Please use a PC Browser to access Register-Tadawul

Sanofi Buyout Of Dynavax Recasts Adult Vaccine Growth For Shareholders

Dynavax Technologies Corporation DVAX | 15.50 | Delist |

- Sanofi agreed to acquire Dynavax Technologies (NasdaqGS:DVAX) in a multi billion dollar deal.

- The transaction focuses on adding Dynavax's approved hepatitis B vaccine and its experimental shingles vaccine to Sanofi's adult vaccines portfolio.

- The deal is framed as an expansion of Sanofi's presence in adult immunizations.

Dynavax Technologies, known for its vaccine work including its hepatitis B product, sits at the intersection of adult immunization and broader infectious disease prevention. Large pharmaceutical groups have been active in vaccines as they look to build out portfolios in areas such as hepatitis, shingles, respiratory infections and other adult indications. This agreement places Dynavax's assets within a larger global commercial and development platform.

For you as an investor, the acquisition raises questions around how Dynavax's products might be integrated, funded and prioritized within Sanofi's broader vaccine efforts. It also puts a spotlight on the role of adult vaccines in future product lineups, especially as healthcare systems continue to pay attention to preventable diseases in older and at risk populations.

Stay updated on the most important news stories for Dynavax Technologies by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Dynavax Technologies.

For Dynavax shareholders, the agreed all cash takeout by Sanofi crystallizes the value of its hepatitis B franchise and early shingles program into a single transaction, rather than leaving those assets to be valued through future clinical and commercial milestones. The deal also effectively hands control of Dynavax's vaccine platform to a larger player in adult immunizations that already competes with names like GSK and Pfizer.

How this ties into the Dynavax Technologies Narrative

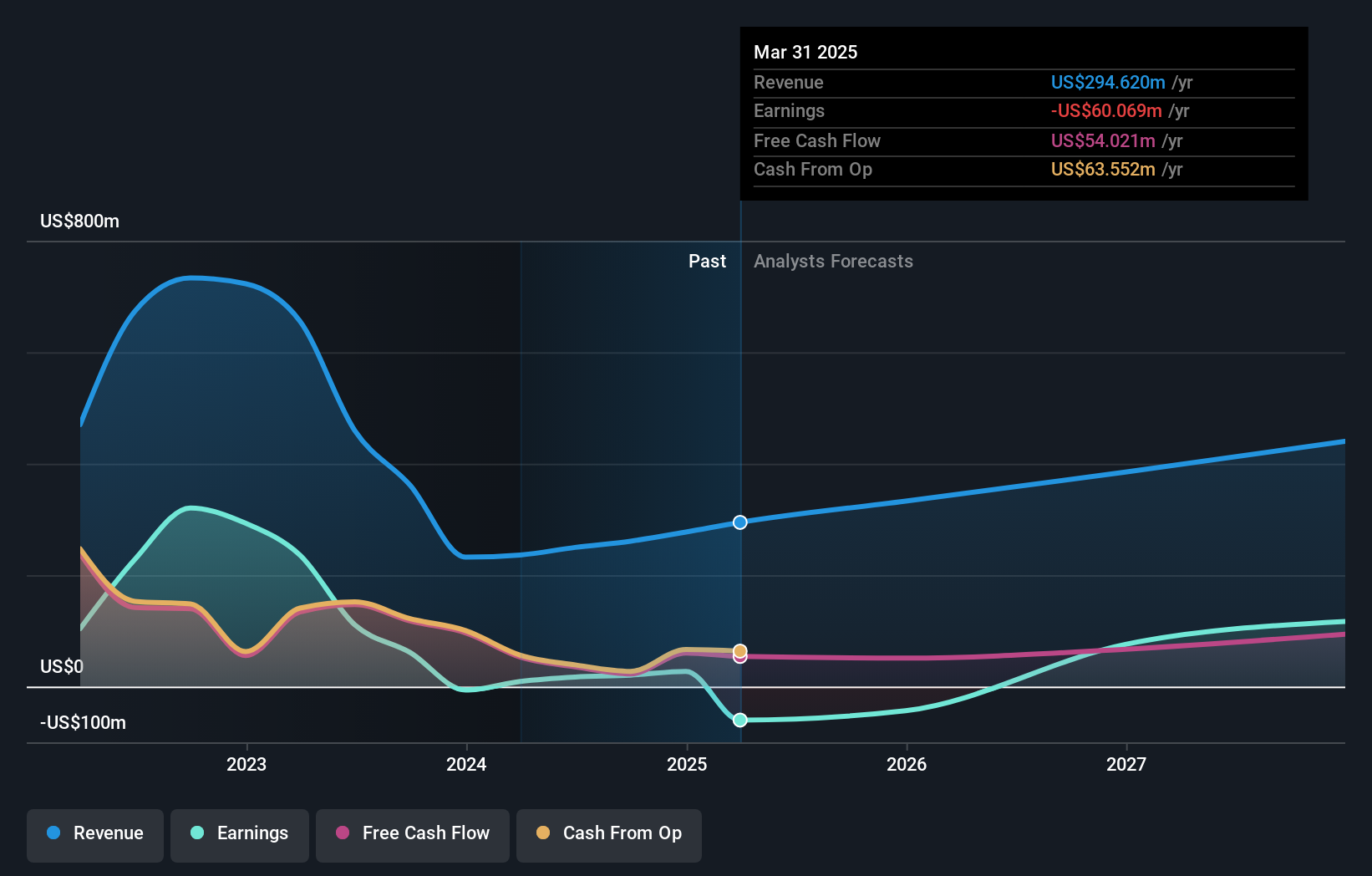

Earlier bullish narratives around Dynavax focused on HEPLISAV B growth, the potential of the shingles candidate and broader use of its CpG 1018 adjuvant in government and partner programs, which together were seen as drivers of long term upside. The Sanofi acquisition channels those expectations into a negotiated cash value today, so the debate for you now shifts from long term compounding to whether the agreed price suitably reflects those earlier growth and diversification arguments.

Risks and rewards for shareholders

- Cash consideration provides certainty of value and removes execution risk around future clinical trials, reimbursement decisions and competitive responses from GSK or Pfizer.

- Integration into Sanofi's global commercial network could support wider use of Dynavax's vaccine technologies, which some investors may view as a validation of the underlying platform.

- Once the deal closes, you lose direct exposure to any upside if HEPLISAV B or the shingles vaccine outperform expectations inside Sanofi's broader portfolio.

- The transaction still needs shareholder and regulatory approvals, so there is some deal completion risk and timing uncertainty to keep in mind.

What to watch from here

From here, the key things to watch are closing milestones, any competing interest that might emerge, and whether updated disclosures from Dynavax or Sanofi change how you think about the underlying vaccine assets. If you want to see how other investors are thinking about the trade off between taking the deal price and the long term story, you can check community narratives on Dynavax's dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.