Please use a PC Browser to access Register-Tadawul

Sea Limited (NYSE:SE) Valuation in Focus After $40 Million Legal Settlement and Profit Turnaround

Sea SE | 123.14 | +1.30% |

Sea (NYSE:SE) just made headlines after agreeing to pay $40 million to settle claims tied to undisclosed regulatory risks in India, finally drawing a line under a legal cloud that has lingered since the ban of its hit game, Free Fire. For investors, that kind of closure can be a weight off, especially with the case linked to events that caused volatility around the company’s $6 billion capital raise. With the legal uncertainty now addressed, market watchers are recalibrating their views on risk and reward for Sea’s future.

This move comes at a time when Sea has been showing clear signs of transformation. Over the past year, the stock posted an impressive 113% total return, with much of that surge building momentum in recent months. The company’s financial turnaround is hard to ignore, delivering a profit in 2024 after reporting a loss the year before, and seeing Shopee continue to command nearly half of Southeast Asia’s e-commerce market. Earnings expectations remain high and recent optimism about near-term business trends has caught the eye of investors, as reflected in estimate revisions and trading activity.

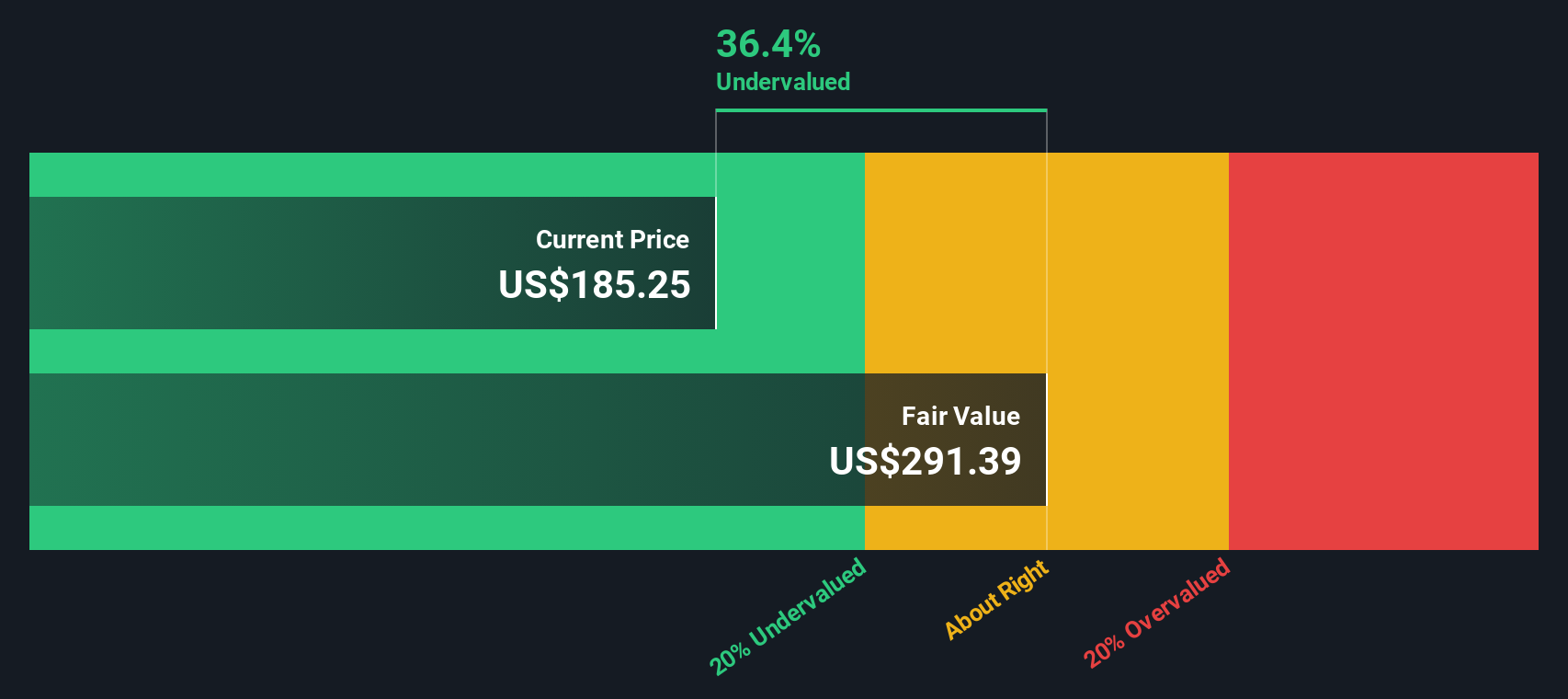

Given the fading legal risk and a strong year for growth, it is worth asking if Sea stock offers a genuine buying opportunity at today’s prices, or if the market is already assuming more upside ahead.

Most Popular Narrative: 4.6% Undervalued

The prevailing narrative sees Sea as moderately undervalued, with the consensus suggesting its fair value is slightly higher than where it trades today. This valuation view is rooted in expectations of accelerated earnings, margin expansion, and ongoing market dominance in key regions.

Ongoing transition towards cashless economies and advancement of digital payment infrastructure (including BNPL and QR code integration) in Sea's key markets is driving rapid expansion in Sea's fintech loan book and transaction volumes. This is improving monetization opportunities and recurring revenues while paving the way for net margin expansion as the business scales.

Think Sea’s current price already bakes in all the upside? The real story is just beginning. The engine of future growth runs on ambitious profit and margin projections. Want the inside scoop behind these bold estimates and what could push the stock even higher? There’s more under the surface, and the numbers behind this narrative might just catch you off guard.

Result: Fair Value of $202.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition from major global rivals or any slowdown in Garena’s Free Fire could still disrupt Sea’s growth story in the future.

Find out about the key risks to this Sea narrative.Another View: What Does Our DCF Model Show?

Looking from a different angle, our DCF model suggests a more optimistic picture for Sea. It points to a potential undervaluation that may be greater than what the market’s current multiples indicate. Could this deeper discount signal a bigger opportunity?

Build Your Own Sea Narrative

If you see things differently or want to chart your own outlook, you can dive into the numbers and shape a personalized narrative in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Sea.

Looking for More Smart Investment Opportunities?

If you want to stay ahead of the curve, don’t settle for what everyone else sees. The right investment ideas are waiting, and your next great portfolio move could be just one fresh search away.

- Boost your returns by targeting companies with outstanding cash flow potential. Seize opportunities with undervalued stocks based on cash flows and uncover stocks that the market hasn’t fully recognized.

- Unleash cutting-edge tech power in your portfolio by zeroing in on AI penny stocks, featuring innovators driving the AI revolution and setting tomorrow’s trends today.

- Lock in income and peace of mind by choosing dividend stocks with yields > 3%, where strong yields meet proven financial health for investors seeking reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.