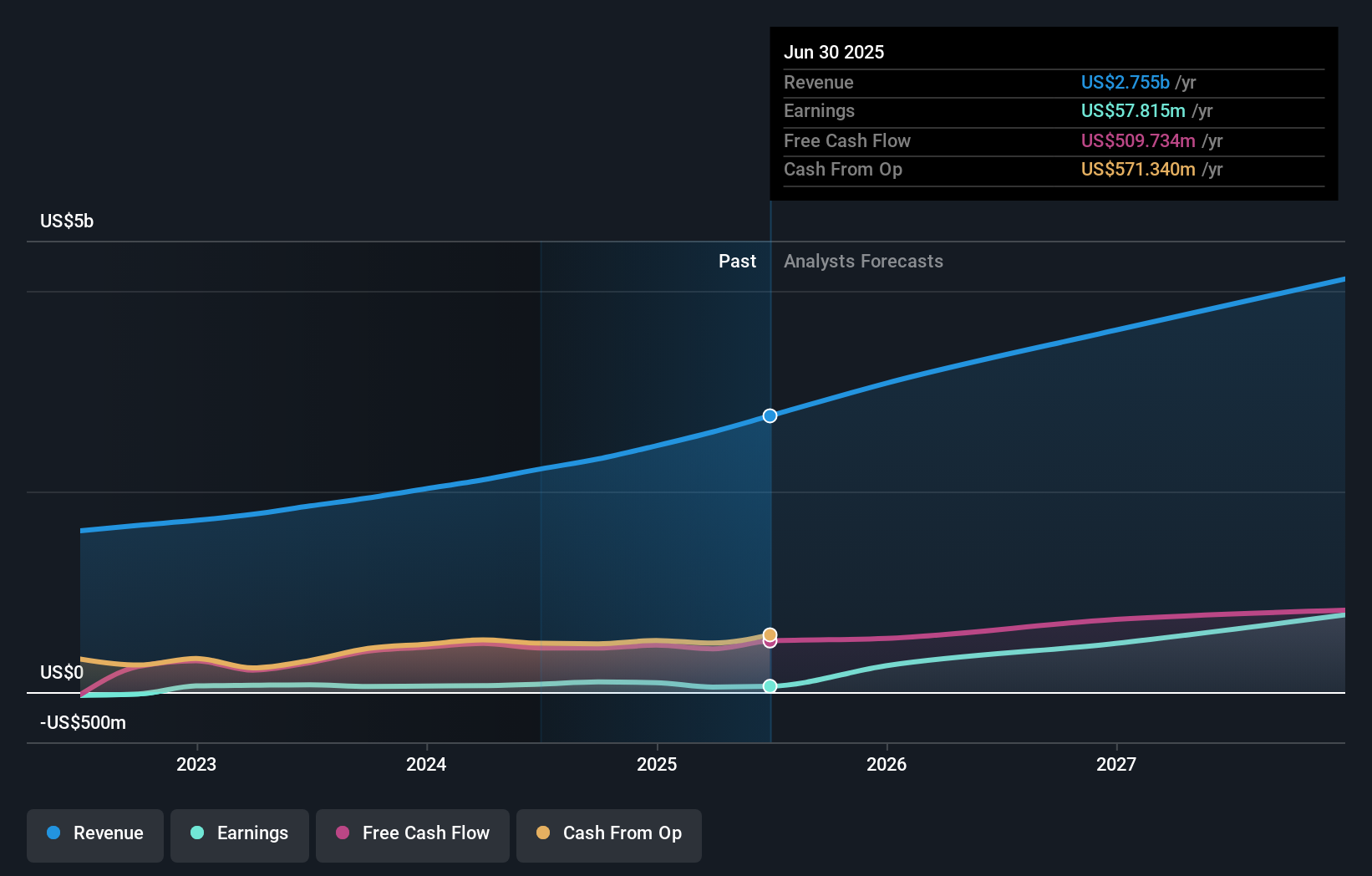

The 8.3% lift in Ryan Specialty’s regular quarterly dividend to US$0.13 per share, alongside a US$300m buyback, indicates the board is comfortable sending more cash back to shareholders even after a year where net income moved from US$229.91m to US$214.16m and Q4 earnings per share softened. A portion of the dividend, US$0.06 per share, will be funded from free cash flow at Ryan Specialty, LLC. This indicates that cash generation at the operating level is supporting these distributions rather than relying solely on the holding company balance sheet. At the same time, revenue reached US$3.05b for 2025 compared with US$2.52b a year earlier, so the higher payout is being set against a larger top line, even as margins have come under pressure.

How This Fits Into The Ryan Specialty Holdings Narrative

- The higher dividend and share repurchase align with the narrative that management is confident enough in cash generation from specialty lines and acquisitions to return more capital while continuing to invest in growth.

- Lower net income and earnings per share versus the prior year could challenge expectations for margin expansion, which is a key part of many long-term growth arguments for Ryan Specialty.

- The creation of Ryan Specialty Canada Limited and the appointment of Stephen Stewart as CEO add a regional integration story that is not fully captured in earlier commentary focused mainly on technology, carrier partnerships and U.S.-oriented acquisitions.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Ryan Specialty Holdings to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Profit margins are weaker than the prior year, and analysts have flagged that debt is not well covered by operating cash flow, which can limit flexibility if conditions tighten.

- ⚠️ The sector faces pressure from digital insurance platforms and AI tools that may compress commission economics for intermediaries like Ryan Specialty, as well as regulatory scrutiny such as the Florida bill that has already unsettled investors.

- 🎁 The company has grown revenue to more than US$3b, completed several acquisitions and is consolidating Canadian MGUs under one platform, which can support scale benefits over time.

- 🎁 Management has authorized a sizable buyback and raised the dividend, which signals confidence in future cash flows and in the company’s ability to fund both investments and shareholder returns.

What To Watch Going Forward

From here, it is worth watching whether earnings and free cash flow grow in line with the richer capital return program, and whether integration of the Canadian businesses under Ryan Specialty Canada Limited leads to cleaner margins. Pay close attention to how operating expenses trend relative to the US$3.05b revenue base and whether the recent dip in net income stabilizes. It also helps to compare Ryan Specialty’s capital allocation and dividend decisions with other insurance intermediaries such as Marsh McLennan, Aon and Arthur J. Gallagher to see how the company is positioning itself in a sector that is facing both pricing cycles and technology-driven change.

To stay current on how the latest news impacts the investment narrative for Ryan Specialty Holdings, head to the community page for Ryan Specialty Holdings to follow the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.