Please use a PC Browser to access Register-Tadawul

Shopify And Swanson Health Partnership Highlights AI Subscriptions For Investors

Shopify, Inc. Class A SHOP | 110.66 | -6.78% |

- Swanson Health has launched a new eCommerce and subscription platform powered by Shopify and Ordergroove.

- The platform uses AI driven personalization to support customer engagement and global scalability.

- The collaboration positions Shopify as a core provider for brands seeking rapid digital commerce transformation.

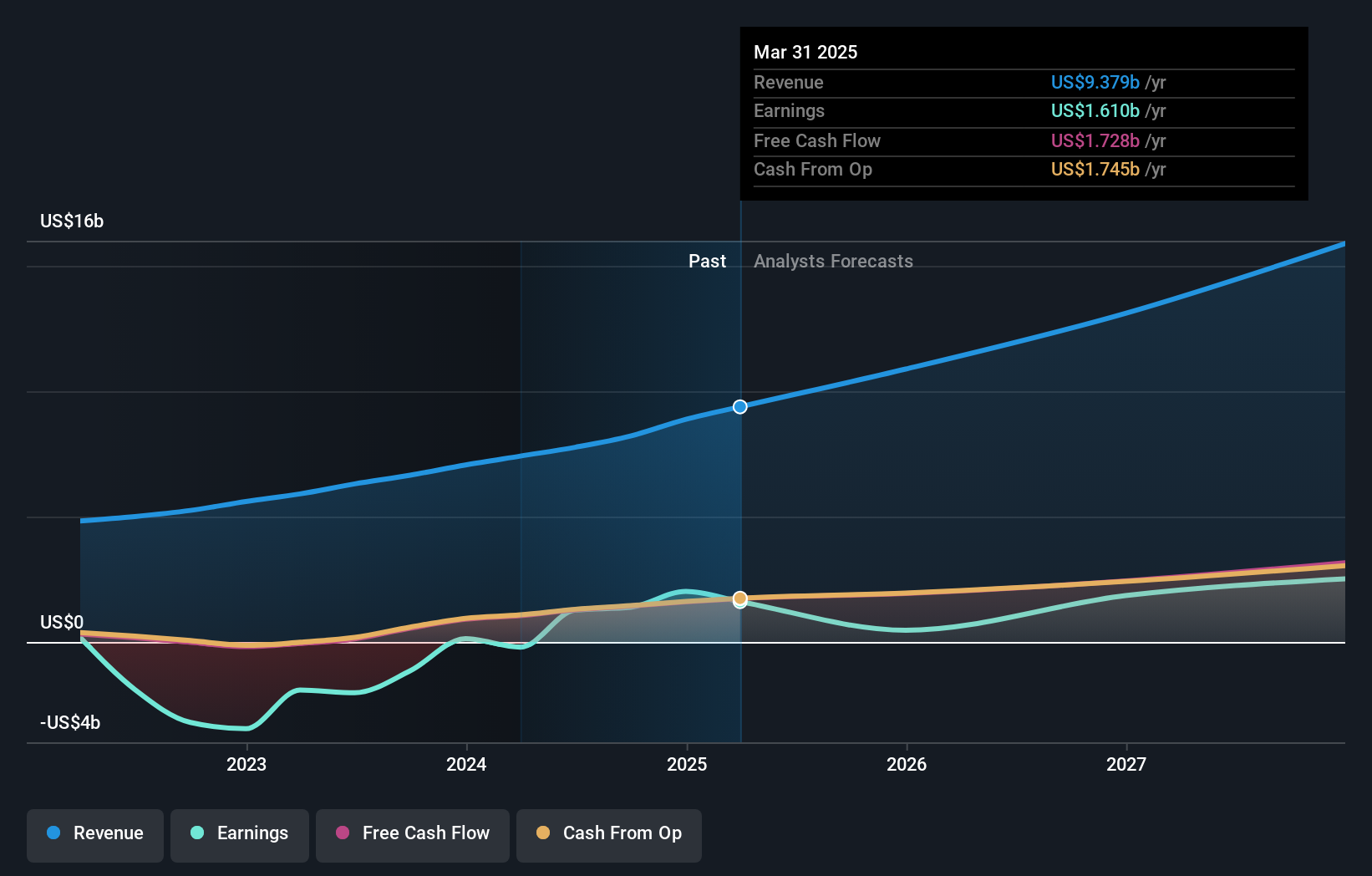

For investors watching Shopify, ticker NasdaqGS:SHOP, this update adds detail on how the platform is being used by established consumer brands. Shopify shares most recently traded at $112.05, with a 3 year return of 132.0%, while the 5 year return reflects a 23.0% decline. Over shorter periods, the stock shows a 14.6% decline over the past week and a 32.8% decline over the past month, alongside a 28.7% decline year to date and a 4.6% decline over the past year.

This Swanson Health rollout highlights how Shopify is being adopted to support AI driven personalization and subscription models that are increasingly important for customer retention. For investors, it emphasizes how Shopify’s role as a commerce backbone can influence long term relationships with larger merchants that want scalable, data driven customer experiences.

Stay updated on the most important news stories for Shopify by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Shopify.

Swanson Health’s move onto Shopify with Ordergroove puts Shopify’s subscription and AI tools in the spotlight, because it shows how a mature direct to consumer brand is willing to replace its own systems with Shopify’s out of the box stack. For you as an investor, this kind of partnership speaks to Shopify’s role as a core commerce platform for brands that want AI driven personalization, recurring revenue models and faster rollout across mobile and desktop without building everything in house.

How this fits the Shopify growth story

This deal lines up with the existing Shopify narratives around large brand adoption and new verticals, as it highlights another enterprise grade use case on top of the millions of small and mid sized merchants already on the platform. It also connects with the idea that Shopify’s value is not just store creation, but a full stack of merchant solutions that can support subscriptions, B2C and potentially B2B, which some narratives see as important for longer term growth.

Risks and rewards investors should keep in mind

- Shows Shopify can win over brands that previously ran custom commerce stacks, which may support higher value enterprise relationships versus only focusing on very small merchants.

- Reinforces Shopify’s positioning in AI powered commerce at a time when investors are watching agent based and AI driven tools across players like Amazon and WooCommerce.

- Reliance on third party partners such as Ordergroove adds integration and execution complexity that might not fully translate into higher margins for Shopify.

- Larger brands still have the option to build their own solutions or use competitors like BigCommerce or Adobe Commerce, so partnerships like this are helpful but not a guarantee of future deal flow.

What to watch next

From here, it is worth tracking whether Shopify highlights Swanson Health type wins in future earnings commentary, especially around subscription GMV, AI driven engagement metrics and enterprise merchant adoption versus smaller sellers. If you want more context on how this sort of partnership fits into the longer term story, take a few minutes to read community views and analyst narratives on Shopify’s dedicated page by checking what other investors are saying about Shopify’s narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.