Please use a PC Browser to access Register-Tadawul

Shake Shack (SHAK): One-Off $33.7M Loss Challenges Bullish Growth Narrative

Shake Shack, Inc. Class A SHAK | 90.55 90.55 | +0.81% 0.00% Pre |

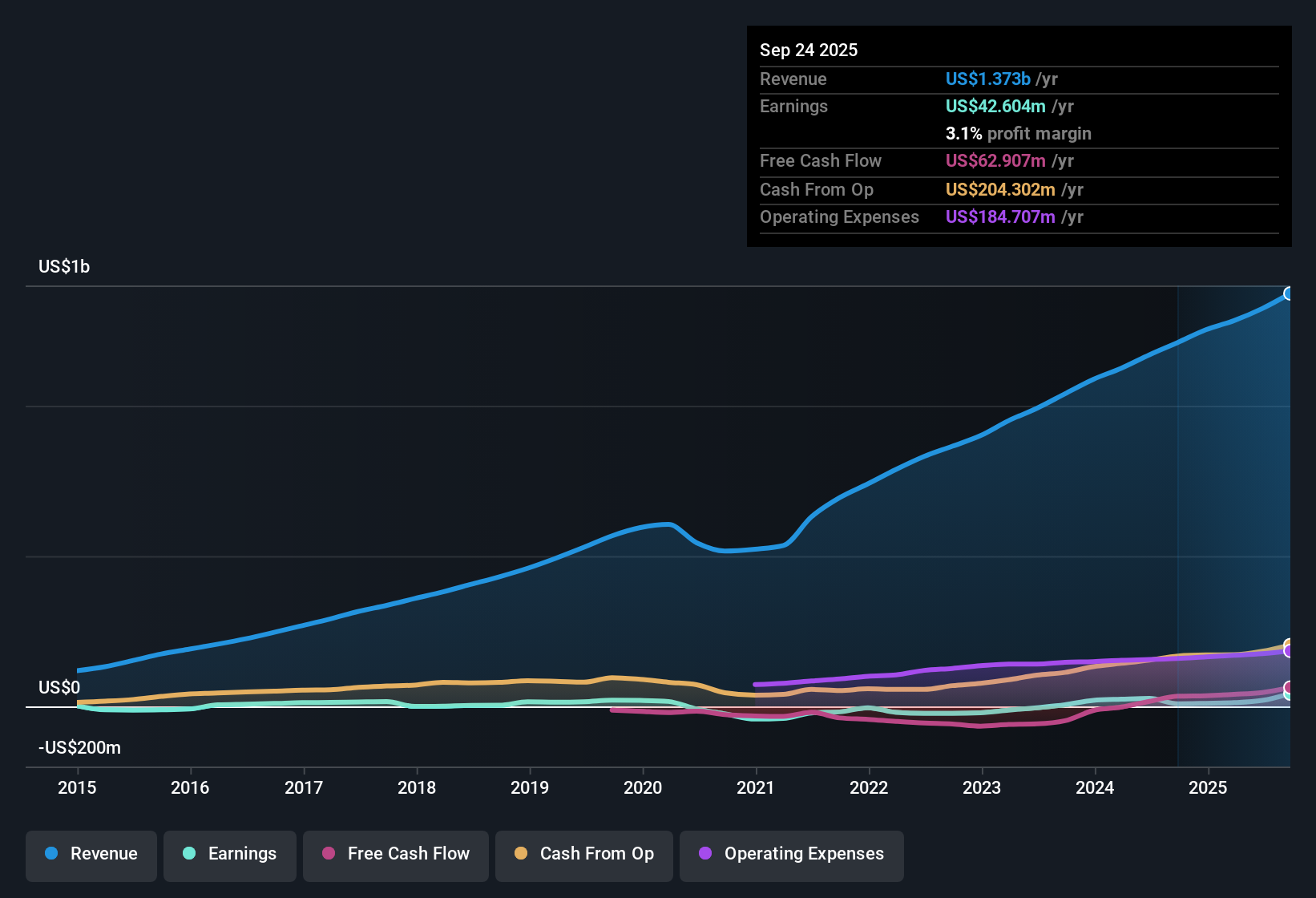

Shake Shack (SHAK) reported net profit margins of 1.5%, down from 2.3% a year ago, highlighting a noticeable decrease in profitability. The latest quarter included a one-off loss of $33.7 million that weighed on reported earnings. Forecasts remain optimistic, with analysts expecting annual earnings growth of 22.7% and revenue growth of 12.2% over the next three years. Despite margin pressure, investors are eyeing the potential for strong profit and sales expansion in the coming years.

See our full analysis for Shake Shack.The next section puts these numbers in context, comparing Shake Shack’s actual results against the most widely followed narratives in the market and at Simply Wall St. Let’s see which stories hold up and which might need a rethink.

Menu Innovation Helps Margin Outlook

- Analysts expect profit margins to grow from 1.5% today to 5.4% in three years, reflecting confidence in Shake Shack's operational improvements and new premium menu items designed to boost spending per visit.

- According to the analysts' consensus view, investing in menu innovation and digital upgrades is expected to fuel stronger sales and long-term earnings power.

- The introduction of exclusive offerings and omni-channel marketing targets higher guest frequency and brand loyalty.

- Strategic expansion into experiential formats and international markets is seen as a lever for system-wide revenue gains, with forecasts calling for annual revenue growth of 14.8% over the next three years.

- Consensus narrative points to Shake Shack's capacity to offset rising input costs and bolster margin expansion through smarter labor scheduling, digital kiosks, and supply chain optimization.

- Operational discipline and a standardized performance scorecard are believed to help balance inflationary pressures, highlighting underappreciated margin tailwinds mentioned by analysts.

Price-to-Sales Premium vs. Peers

- Shake Shack trades at a price-to-sales ratio of 2.8x, noticeably higher than the peer average of 2.2x and the US hospitality industry average of 1.7x, signaling a premium valuation compared to competitors.

- The consensus narrative stresses that this premium is balanced by projected system-wide growth and the company's brand equity.

- Enhanced digital and operational capabilities are cited as supporting near-term margin expansion.

- However, analysts warn that heavy G&A and CapEx investments need to translate into higher sales and margin leverage or risk weighing on future profitability.

DCF Fair Value Shows Upside

- Shake Shack’s share price stands at $91.38, which is below the DCF fair value estimate of $100.55, suggesting possible undervaluation from a discounted cash flow perspective even as near-term results show margin pressure.

- Analysts' consensus view highlights that, while headline profitability is down due to a $33.7 million one-off loss, the bigger story is whether future profit and revenue growth is enough to justify not only the current price, but also the $117.59 analyst price target, which is 27.4% higher than today.

- Forecasts call for earnings to rise to $107.9 million by 2028, but investors should sense check assumptions relating to growth, margins, and valuation multiples.

- Disagreement among analysts, with price targets ranging from $110.0 to $162.0, underscores the importance of weighing current valuation signals alongside optimistic growth projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Shake Shack on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking for a fresh angle on the figures? Spin your perspective into a narrative of your own in just a few minutes, and Do it your way.

A great starting point for your Shake Shack research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Shake Shack faces risks of margin compression and a premium valuation, with near-term profits pressured by high costs and large ongoing investments.

If reliable, steady returns are a priority, check out stable growth stocks screener (2112 results) and find companies consistently delivering growth and performance even when the market gets bumpy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.