Please use a PC Browser to access Register-Tadawul

Schneider National (SNDR): Evaluating Valuation Following Launch of Fast Track Premium Freight Service

Schneider National, Inc. Class B SNDR | 29.31 | +1.00% |

Schneider National (SNDR) is rolling out its new Fast Track solution, aiming to give shippers an edge with faster and more reliable freight options. This service harnesses Schneider’s trucking and intermodal strengths, working together with top rail partners.

Schneider National’s new Fast Track service arrives as the company seeks to regain momentum after a challenging stretch for the share price. While innovation is front and center, the stock itself has seen the 1-year total shareholder return fall 32.4% and is currently trading at $20.77. Year-to-date and recent 30-day share price returns are also in negative territory. Short-term sentiment may be cautious right now, but steps like Fast Track signal Schneider’s commitment to strengthening its long-term profile within logistics.

If this evolution in freight transport got you thinking about broader opportunities, now’s the perfect moment to explore See the full list for free.

With shares down nearly a third over the past year and trading well below analyst targets, is Schneider National now presenting a genuine value opportunity, or is the market already factoring in all future growth?

Most Popular Narrative: 18% Undervalued

According to the most followed narrative, the current share price of $20.77 sits noticeably below a fair value estimate of $25.42. This narrative weighs future earnings growth and margin outlook against recent market skepticism.

Schneider's continued investments and focus on technology-driven efficiency, such as AI, automation, a digital freight platform, and cost reduction initiatives, are set to drive sustainable operational improvements. Containing expenses even in inflationary environments should support higher net margins and earnings growth as volumes recover.

Want to know what ambitious profit and margin numbers are hiding beneath this fair value? The engine of this narrative is bold earnings growth and a profit multiple below the industry’s. Find out the full logic and see how these levers could set a surprising price trajectory.

Result: Fair Value of $25.42 (UNDERVALUED)

However, elevated exposure to volatile spot market pricing and stricter regulatory changes could disrupt Schneider National’s margin recovery narrative in the near term.

Another View: The Numbers Behind the Multiple

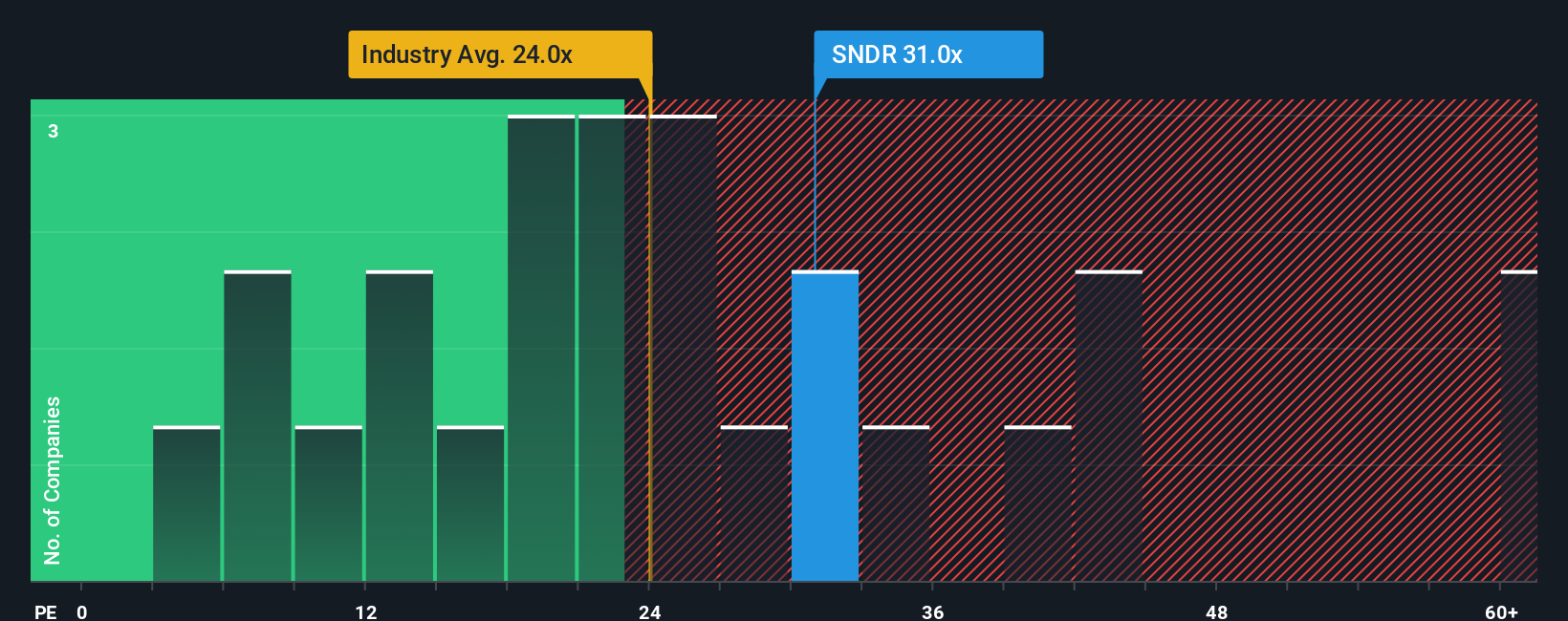

Despite appearing undervalued by some models, Schneider National actually trades at a price-to-earnings ratio of 31.9x. This is quite a bit higher than the transportation industry average of 25.8x and its closest peers at 26.5x. It is also well above a fair ratio of 22.1x, suggesting the market is demanding a premium. Could this hefty valuation mean investors are seeing upside others are missing, or is it a warning sign ahead?

Build Your Own Schneider National Narrative

If you see the story differently or want to dig into the numbers yourself, you can easily create your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Schneider National.

Looking for More Investment Opportunities?

Your next winning idea could be just one screen away. Don’t let opportunity pass you by when so many smart strategies are within easy reach on Simply Wall St.

- Uncover high-yield potential by checking out these 15 dividend stocks with yields > 3%. Access stocks boasting steady dividends above 3%.

- Seize the pace of technological change and see which companies stand out using these 27 AI penny stocks to find leaders in artificial intelligence.

- Capture value now with these 895 undervalued stocks based on cash flows, which reveals stocks that remain priced below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.