Please use a PC Browser to access Register-Tadawul

Sarepta Therapeutics (SRPT) Faces Renewed Scrutiny After ELEVIDYS Linked Safety Events and Legal Challenges

Sarepta Therapeutics, Inc. SRPT | 21.32 | -0.98% |

- In July 2025, Sarepta Therapeutics faced a series of regulatory and operational disruptions after multiple patient deaths linked to its gene therapy ELEVIDYS, prompting a temporary halt on US shipments, clinical holds on trials, and the addition of a black box warning for acute liver injury and failure at the request of the FDA. Although the FDA ultimately determined a recent patient death was unrelated to treatment and allowed the resumption of ELEVIDYS shipments for ambulatory Duchenne patients, Sarepta continues to be challenged by heightened regulatory oversight, ongoing safety concerns, and several securities class action lawsuits.

- These developments underscore both the intense regulatory scrutiny surrounding novel gene therapies for rare diseases and the material business risks associated with rapid clinical and commercial advancement in a high-profile therapeutic area.

- We’ll now assess how this wave of regulatory and legal scrutiny surrounding ELEVIDYS safety may affect Sarepta’s updated investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Sarepta Therapeutics Investment Narrative Recap

To be a shareholder in Sarepta Therapeutics, you need confidence in the long-term potential of gene therapy for rare diseases despite near-term volatility and regulatory scrutiny. The FDA’s decision to allow ELEVIDYS shipments for ambulatory patients resumes a critical revenue pathway, yet safety concerns and ongoing legal challenges remain the most significant risks to Sarepta’s immediate business outlook. At this stage, the regulatory developments materially affect both short-term catalysts and downside risks for the stock.

A highly relevant recent announcement is Sarepta’s voluntary pause and subsequent resumption of ELEVIDYS shipments in the US, tied directly to the FDA’s updated safety labeling and review following patient deaths. This intervention underlines how quickly regulatory actions can impact access to therapy, market confidence, and the company’s ability to deliver on its main growth driver, with safety and compliance staying at the core of near-term investor concerns.

In contrast, investors should be aware of unresolved securities lawsuits alleging Sarepta made false statements regarding the safety of ELEVIDYS...

Sarepta Therapeutics' outlook anticipates $1.6 billion in revenue and $275.3 million in earnings by 2028. This involves a 10.2% annual revenue decline and a $523.7 million increase in earnings from the current level of -$248.4 million.

Uncover how Sarepta Therapeutics' forecasts yield a $28.83 fair value, a 82% upside to its current price.

Exploring Other Perspectives

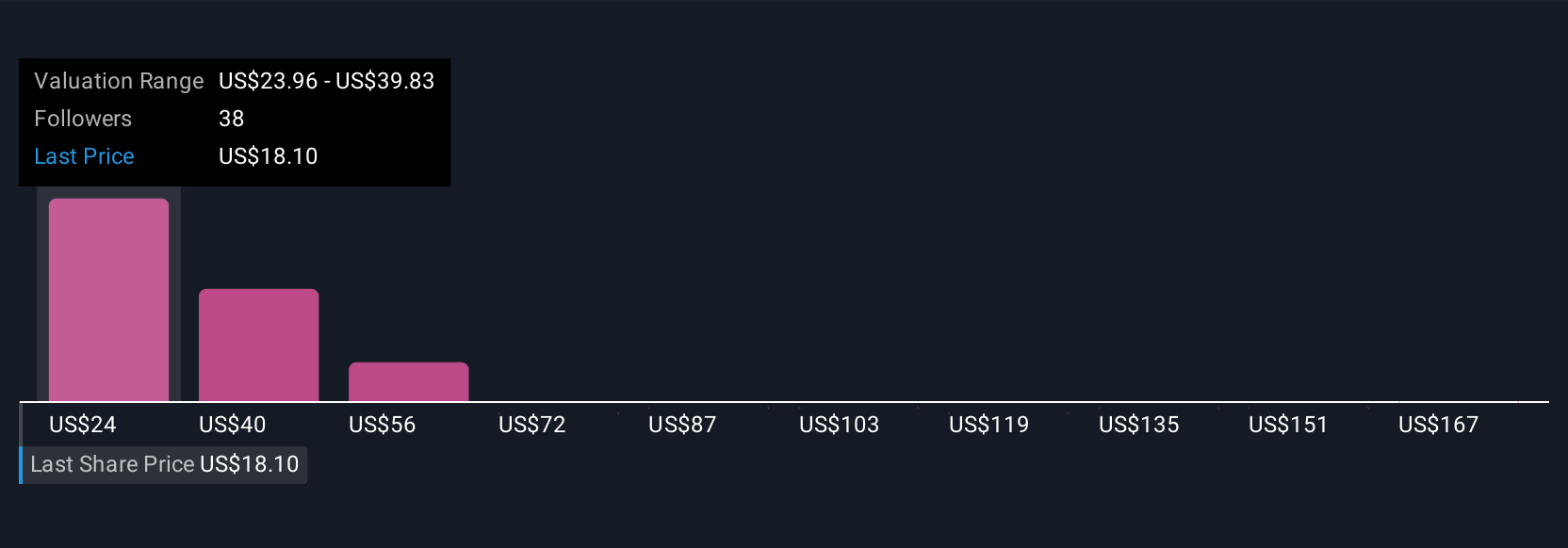

The Simply Wall St Community’s nine fair value estimates for Sarepta Therapeutics range from US$28.83 to US$182.67 per share. Given the ongoing regulatory and safety risks, expect opinions to continue to differ widely on the company’s future performance.

Explore 9 other fair value estimates on Sarepta Therapeutics - why the stock might be worth just $28.83!

Build Your Own Sarepta Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sarepta Therapeutics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sarepta Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sarepta Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.