Please use a PC Browser to access Register-Tadawul

Should Analyst Optimism on Record Patient Volumes and AI Efforts Require Action From HCA Healthcare (HCA) Investors?

HCA Holdings, Inc. HCA | 484.77 | +0.50% |

- Recently, HCA Healthcare received heightened positive attention from major analysts following reports of record patient volumes and better-than-expected earnings results.

- This surge in recognition coincides with the company’s ongoing investments in artificial intelligence, care quality, and expansions aiming to unify its hospital network and improve operational efficiency.

- We'll examine how strong analyst sentiment, supported by operational improvements and technology initiatives, could influence HCA Healthcare’s investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

HCA Healthcare Investment Narrative Recap

To be a shareholder in HCA Healthcare, you need to believe in the company’s ability to grow patient volumes and drive operational improvements through technology and network expansions. The recent surge in analyst optimism, sparked by record patient volumes and robust earnings, could reinforce confidence in revenue growth as the key short-term catalyst. At the same time, policymakers remain a major risk, as changes in federal reimbursement frameworks or Medicaid could materially affect HCA’s earnings potential. Overall, this news reinforces existing themes but does not singlehandedly change the risk-reward balance.

Among recent developments, HCA Healthcare’s advancements in artificial intelligence stand out for their relevance to future growth catalysts. The organization’s deployment of AI for patient safety, nurse staffing, and clinical documentation highlights ongoing efforts to streamline care and manage costs. These initiatives intersect directly with operational efficiency objectives, which are central to supporting margin growth as volumes increase.

However, despite operational strengths, evolving policy risks could still present hurdles investors should be aware of...

HCA Healthcare's outlook anticipates $85.4 billion in revenue and $6.9 billion in earnings by 2028. This scenario assumes a 5.5% annual revenue growth rate and a $0.9 billion increase in earnings from the current $6.0 billion.

Uncover how HCA Healthcare's forecasts yield a $417.52 fair value, in line with its current price.

Exploring Other Perspectives

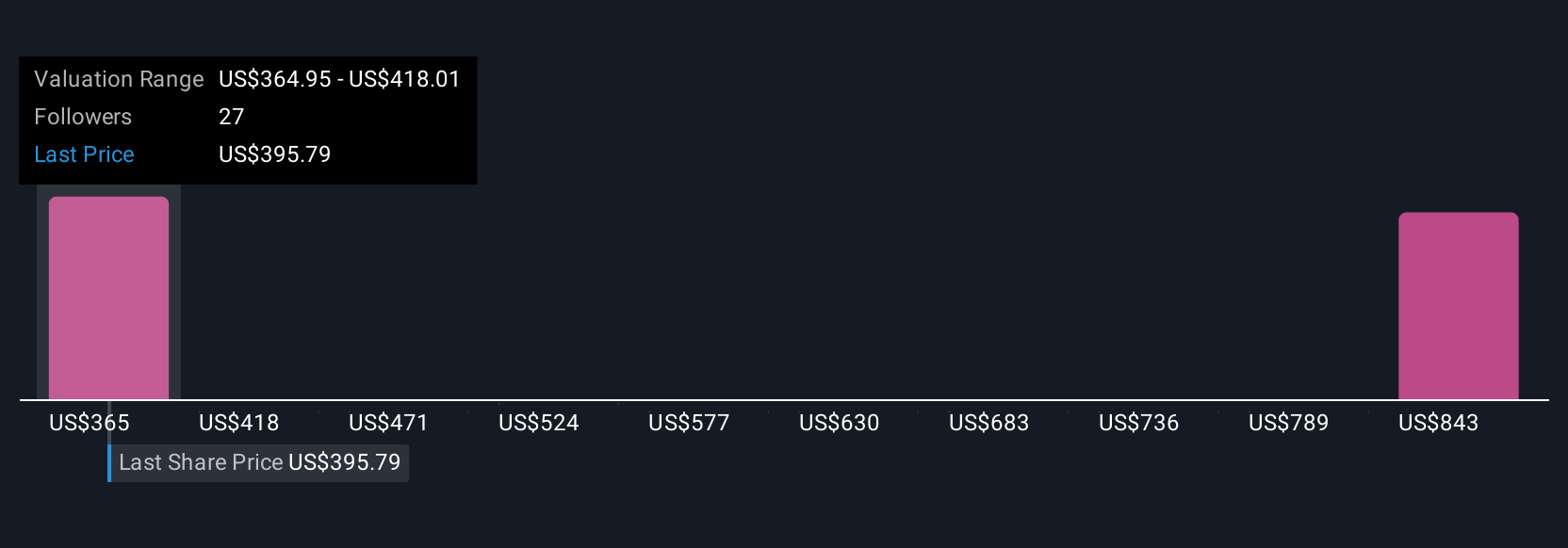

Seven retail investors from the Simply Wall St Community estimate HCA Healthcare’s fair value between US$364.95 and US$814.10 per share. While some expect strong upside, others are more conservative, reflecting uncertainty around federal policy impacts that could shape performance in the longer term. Explore these contrasting viewpoints to better understand the range of possible outcomes.

Explore 7 other fair value estimates on HCA Healthcare - why the stock might be worth as much as 91% more than the current price!

Build Your Own HCA Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free HCA Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HCA Healthcare's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.