Please use a PC Browser to access Register-Tadawul

Sandisk (SNDK) Is Up 31.7% After Launching Advanced Fab2 Facility to Boost AI-Driven Memory Production

SanDisk Corporation SNDK | 206.18 | -14.66% |

- Kioxia Corporation and Sandisk Corporation recently announced the operational launch of Fab2, a new semiconductor fabrication facility at the Kitakami Plant in Iwate Prefecture, Japan, with production capacity for advanced eighth-generation, 218-layer 3D flash memory utilizing their CBA technology to meet rising market demand driven by AI.

- This development highlights how joint ventures and technological innovation play a vital role in expanding production capabilities for data-driven applications and storage solutions.

- With Sandisk's 7-day share price return at 31.66%, we'll explore how expanded cutting-edge flash memory production could reshape the company's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Sandisk's Investment Narrative?

For anyone considering Sandisk, the big picture comes down to believing that large-scale bet on next-generation flash memory and AI-driven storage will pay off. The launch of Fab2, in partnership with Kioxia, is highly relevant now, it signals a jump in production capacity and technological edge that could accelerate Sandisk’s transition toward profitability. Until this news, risk and reward largely hinged on Sandisk’s ability to maintain momentum in R&D, secure big design wins, and manage unprofitability, all while responding to price swings and index membership changes. Fab2 has the potential to improve margins and strengthen short-term investor confidence, as shown by a very large share price surge in recent days. However, the ramp-up isn’t expected to deliver meaningful output until 2026 and Sandisk is still working through the fallout of recent index drops, volatility, and previous goodwill impairment. This facility raises the stakes, execution risk around Fab2 and competition in high-end flash are now even bigger short-term questions that could shape Sandisk's narrative in the next year. But don’t overlook how quickly share price swings can amplify risks if expectations aren’t met.

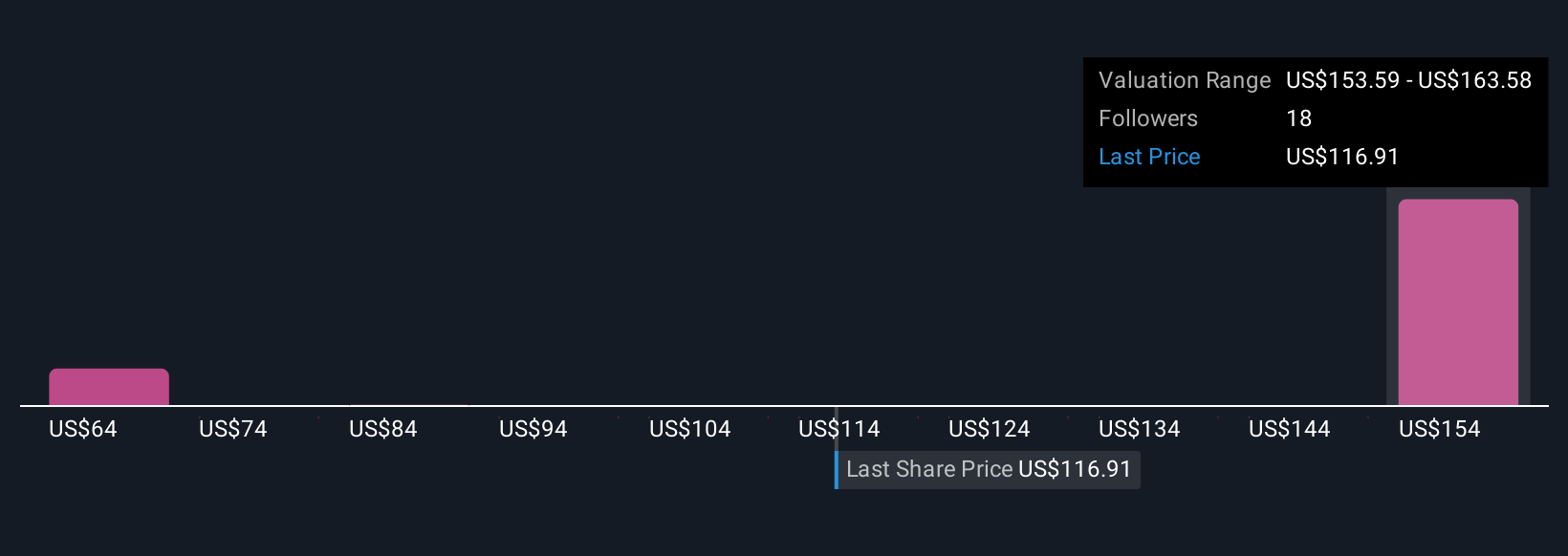

Sandisk's shares have been on the rise but are still potentially undervalued by 25%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Sandisk - why the stock might be worth 49% less than the current price!

Build Your Own Sandisk Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sandisk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sandisk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sandisk's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.