Please use a PC Browser to access Register-Tadawul

Sarepta Therapeutics Elevidys Data Highlights Durable Duchenne Benefits And Risks

Sarepta Therapeutics, Inc. SRPT | 18.88 | +1.56% |

- Sarepta Therapeutics (NasdaqGS:SRPT) reported positive 3 year data from the EMBARK Phase 3 study of Elevidys gene therapy in Duchenne muscular dystrophy.

- The results show sustained functional benefits in ambulatory Duchenne patients over 3 years with a manageable safety profile.

- No new safety issues were identified in the 3 year readout, addressing prior concerns around long term efficacy and safety.

Sarepta Therapeutics focuses on genetic medicines for rare neuromuscular diseases, and Elevidys is the company’s lead gene therapy for Duchenne muscular dystrophy. The new 3 year EMBARK data comes after earlier regulatory restrictions that followed safety incidents, so investors now have additional clinical information on durability and tolerability for ambulatory patients.

For you as an investor, this update matters because Elevidys sits at the center of the NasdaqGS:SRPT story, both clinically and commercially. The durability and safety profile seen so far may influence how regulators, physicians, caregivers and payers think about gene therapy for Duchenne from this point on.

Stay updated on the most important news stories for Sarepta Therapeutics by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Sarepta Therapeutics.

The 3 year EMBARK data gives a clearer picture of Elevidys as a long term treatment option for ambulatory Duchenne patients. Functional gains on NSAA and timed tests are holding up well into later childhood, and no new safety issues have been reported. For Sarepta, that type of durability and safety profile can be important for physician confidence, treatment adoption and payer discussions, especially given prior regulatory caution around hepatic risks in non ambulatory patients.

Sarepta Therapeutics narrative: why this update could shift the conversation

There is no formal public narrative attached here, but this readout directly addresses the key debate around Sarepta, which is whether Elevidys can justify its position in Duchenne over the long run after earlier safety concerns and label changes. The statistically significant, clinically meaningful 3 year outcomes may reinforce the view that Elevidys is a core asset in Sarepta’s rare disease portfolio, even as opinions remain mixed across the analyst community.

Risks and rewards to keep in mind

- Durable 3 year efficacy across NSAA and key timed tests, with roughly 70% slowing of functional decline versus external controls, supports the commercial potential of Elevidys in ambulatory patients.

- No new treatment related safety signals in this dataset help address concerns that regulatory restrictions and prior incidents might limit longer term use.

- The therapy still carries the FDA’s strongest safety warning for certain patient groups, so any future safety events or label changes could weigh on adoption.

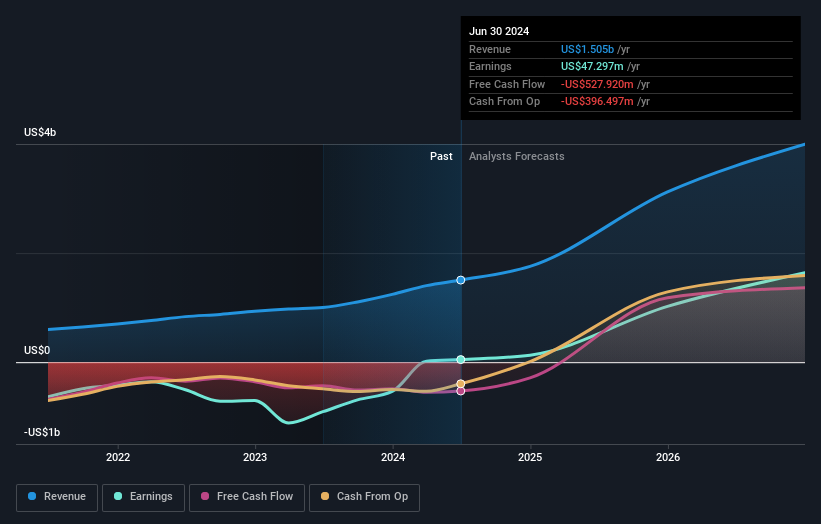

- Sarepta also faces broader financial risk factors, including negative profitability metrics and share price volatility flagged in risk assessments, which can add to execution risk around Elevidys.

What to watch from here

It is worth watching how regulators, clinicians and payers respond to these 3 year data, and whether Sarepta and partner Roche can translate clinical durability into steady real world uptake. This is particularly relevant as more information emerges for non ambulatory patients and other geographies. You can stay informed about how investors are interpreting the story by following updated community narratives at this link.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.