Please use a PC Browser to access Register-Tadawul

Semtech (SMTC): Evaluating Valuation After New AI Connectivity Launches and Analyst Upgrades

Semtech Corporation SMTC | 72.89 | -8.62% |

Semtech, a US-based semiconductor company, has drawn new attention after announcing the immediate availability of high-performance 1.6T Receiver Optical Engines through a collaboration with POET Technologies. These product launches highlight the company's expanding role in AI and data center infrastructure.

Semtech’s launch of advanced connectivity solutions for AI networks has sparked renewed optimism, as seen in a surge following an analyst upgrade and consecutive product rollouts for data center infrastructure. While the latest share price return remains modest, the company’s 1-year total shareholder return of 0.73% reflects steady progress. Momentum appears to be building as management targets high-growth applications in both AI and IoT markets.

If Semtech’s momentum has you curious about where innovation is taking hold, it’s a great time to discover See the full list for free.

With Semtech shares steadily recovering but still trading within analysts’ estimated value ranges, the question remains whether current prices account for the company’s ambitious AI and IoT pipeline or if investors are missing a potential buying opportunity.

Most Popular Narrative: 6.6% Overvalued

With Semtech closing at $72, the most widely followed narrative values the stock at $67.57, about 6.6% below where it last traded. This gap reveals how analysts are weighing recent optimism against the company's ambitious multi-year targets.

Portfolio rationalization and renewed focus on core high-growth segments (data center, LoRa, PerSe), is leading to above-market sales momentum. Increased R&D investment in these verticals is expected to accelerate product cycles and capture incremental market share, positively impacting future earnings and margin profile.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $67.57 (OVERVALUED)

However, weaker performance in recent acquisitions and falling gross margins in key segments could quickly challenge the bullish outlook for Semtech’s growth story.

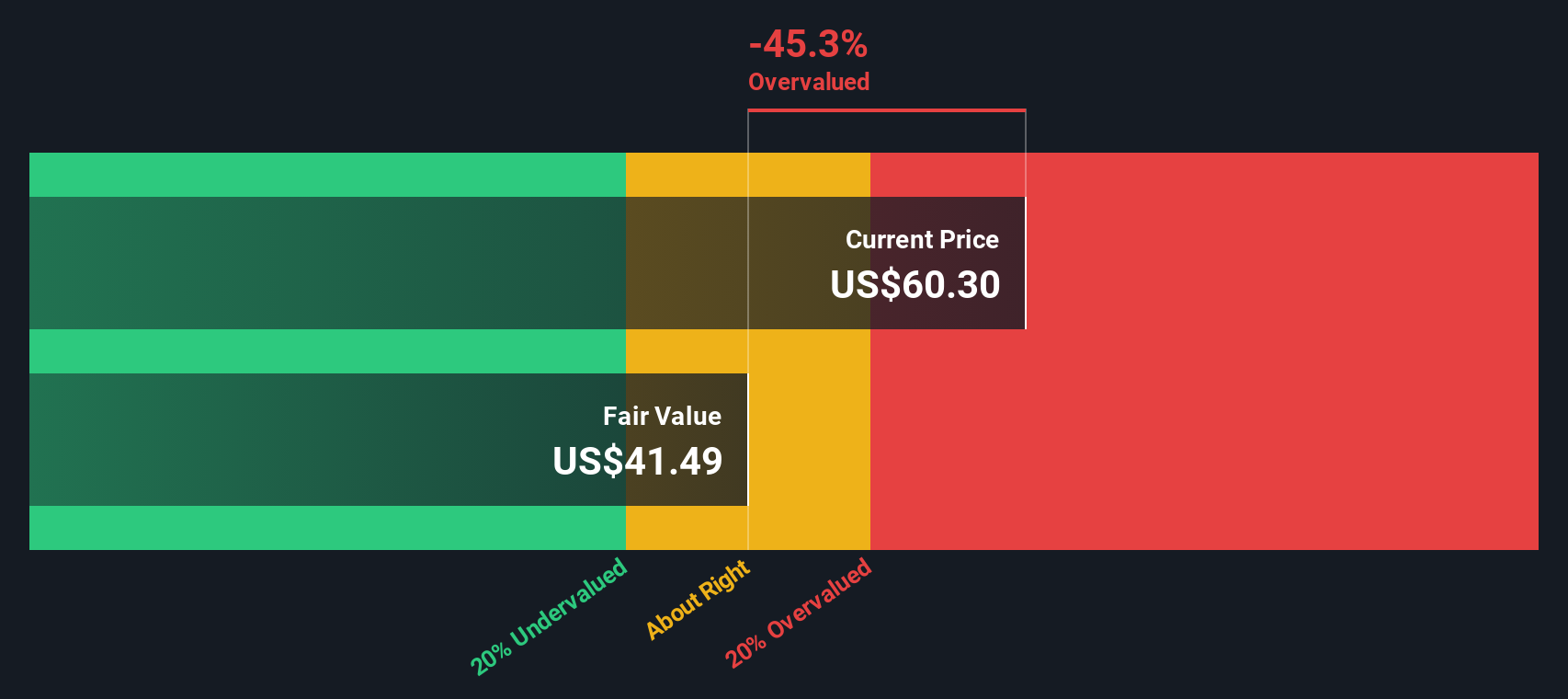

Another View: DCF Model Suggests a Wider Gap

While multiples point to Semtech being slightly overvalued, our DCF model paints a starker picture. According to this discounted cash flow approach, Semtech's fair value is about $41.16. This suggests the current share price could be significantly above intrinsic value. Is the market too optimistic?

Build Your Own Semtech Narrative

If you have a different perspective or want to validate the numbers yourself, it only takes a few minutes to craft your own view. Do it your way

A great starting point for your Semtech research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Make your next move count by getting firsthand access to stocks powering breakthroughs, outperforming expectations, and delivering strong returns. These handpicked screeners are your ticket to opportunities you simply can't afford to overlook.

- Tap into steady income, reliable yields, and long-term stability by checking out these 19 dividend stocks with yields > 3%, known for their solid dividend track records.

- Jump ahead of the crowd by spotting tomorrow’s tech leaders with these 24 AI penny stocks, making headlines in artificial intelligence advancements every day.

- Unlock surprising bargains positioned for a comeback using these 896 undervalued stocks based on cash flows, which may be flying under most investors’ radars right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.