Please use a PC Browser to access Register-Tadawul

SharpLink Gaming (SBET): Assessing Valuation Following Equity Tokenization Initiative with Superstate

SharpLink Gaming SBET | 9.93 | -5.52% |

If you have been tracking SharpLink Gaming (SBET), their latest move probably caught your eye. The company announced a bold shift this week as they are partnering with Superstate to tokenize their equity directly on the Ethereum blockchain. If this initiative takes off, SharpLink could become the first public firm in the US to issue its stock natively on-chain. This could open the door to compliant secondary trading on decentralized platforms and potentially set new standards for how equities are managed and traded.

In the bigger picture, SharpLink has experienced dramatic volatility this year. Shares are up 84% over the past twelve months and have gained 71% in the past 3 months alone, though recent weeks saw some retracement. Alongside the blockchain news, SharpLink filed to increase its authorized share count and has been active at industry conferences. All of this suggests momentum is building behind their new strategy and investor interest is rising.

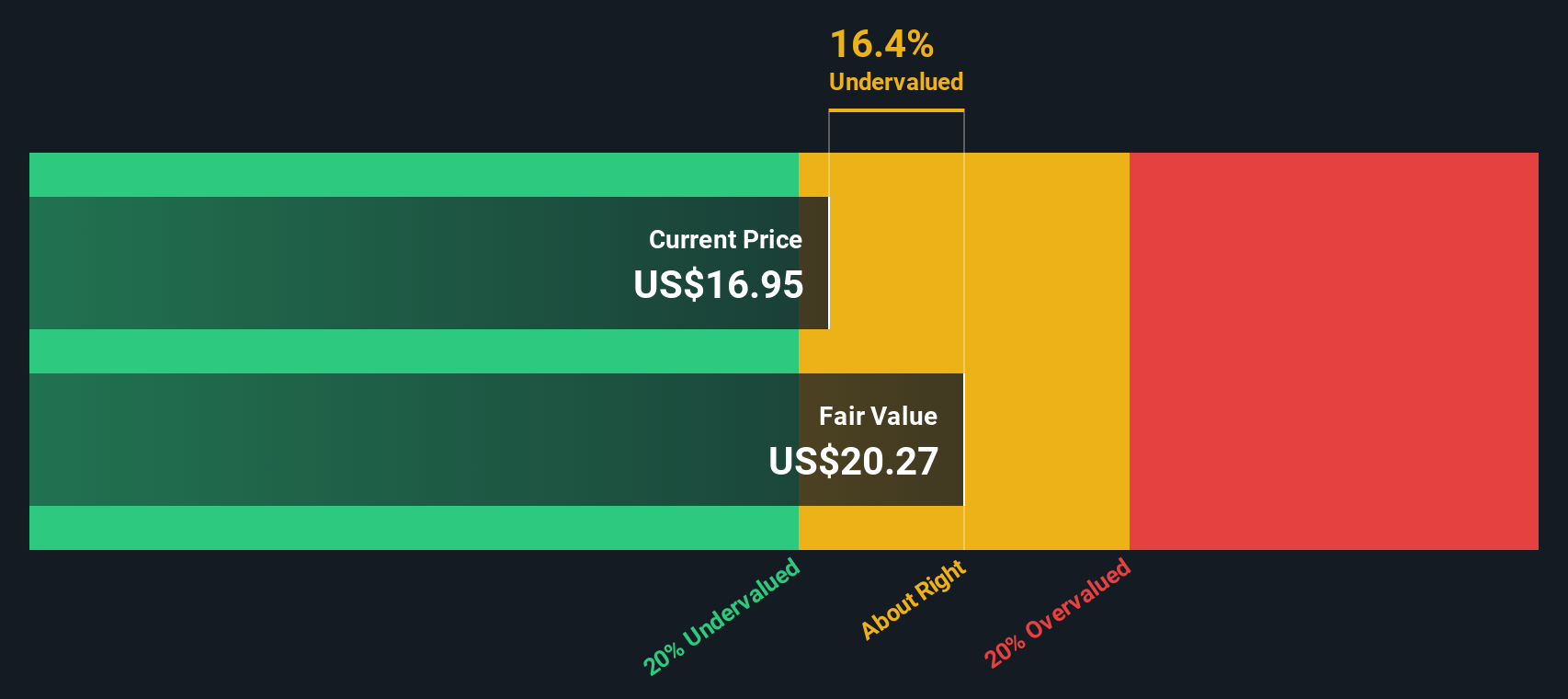

With those kinds of moves and price swings, the real question now is whether SharpLink is actually undervalued by the market or if all the promise of future growth has already been priced in.

Price-to-Book Ratio of 6.8x: Is it justified?

SharpLink Gaming is currently trading at a Price-To-Book Ratio of 6.8x, which makes the stock appear expensive compared to both its direct peers and the broader US Hospitality industry.

The price-to-book ratio compares a company's market value to its book value, and it is particularly useful for evaluating firms in asset-heavy sectors like hospitality. A higher P/B ratio like SharpLink’s suggests investors are willing to pay much more for each dollar of net assets than for peer companies, possibly reflecting optimism about the company’s future prospects or a premium attached to its unique positioning.

However, this elevated multiple may also indicate that the market expects substantial future growth or significant fundamental improvement. Expectations for such growth are not always borne out. Investors should consider whether SharpLink’s recent volatility and new on-chain equity strategy fully support such a premium, or if the current valuation outpaces realistic growth potential.

Result: Fair Value of $20.07 (UNDERVALUED)

See our latest analysis for SharpLink Gaming.However, sustained losses and high valuation multiples could cloud the growth story, especially if execution on blockchain initiatives falls short of expectations.

Find out about the key risks to this SharpLink Gaming narrative.Another View: SWS DCF Model Suggests Undervaluation

While SharpLink looks expensive compared to other companies in its industry, our DCF model gives a different signal. This approach points to shares being undervalued at current levels. Is the market missing something, or are risks understated?

Build Your Own SharpLink Gaming Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own view of SharpLink Gaming in just a few minutes. Do it your way.

A great starting point for your SharpLink Gaming research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Great opportunities are waiting beyond SharpLink, and some may surprise you. Don’t let the next market leader pass you by. Give yourself an edge with these powerful picks:

- Uncover emerging companies with solid financials and big upside by checking out our penny stocks with strong financials.

- Tap into booming demand for innovative healthcare solutions backed by artificial intelligence with our healthcare AI stocks.

- Add steady potential to your portfolio with picks boasting strong yields through our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.