Please use a PC Browser to access Register-Tadawul

Shopify (SHOP): Assessing Valuation After Expanding Shop Pay Internationally with Global-e Partnership

Shopify, Inc. Class A SHOP | 164.19 165.52 | -0.34% +0.81% Pre |

Shopify (SHOP) has expanded the reach of its Shop Pay one-click checkout by teaming up with Global-e to make the streamlined payment option available for international merchants. This update is poised to enhance Shopify’s cross-border commerce ambitions.

Shopify’s year-to-date share price return of 45.6% easily outpaces the broader market, and its one-year total shareholder return has soared to a remarkable 91.8%. Positive momentum has been building over the past quarter, fueled by ongoing product launches, key partnerships such as the recent Global-e deal, and leadership changes that signal a push for international growth and innovation.

If you’re intrigued by companies with rapidly growing platforms and strong insider backing, now is the perfect time to discover fast growing stocks with high insider ownership

With shares surging nearly 92% over the past year and multiple analyst upgrades in tow, the key question now is whether Shopify still offers compelling value to new investors, or if anticipated growth is already reflected in its price.

Most Popular Narrative: 4% Undervalued

Shopify’s most widely followed narrative sees its fair value slightly above the last close of $156.57, hinting that current prices still allow for some upside. The market is weighing sharp earnings growth and expectations for international expansion as potential share price catalysts.

“Rapid international expansion, upmarket focus, and financial ecosystem growth are diversifying revenue streams and increasing resilience amid evolving digital commerce trends. Aggressive integration of AI and emerging retail channels is boosting merchant acquisition, efficiency, and margins. This positions Shopify as a central digital commerce enabler.”

Want to unlock the math behind this price tag? Shopify’s fair value relies on bold projections for future profits, revenue streams beyond borders, and tech innovation payoffs. Ready to see which numbers power this bullish scenario? Click to discover what’s driving analyst conviction.

Result: Fair Value of $163.15 (UNDERVALUED)

However, persistent competition from major e-commerce players and potential global regulatory shifts could quickly challenge Shopify’s growth momentum and have an impact on future profitability.

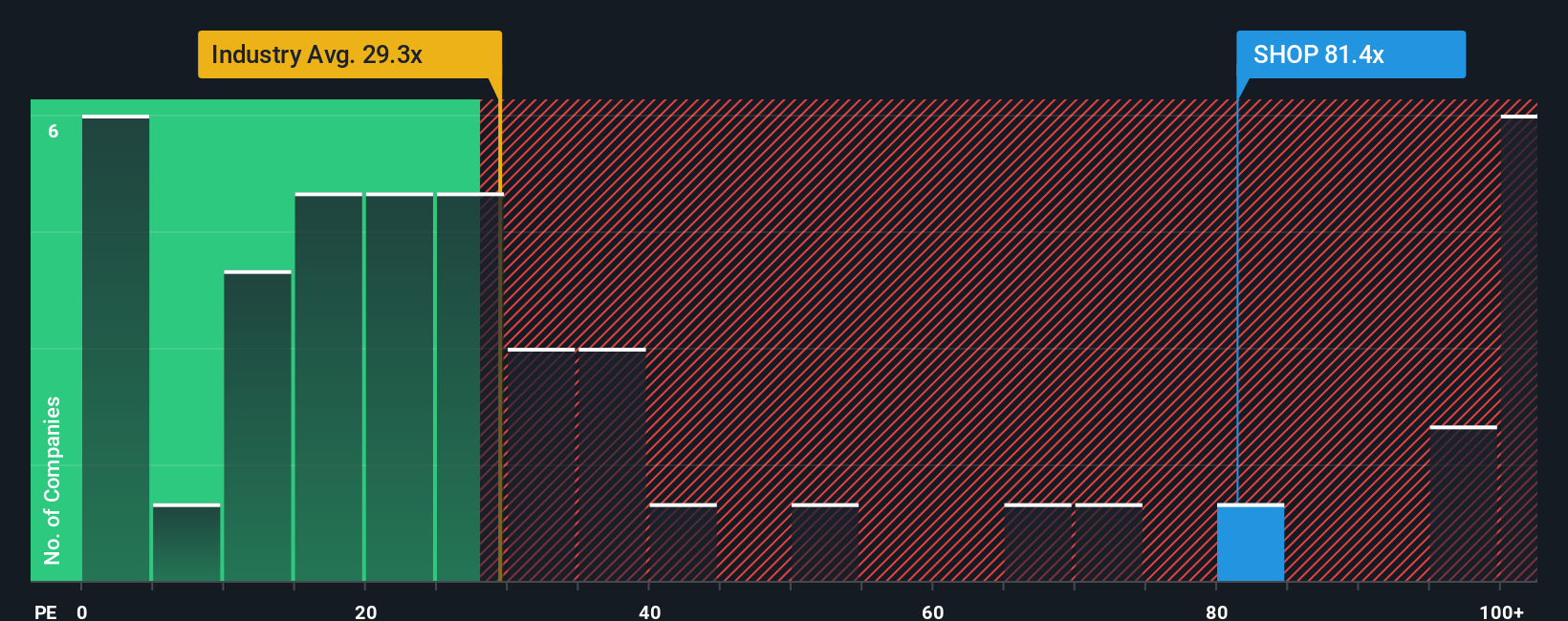

Another View: Multiples Tell a Different Story

Looking at Shopify through the lens of its current price-to-earnings ratio paints a contrasting picture. Shares are trading at 86.8x earnings, which is more than double the US IT industry average of 32x, and well above a fair ratio estimate of 43.3x. This raises caution for investors, as a move toward lower multiples could mean significant downside. Could momentum keep valuations elevated, or will reality catch up?

Build Your Own Shopify Narrative

If these valuations or perspectives don’t quite resonate, you’ve got the tools to investigate the data and shape your own Shopify outlook in just a few minutes. Do it your way

A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stand still. Now is your chance to find stocks that match your unique strategy. Don’t let fresh opportunities slip by.

- Boost your passive income potential when you check out these 20 dividend stocks with yields > 3% that offer yields above 3% and solid financial health.

- Spot hidden bargains easily by using these 868 undervalued stocks based on cash flows based on strong cash flow fundamentals and attractive market pricing.

- Jump on the frontier of disruptive innovation by exploring these 24 AI penny stocks paving the way in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.