Please use a PC Browser to access Register-Tadawul

Sezzle (SEZL) Soars 212% Last Quarter Amid Strong Earnings Performance

Sezzle Inc. Ordinary Shares SEZL | 70.14 | -3.96% |

Sezzle (SEZL) recently launched a suite of consumer-focused features, including a popular pre-loadable digital wallet, amid declining consumer confidence. Despite these product advancements, the company faced notable removals from key indices, which might impact investor sentiment. Meanwhile, amidst the backdrop of a stable broader market, Sezzle's impressive 212% price increase in the last quarter is remarkable. Strong earnings performance, with significant revenue and income jumps, potentially bolstered investor confidence in SEZL. More broadly, the focus on technological innovation aligns with the tech sector's modest gains, contrasting the market's overall volatility linked to geopolitical and policy concerns.

The recent launch of Sezzle's consumer-focused features, including the digital wallet, holds potential for increased customer engagement, yet the impact of its removal from key indices looms large. This could present challenges despite the share price's 212% surge in the last quarter. Looking at the longer term, Sezzle's total return over the past year, including share price and dividends, reached a very large 775.66%, significantly outpacing the 10% return of the US market and the 14% return of the US Diversified Financial industry.

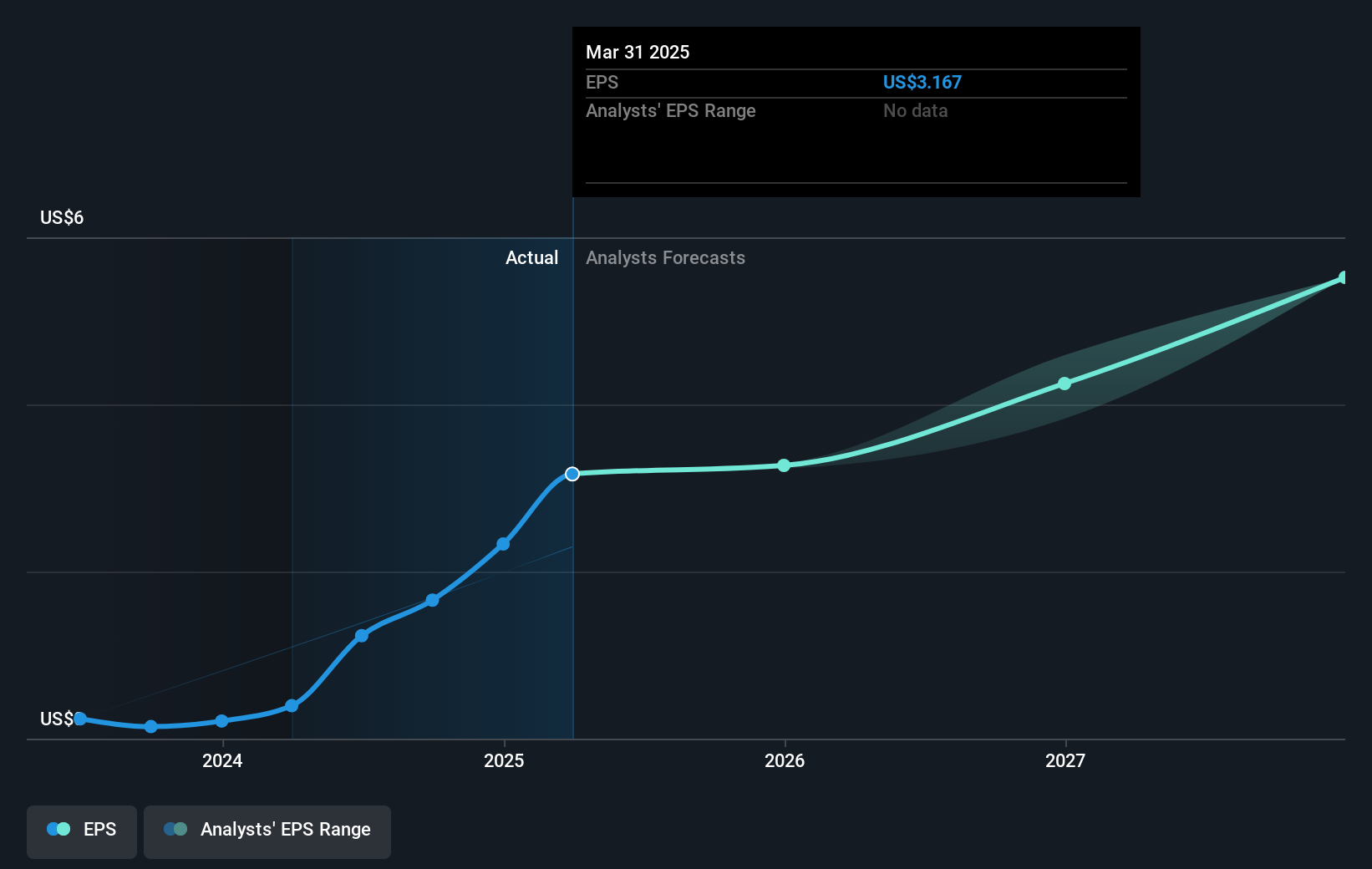

Sezzle's revenue and earnings forecasts remain robust, with analysts predicting 22.2% annual revenue growth and a shift in profit margins over the coming years. Nevertheless, the recent product innovations might further boost shopper engagement, supporting these projections. However, the company faces challenges including high competition and regulatory changes that could affect market share and profitability. With the current share price at US$133.32, still trading at a discount to the price target of US$161.00, there's room for market optimism, contingent on achieving forecasted revenue of $329.06 million and earnings of $106.68 million.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.