Please use a PC Browser to access Register-Tadawul

Saudi 2024 IPO Review | Miahona Leads 2024 IPO Surge with Over 134% Return: A Year of Strong Sectoral Trends

Tadawul All Shares Index TASI.SA | 10414.06 | -0.37% |

MIAHONA 2084.SA | 19.15 | +0.74% |

MBC GROUP 4072.SA | 32.02 | -1.54% |

TALCO 4143.SA | 35.62 | -0.06% |

ALMAJED OUD 4165.SA | 130.00 | 0.00% |

The Saudi stock market, especially the Tadawul All Shares Index(TASI.SA), has witnessed significant activity in the IPO sector throughout 2024.

Based on Sahm’s analysis of market data, by December 25, 2024, the Saudi market’s TASI (Main market) recorded a total of 27 IPOs and secondary offerings, including private offerings and rights issues. Of these, 13 were IPOs, with 10 of them showing positive returns. When including all IPOs, both positive and negative performers, the average return stands at approximately 36%. This highlights a generally strong performance in the IPO market despite some variations in individual stock returns.

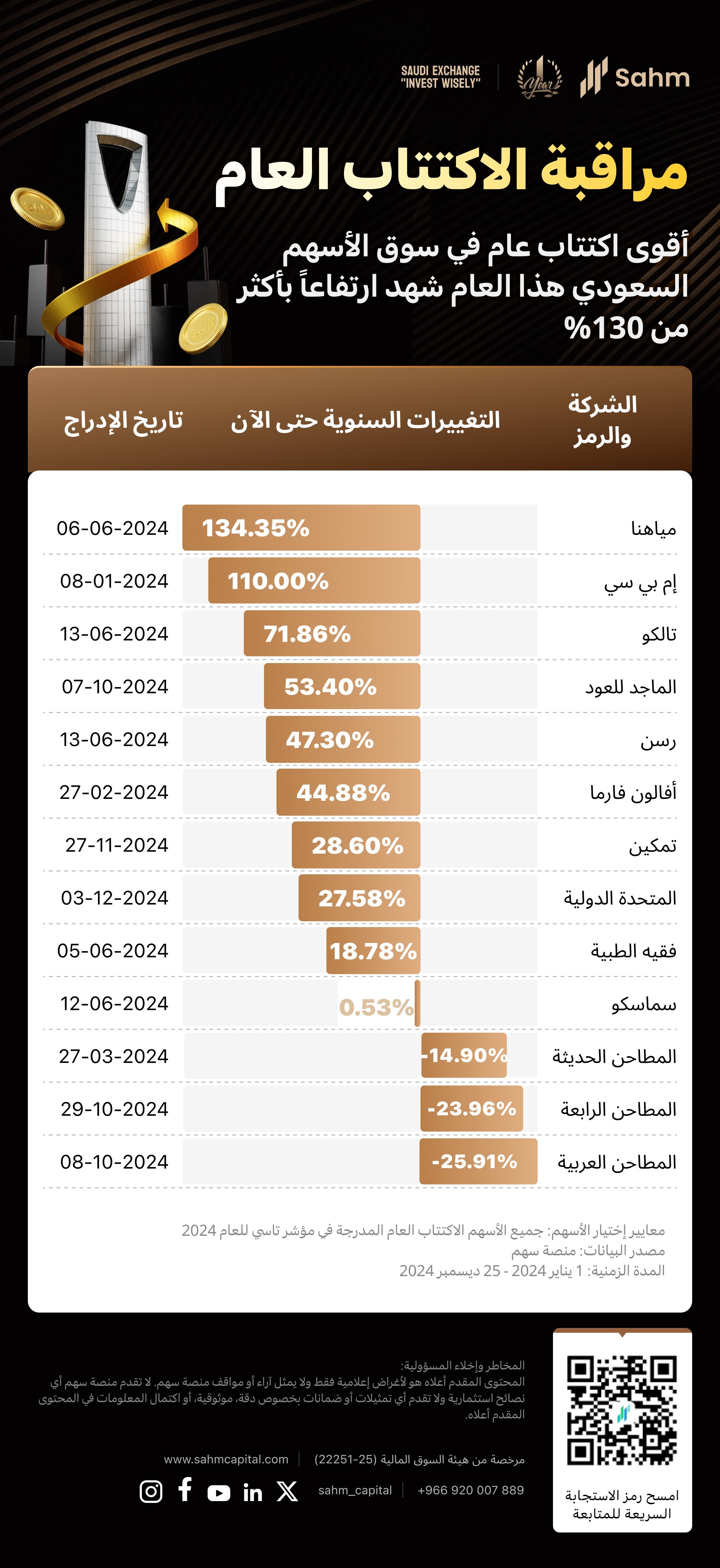

Top-Performing Saudi IPOs of 2024

As of December 25, Sahm’s data reveals that several IPOs in 2024 have outperformed most of Saudi stocks. Among these, Miahona Co.(2084.SA), listed in the Utilities sector, stands as the top performer, with a remarkable price increase of over 134.35% since its listing.

