Please use a PC Browser to access Register-Tadawul

SelectQuote, Inc. (NYSE:SLQT) Stock's 27% Dive Might Signal An Opportunity But It Requires Some Scrutiny

SelectQuote Inc SLQT | 0.89 | +7.33% |

Unfortunately for some shareholders, the SelectQuote, Inc. (NYSE:SLQT) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 77% loss during that time.

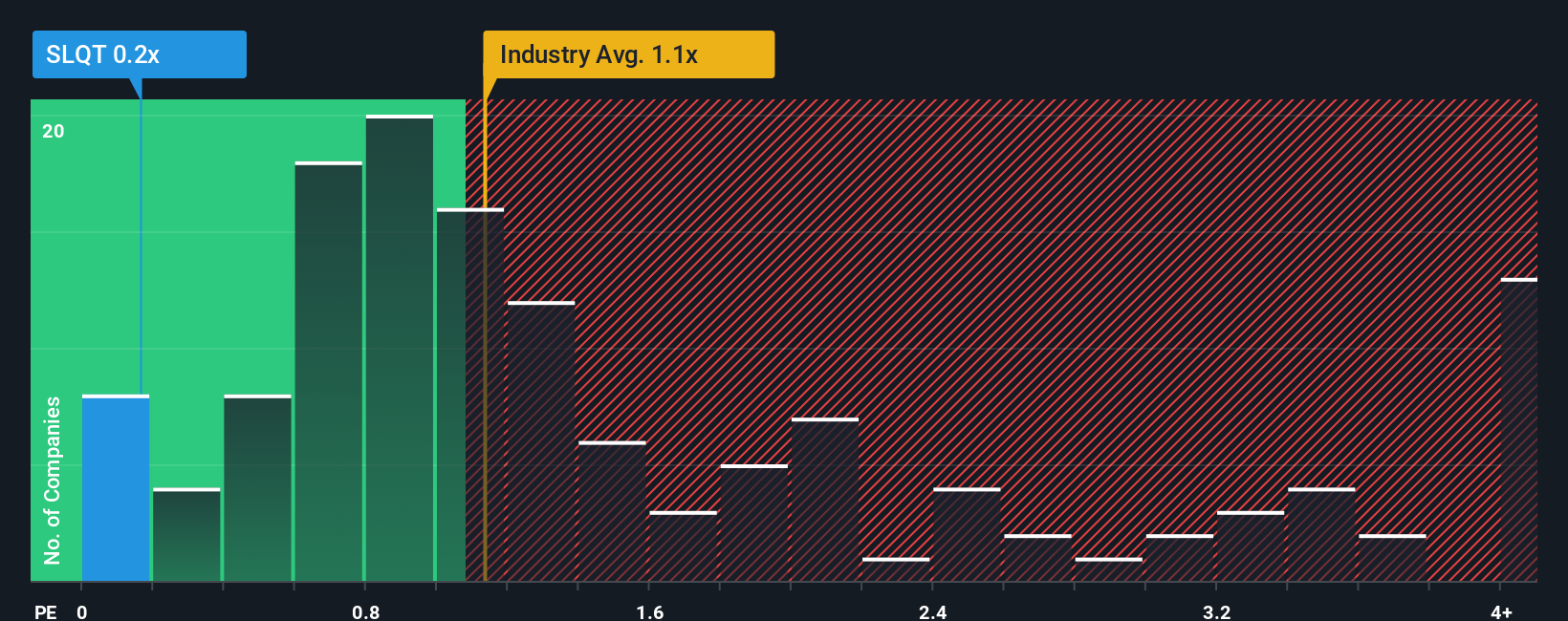

Since its price has dipped substantially, when close to half the companies operating in the United States' Insurance industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider SelectQuote as an enticing stock to check out with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has SelectQuote Performed Recently?

SelectQuote certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on SelectQuote will help you uncover what's on the horizon.How Is SelectQuote's Revenue Growth Trending?

In order to justify its P/S ratio, SelectQuote would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The latest three year period has also seen an excellent 103% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 10% as estimated by the four analysts watching the company. With the industry only predicted to deliver 2.3%, the company is positioned for a stronger revenue result.

With this information, we find it odd that SelectQuote is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

SelectQuote's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems SelectQuote currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.