Please use a PC Browser to access Register-Tadawul

September 2025 Penny Stock Gems To Watch

Vimeo, Inc. - Common Stock VMEO | 7.85 | Delist |

As of September 2025, the U.S. stock market has experienced fluctuations, with major indices like the S&P 500 and Nasdaq touching record highs before slipping slightly following a weaker-than-expected jobs report. In such a climate, investors often look beyond traditional large-cap stocks to discover opportunities in lesser-known areas of the market. Penny stocks, though sometimes seen as relics of past speculative eras, continue to hold potential for growth when backed by strong financials and sound fundamentals. This article will explore several penny stocks that stand out for their financial strength and potential upside in today's market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.17 | $465.04M | ✅ 4 ⚠️ 0 View Analysis > |

| ATRenew (RERE) | $4.36 | $973.64M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.81 | $654.61M | ✅ 4 ⚠️ 0 View Analysis > |

| VTEX (VTEX) | $4.09 | $744.23M | ✅ 3 ⚠️ 1 View Analysis > |

| WM Technology (MAPS) | $1.17 | $200.09M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.60 | $21.34M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.9699 | $7.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.29 | $97.2M | ✅ 3 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $4.69 | $625.08M | ✅ 3 ⚠️ 2 View Analysis > |

Here's a peek at a few of the choices from the screener.

Duluth Holdings (DLTH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Duluth Holdings Inc. operates in the United States, selling casual wear, workwear, outdoor apparel, and accessories for men and women with a market cap of $142.42 million.

Operations: The company's revenue is primarily generated from online retail sales amounting to $602.75 million.

