Please use a PC Browser to access Register-Tadawul

Should American Healthcare REIT's (AHR) Raised 2025 Guidance Spur a Closer Look From Investors?

American Healthcare REIT, Inc. AHR | 47.81 | +1.29% |

- American Healthcare REIT recently reported strong second quarter 2025 results, delivering US$542.5 million in revenue and a significant year-over-year increase in net income amid rising occupancy in senior housing and health campuses.

- The company simultaneously raised its full-year 2025 earnings and net operating income guidance, reflecting robust operating performance, multiple portfolio acquisitions, and a completed follow-on equity offering worth up to US$1 billion.

- We'll explore how the upgraded earnings guidance and robust NOI growth could influence American Healthcare REIT's long-term investment outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

American Healthcare REIT Investment Narrative Recap

To believe in American Healthcare REIT, investors need confidence in the long-term demand tailwinds for senior care and the company's ability to deliver operational gains from its growing senior housing and health campuses portfolio. The recent equity offering and strong quarterly results both support access to growth capital and improved earnings guidance, but also raise the profile of execution and integration risk as AHR accelerates its acquisition plans in niche sectors of healthcare real estate. Short-term, the biggest catalyst remains continued occupancy growth in senior housing, while the greatest risk lies in the concentration of revenues linked to government reimbursement and the challenges of integrating new acquisitions, neither of which has been fundamentally altered by the latest announcements, though capital flexibility has improved. Among AHR’s recent announcements, the completion of a US$1 billion follow-on equity offering and portfolio acquisitions stands out most. This development increases financial flexibility and supports continued expansion in its senior care footprint, but also brings heightened expectations for management to successfully deploy this capital and integrate new properties, directly impacting the short-term outlook for net operating income improvements and underlying dividend support. Yet, in contrast to the favorable guidance, investors should be aware of the risks if government reimbursement policies shift or integration challenges emerge...

American Healthcare REIT's narrative projects $2.7 billion revenue and $156.0 million earnings by 2028. This requires 8.5% yearly revenue growth and a $196.7 million increase in earnings from the current -$40.7 million.

Uncover how American Healthcare REIT's forecasts yield a $40.55 fair value, in line with its current price.

Exploring Other Perspectives

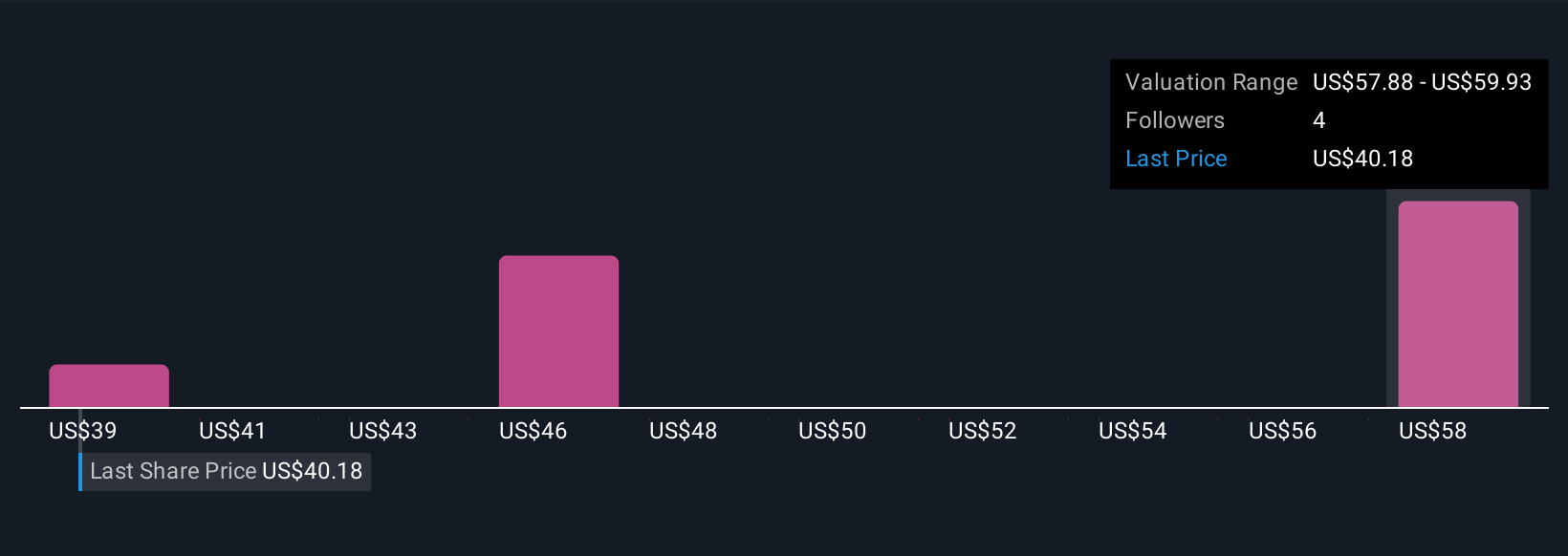

The Simply Wall St Community includes three unique fair value estimates for AHR, spanning from US$39.37 to US$62.78 per share. While shareholder views diverge, revenue growth tied to senior housing demand and operational gains remain central to the company’s future performance, underscoring how perspectives and risk tolerance can differ widely.

Explore 3 other fair value estimates on American Healthcare REIT - why the stock might be worth as much as 55% more than the current price!

Build Your Own American Healthcare REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Healthcare REIT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Healthcare REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Healthcare REIT's overall financial health at a glance.

No Opportunity In American Healthcare REIT?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.