Following closely are MBC Group Co.(4072.SA) in the Media and Entertainment sector, which has surged by over 110%, and Al Taiseer Group Talco Industrial Co.(4143.SA), part of the Capital Goods sector, which has seen a 71.86% rise.

These performances align with sectoral trends, where Capital Goods saw a 52.27% annual increase, Media and Entertainment gained 32.08%, and Utilities had a solid 35.09% gain.

| Company | Sector | Stock's Year-to-date Changes | Sector's Year-to-date Changes | Offering Price | Listing Date |

| Miahona Co.(2084.SA) | Utilities | 134.35% | 35.09% | 11.50 | 06-06-2024 |

| MBC Group Co.(4072.SA) | Media and Entertainment | 110.00% | 32.08% | 25.00 | 08-01-2024 |

| Al Taiseer Group Talco Industrial Co.(4143.SA) | Capital Goods | 71.86% | 52.27% | 43.00 | 13-06-2024 |

| Al Majed Oud Co.(4165.SA) | Household & Personal Products | 53.40% | - | 94.00 | 07-10-2024 |

| Rasan Information Technology Co.(8313.SA) | Insurance | 47.30% | 18.71% | 37.00 | 13-06-2024 |

| Middle East Pharmaceutical Industries Co.(4016.SA) | Pharma, Biotech & Life Science | 44.88% | 2.58% | 82.00 | 27-02-2024 |

| Tamkeen Human Resource Co.(1835.SA) | Commercial & Professional Svc | 28.60% | -12.25% | 50.00 | 27-11-2024 |

| United International Holding Co.(4083.SA) | Financial Services | 27.58% | 17.09% | 132.00 | 03-12-2024 |

| Dr. Soliman Abdel Kader Fakeeh Hospital Co.(4017.SA) | Health Care Equipment & Svc | 18.78% | -0.91% | 57.50 | 05-06-2024 |

| Saudi Manpower Solutions Co.(1834.SA) | Commercial & Professional Svc | 0.53% | -12.25% | 7.50 | 12-06-2024 |

| Modern Mills for Food Products Co.(2284.SA) | Food & Beverages | -14.90% | 6.84% | 48.00 | 27-03-2024 |

| Fourth Milling Co.(2286.SA) | Food & Beverages | -23.96% | 6.84% | 5.30 | 29-10-2024 |

| Arabian Mills for Food Products Co.(2285.SA) | Food & Beverages | -25.91% | 6.84% | 66.00 | 08-10-2024 |

| Data as of December 25, 2024 | |||||

This suggests that sectors exhibiting strong performance may positively influence the post-IPO performance of new listings, studies in market psychology, such as those by Daniel Kahneman and Amos Tversky, highlight that investor sentiment is often influenced by broader sector trends, which can drive market expectations and performance. However, it is important to note that the success of individual IPOs also depends on the inherent quality and fundamentals of the companies themselves. As such, investors who pay attention to these sectoral trends while considering the underlying strength of companies may find that their decision-making process becomes more informed, potentially enhancing the overall trading experience.

As mentioned earlier, the Saudi market’s TASI (Main market) saw a total of 27 IPOs and secondary offerings this year, which places 2024 in third position, slightly below the record numbers of 39 offerings in 2022 and 30 in 2021, still reflects robust market activity.

In total, the funds raised exceeded SAR 60 billion, making it the second-highest in the last decade, following only 2019’s SAR 100.35 billion. Of the total funds raised, over SAR 12 billion was from IPOs alone, highlighting investor confidence and the strong appetite for new listings.

A standout event this year was the secondary offering by Saudi Aramco, which concluded in June. This was the largest secondary offering in the EMEA (Europe, Middle East, and Africa) region since 2000 and the largest equity capital market (ECM) offering in the Middle East, following Aramco’s own IPO in 2019. The gross proceeds from this offering amounted to an impressive SAR 42.1 billion.