Market Cap: $142.42M

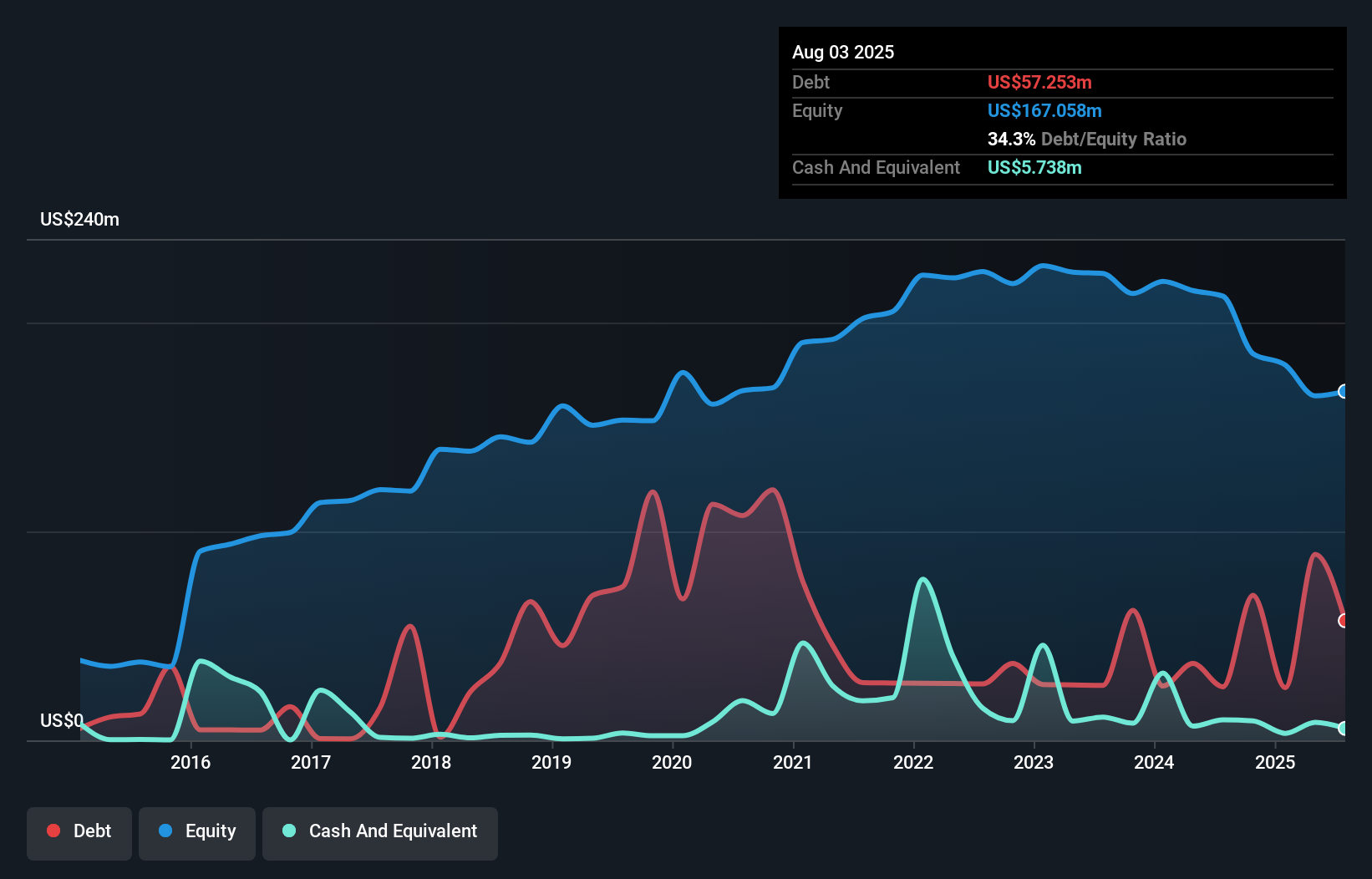

Duluth Holdings, with a market cap of US$142.42 million, remains a volatile penny stock in the retail sector. Despite recent improvements in earnings for Q2 2025, reporting a net income of US$1.26 million compared to a loss last year, Duluth is still unprofitable over the long term with losses increasing at 70.6% annually over five years. The company's short-term and long-term liabilities are well-covered by its assets, but negative operating cash flow raises concerns about debt coverage. Recent business expansion includes opening a new store in Kansas City to bolster retail presence amidst financial challenges.

Vimeo (VMEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vimeo, Inc. and its subsidiaries offer video software solutions globally, with a market cap of $734.10 million.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $415.40 million.

