Please use a PC Browser to access Register-Tadawul

SentinelOne (S) Valuation Check As CFO Exit And Cautious Guidance Weigh On Investor Confidence

SentinelOne, Inc. Class A S | 12.97 | -4.35% |

Why SentinelOne’s CFO Transition Matters for the Stock

SentinelOne (S) is back in focus after the resignation of Chief Financial Officer Barbara Larson and the appointment of Chief Growth Officer Barry Padgett as interim CFO and principal financial officer on January 16, 2026.

This leadership shift comes shortly after fiscal results that topped analyst expectations but coincided with cautious guidance and continued selling in the shares. As a result, many investors are reassessing how they view execution risk, profitability, and the company’s current valuation.

SentinelOne’s recent 1 day share price return of 1.69% to US$13.80 comes after a tougher stretch, with a 30 day share price return of a 7.57% decline and a 1 year total shareholder return of a 40.57% loss. This suggests momentum has faded despite product milestones like GovRAMP High Authorization and ongoing concern around guidance and the CFO transition.

If this kind of volatility has you looking beyond a single cybersecurity name, it could be a useful time to scan other high growth tech and AI opportunities through high growth tech and AI stocks.

With the shares sitting well below analyst targets and the business still posting double digit revenue growth, you have to ask yourself: is SentinelOne now trading at a discount, or is the market already pricing in all the future gains?

Price-to-Sales of 4.9x: Is it justified?

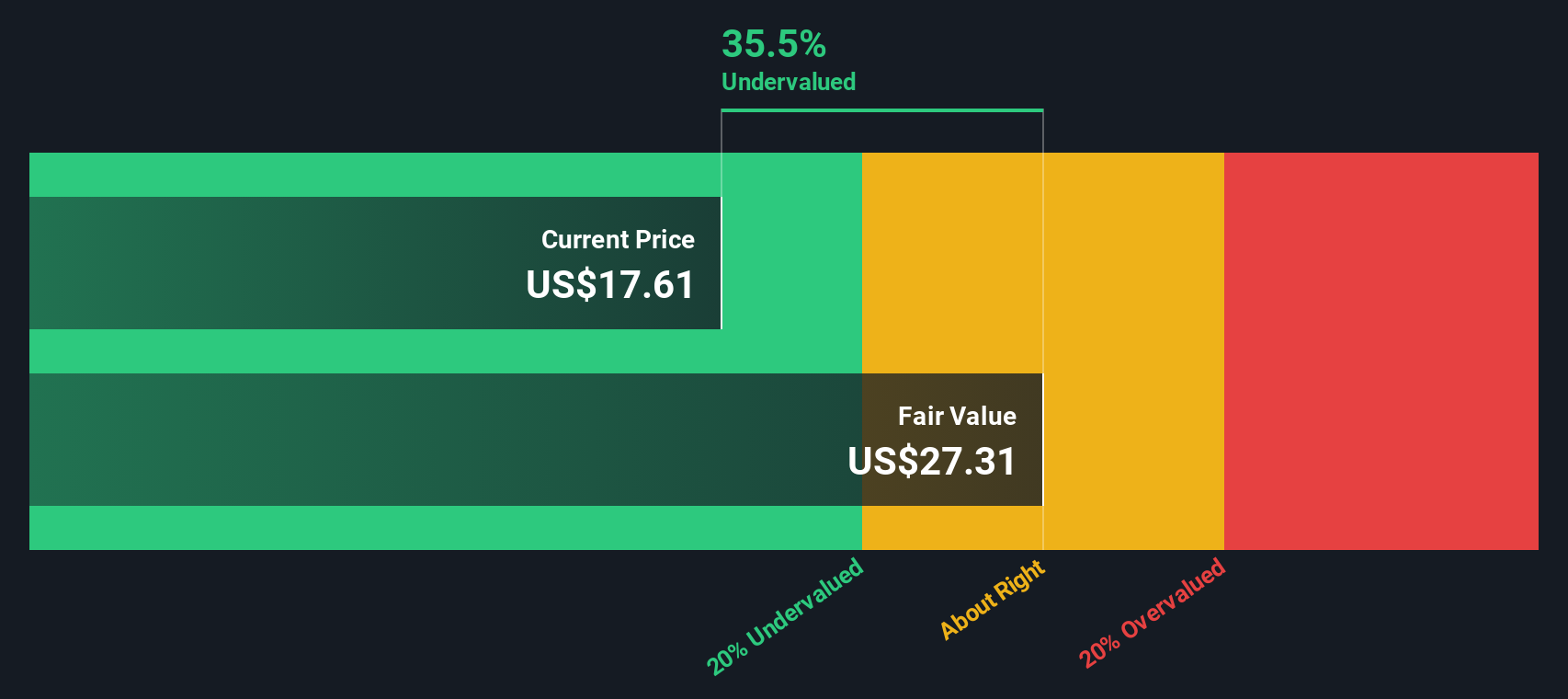

SentinelOne trades on a P/S ratio of 4.9x at a last close of US$13.80, which our checks flag as good value relative to some benchmarks but not others.

P/S looks at how much investors are paying for each dollar of current revenue, and it is often used for high growth or unprofitable software names where earnings are still negative.

On one hand, SentinelOne screens as good value versus its own fair P/S estimate of 5.8x and the peer average of 6.7x. This suggests the market price is below levels that some models and peers might support. On the other hand, the shares screen as expensive against the broader US software industry average P/S of 4.5x, so investors are still paying a premium versus the typical software name even if several valuation checks point to some headroom.

Result: Price-to-Sales of 4.9x (UNDERVALUED)

However, you still have to factor in execution risks around the CFO transition, as well as the current net loss of US$411.291 million, which could pressure sentiment.

Another View: Our DCF Model Points to Deeper Upside

While the 4.9x P/S ratio hints at some value, our DCF model presents a different perspective. It places SentinelOne’s future cash flow value at US$23.44 per share, compared with the current US$13.80 price, indicating that the shares are trading at a steep discount.

That gap can appear to be an opportunity if you place confidence in the long term cash flow assumptions, or a warning if you are more cautious about profitability and execution. Which side of that trade do you feel more comfortable on?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SentinelOne for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SentinelOne Narrative

If you see the numbers differently or prefer to work from your own assumptions, you can build a fresh, data driven thesis in minutes with Do it your way.

A great starting point for your SentinelOne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If SentinelOne is on your radar, do not stop there. Broaden your watchlist with fresh ideas that match your style before the next opportunity moves away.

- Target income focused opportunities by scanning these 13 dividend stocks with yields > 3% that might fit a yield oriented approach to portfolio building.

- Spot potential growth stories early by checking out these 3534 penny stocks with strong financials that already show stronger financial footing than many peers.

- Get ahead of fast moving themes by reviewing these 19 cryptocurrency and blockchain stocks shaping the future of digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.