Please use a PC Browser to access Register-Tadawul

Sempra Hydrogen Petition Tests California Policy And Long Term Investment Case

Sempra SRE | 93.55 | +0.62% |

- Sempra subsidiaries, including SoCalGas and San Diego Gas & Electric, have jointly petitioned California regulators to modify prior requirements for hydrogen blending demonstration projects.

- The utilities argue that updated safety research and real world data support moving more quickly toward systemwide low percentage hydrogen integration across California's natural gas network.

- The petition seeks to rely on this newer evidence instead of completing earlier mandated pilot projects before broader deployment.

For investors watching NYSE:SRE, this move sits at the intersection of regulated utility operations and the push to decarbonize gas infrastructure. Sempra's core business includes large utility footprints in California, where policy decisions can influence how capital is allocated across gas and power networks. Hydrogen blending has become a key topic as policymakers look for ways to cut emissions from existing gas systems without an immediate full shift to all electric solutions.

Regulators' response to this petition could shape how quickly hydrogen blending becomes part of day to day operations for Sempra's California utilities. For investors, the outcome is more relevant to how Sempra positions its gas networks within longer term energy transition plans and future capital spending priorities than to short term trading considerations.

Stay updated on the most important news stories for Sempra by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Sempra.

Investor Checklist

Quick Assessment

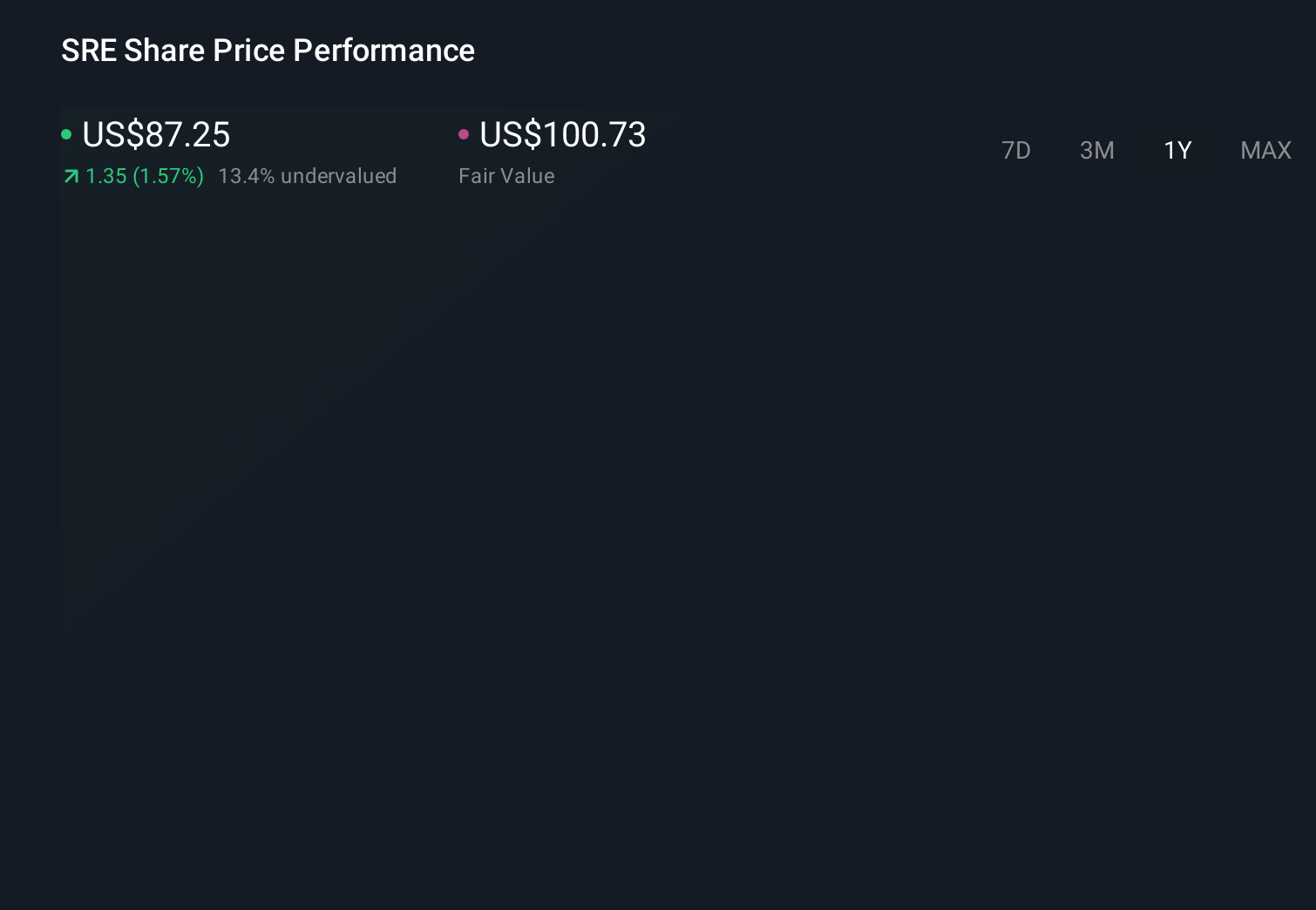

- ⚖️ Price vs Analyst Target: At US$87.0, Sempra trades roughly 12.7% below the US$99.6 analyst target, so it sits within sight of consensus rather than far away from it.

- ⚖️ Simply Wall St Valuation: Simply Wall St flags Sempra as trading close to its estimated fair value, so the current price does not screen as clearly cheap or expensive.

- ❌ Recent Momentum: The 30 day return of about 3.0% decline signals weak short term momentum while this hydrogen blending petition is in focus.

Check out Simply Wall St's in depth valuation analysis for Sempra.

Key Considerations

- 📊 The petition could influence how quickly Sempra shifts parts of its gas network toward hydrogen, which may affect future capital allocation and regulatory treatment.

- 📊 Watch how California regulators respond, any guidance on systemwide hydrogen blending timelines, and how Sempra frames related spending and returns in future updates.

- ⚠️ Existing flags around interest coverage and dividend cash flow coverage sit in the background if hydrogen projects require heavier investment or financing.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Sempra analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.