Please use a PC Browser to access Register-Tadawul

Sabine Royalty Trust (SBR): Assessing Valuation Following the Latest Distribution Decrease

Sabine Royalty Trust SBR | 69.86 69.86 | +0.07% 0.00% Pre |

If you hold or follow Sabine Royalty Trust (SBR), you probably took note of its latest announcement. The company declared a new cash distribution of $0.584 per unit, with the payout coming at the end of the month. Since this figure represents a decrease, the news may have caught the attention of investors who rely on the trust’s regular income. Distributions often signal management’s outlook on revenue streams from underlying oil and gas assets.

This development arrives as Sabine Royalty Trust’s stock has pushed higher, gaining 13% over the past three months and 34% in the last year. Such performance suggests that momentum has held up even as the distribution fluctuates. However, dividend changes tend to recalibrate investor expectations and can reshape how the market values the trust compared to its peers or historical averages.

Is the current price reflecting a fair value in light of the reduced payout, or is there still an opportunity to buy in before the market adjusts for future growth?

Price-to-Earnings of 14.7x: Is it justified?

Based on the preferred metric, Sabine Royalty Trust trades at a price-to-earnings (P/E) ratio of 14.7x. This is above the US Oil and Gas industry average of 12.7x but below its peer average of 25.1x. The stock appears more expensive compared to the industry average, yet potentially more attractive than many of its peers.

The P/E ratio is a snapshot of how much investors are willing to pay for each dollar of company earnings. For royalty trusts like Sabine, this metric is particularly important because it reflects market expectations about the sustainability of profits from their underlying oil and gas assets.

This valuation suggests the market is pricing in stable earnings or potentially rewarding Sabine’s proven assets and high profit margins, despite recent fluctuations and a lack of clear future growth guidance. While the trust does not offer a discount relative to the wider industry, its standing compared to similar peers could attract value-oriented investors seeking above-average returns from the energy sector.

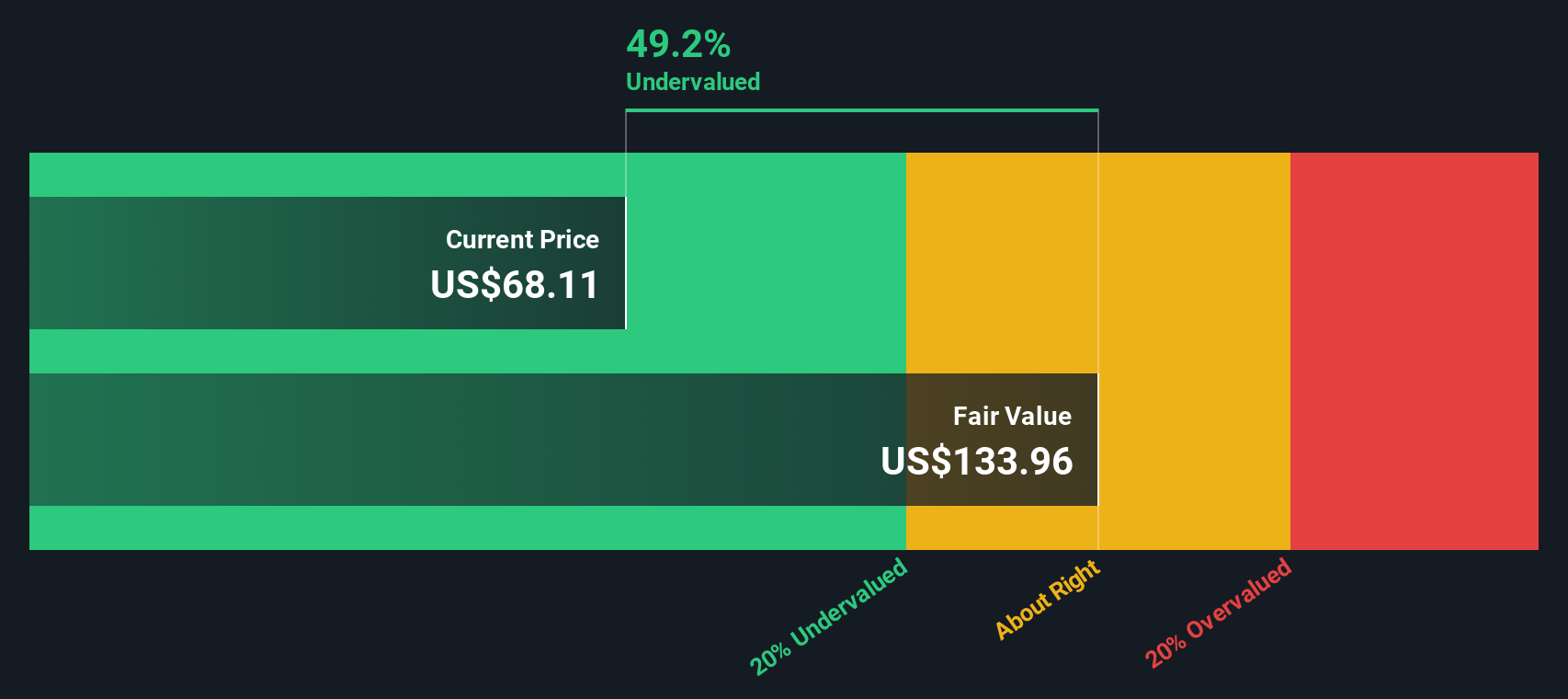

Result: Fair Value of $138.72 (UNDERVALUED)

See our latest analysis for Sabine Royalty Trust.However, lower distributions or ongoing volatility in oil markets could quickly challenge the current valuation and investor confidence in Sabine’s future returns.

Find out about the key risks to this Sabine Royalty Trust narrative.Another View: What Does Our DCF Model Show?

While Sabine Royalty Trust appears somewhat pricey compared to its industry using one metric, the SWS DCF model points to the stock being undervalued. Could the market be missing something, or will reality catch up soon?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sabine Royalty Trust Narrative

If you see things differently or want to dig deeper into the numbers, you can quickly put together your own story in minutes. Do it your way.

A great starting point for your Sabine Royalty Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Staying ahead means constantly seeking new and exciting ideas. Let the Simply Wall Street Screener help you spot companies with the potential to make your next smart move count.

- Unlock potential with stocks trading below their value by using our undervalued stocks based on cash flows to highlight overlooked gems based on future cash flows.

- Spot rising stars in cutting-edge medicine and technology with our tool for healthcare AI stocks, which pinpoints companies advancing healthcare with artificial intelligence.

- Capture regular income streams when you check out dividend stocks with yields > 3% and find companies offering yields above 3% that could strengthen your portfolio’s foundation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.