Please use a PC Browser to access Register-Tadawul

Sangamo Therapeutics, Inc.'s (NASDAQ:SGMO) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Sangamo BioSciences, Inc. SGMO | 0.44 | +0.23% |

Those holding Sangamo Therapeutics, Inc. (NASDAQ:SGMO) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.6% over the last year.

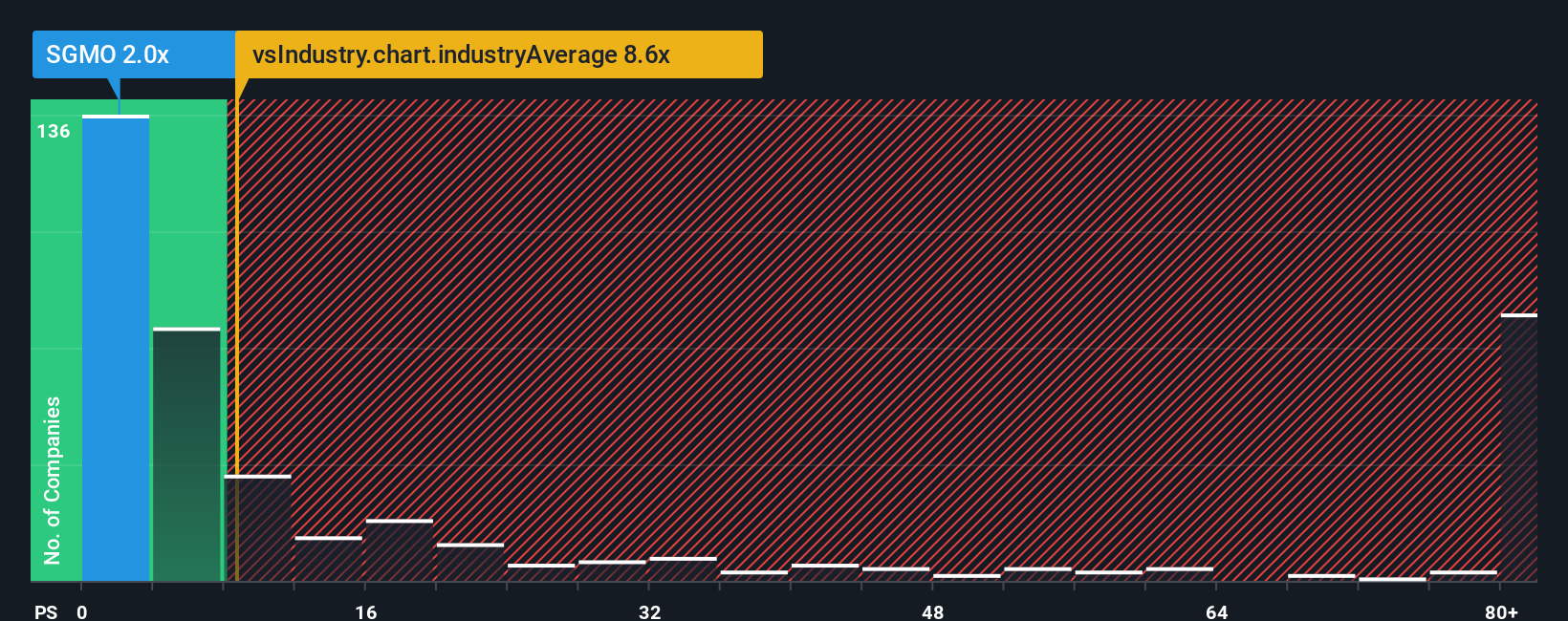

Although its price has surged higher, Sangamo Therapeutics' price-to-sales (or "P/S") ratio of 2x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 8.6x and even P/S above 61x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does Sangamo Therapeutics' P/S Mean For Shareholders?

Recent times haven't been great for Sangamo Therapeutics as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Sangamo Therapeutics will help you uncover what's on the horizon.How Is Sangamo Therapeutics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Sangamo Therapeutics' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 240%. Still, revenue has fallen 43% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 52% per annum during the coming three years according to the five analysts following the company. With the industry predicted to deliver 103% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Sangamo Therapeutics' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Shares in Sangamo Therapeutics have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sangamo Therapeutics maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

If these risks are making you reconsider your opinion on Sangamo Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.