Market Cap: $734.1M

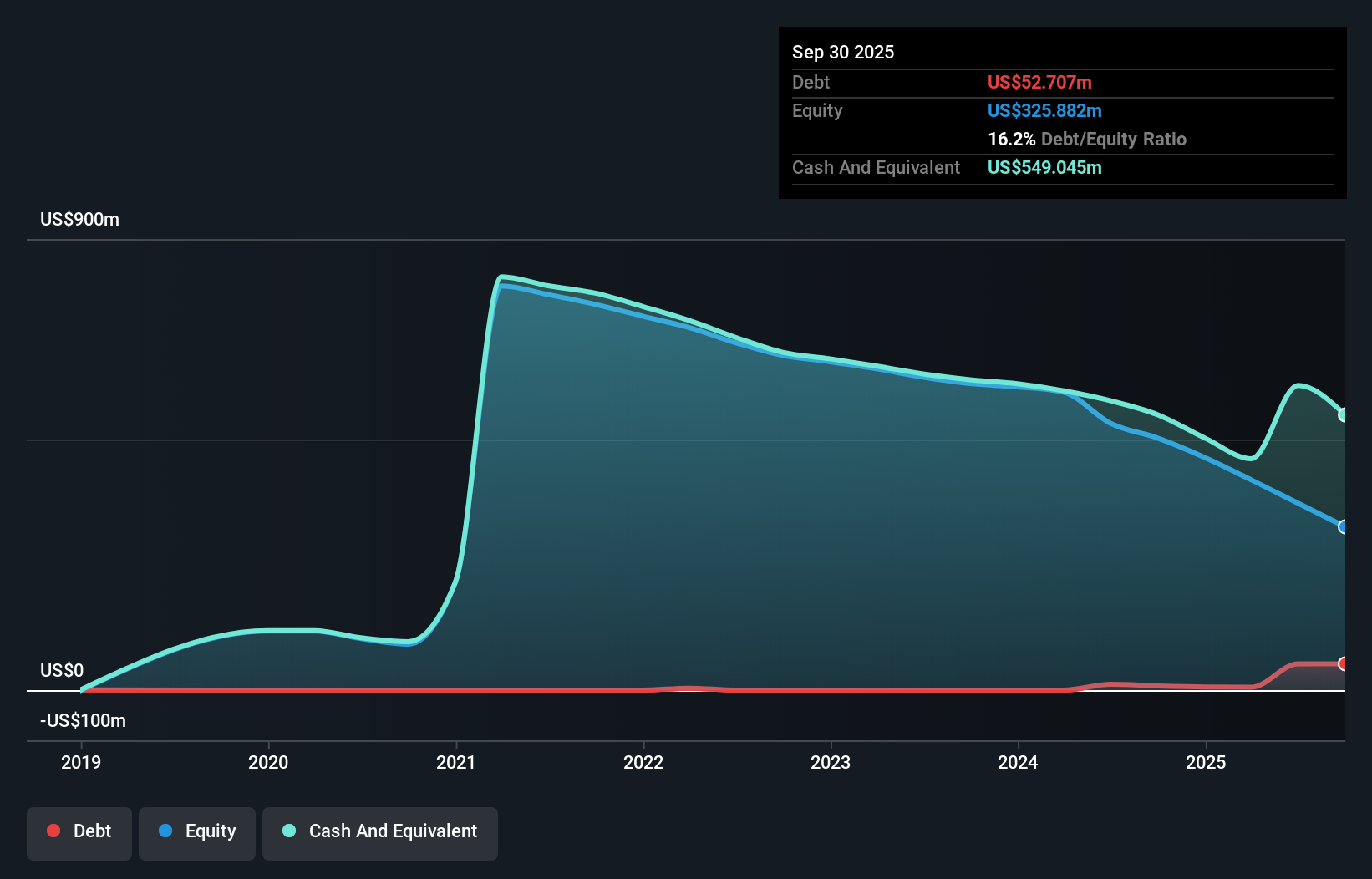

Vimeo, Inc., with a market cap of US$734.10 million, displays characteristics typical of penny stocks, including volatility and recent executive changes. Despite being debt-free and having assets that cover liabilities, its net profit margins have declined from 7.7% to 3.1% over the past year amid negative earnings growth of -60.1%. The company reported Q2 2025 sales of US$104.65 million but saw a drop in net income to US$6.29 million from US$10.12 million last year, reflecting challenges in profitability despite stable revenue figures and anticipated growth acceleration for the remainder of 2025.

Nuvation Bio (NUVB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nuvation Bio Inc. is a clinical-stage biopharmaceutical company dedicated to developing therapeutic candidates for oncology, with a market cap of approximately $1.33 billion.

Operations: The company generates revenue primarily from its oncology development activities, amounting to $14.36 million.

Market Cap: $1.33B

Nuvation Bio Inc., with a market cap of US$1.33 billion, exemplifies the volatility and potential of penny stocks in the biopharmaceutical sector. Despite being unprofitable, it has a robust cash position exceeding its liabilities and no significant debt concerns. The recent FDA approval of IBTROZI™ for ROS1-positive NSCLC marks a significant milestone, supported by promising Phase 2 study results showing high response rates in TKI-naive patients. However, challenges remain with ongoing losses and an inexperienced board. Revenue growth is anticipated at 48.59% annually, but profitability remains elusive in the near term.

Turning Ideas Into Actions

- Access the full spectrum of 376 US Penny Stocks by clicking on this link.

- Want To Explore Some Alternatives? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.