Please use a PC Browser to access Register-Tadawul

Should Analyst Upgrades and Insider Selling Shift Views on Commvault Systems (CVLT) Ahead of SHIFT Event?

CommVault Systems, Inc. CVLT | 121.59 | -2.02% |

- Commvault Systems recently received multiple analyst upgrades, including ratings changes by Piper Sandler and Guggenheim, citing optimism about the company's positioning ahead of its November SHIFT event.

- Despite this strengthening analyst sentiment, there has been significant insider selling activity over the past six months, highlighting some ongoing market caution even as further company developments are anticipated.

- We'll explore how growing analyst optimism around the upcoming SHIFT event influences Commvault Systems' investment outlook and future expectations.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Commvault Systems Investment Narrative Recap

To be a shareholder in Commvault Systems right now, you would need to believe that the company’s transformation to a SaaS-driven business and its leadership in cyber resilience can drive sustainable growth, particularly with the anticipated SHIFT event in November serving as a key short-term catalyst. While analyst upgrades point to optimism ahead of the event, the ongoing risk of margin compression linked to the transition to recurring revenue remains the most important consideration, recent news raises sentiment but does not fundamentally alter this risk profile.

The launch of "Clumio for Apache Iceberg on AWS" stands out among recent product announcements, aligning with the company’s focus on expanding its cyber resilience platform and targeting the growth in data lakehouse and analytics workloads. This move supports the upcoming SHIFT event’s positioning as a platform to highlight Commvault’s progress in advanced data protection offerings, reinforcing the near-term catalyst investors are watching for.

Yet, in contrast to growing analyst optimism, the persistence of margin pressures amid the SaaS transition is a factor investors should be aware of...

Commvault Systems' outlook anticipates $1.5 billion in revenue and $173.1 million in earnings by 2028. This assumes a 12.2% annual revenue growth rate and a $92 million increase in earnings from the current $81.1 million level.

Uncover how Commvault Systems' forecasts yield a $208.09 fair value, a 21% upside to its current price.

Exploring Other Perspectives

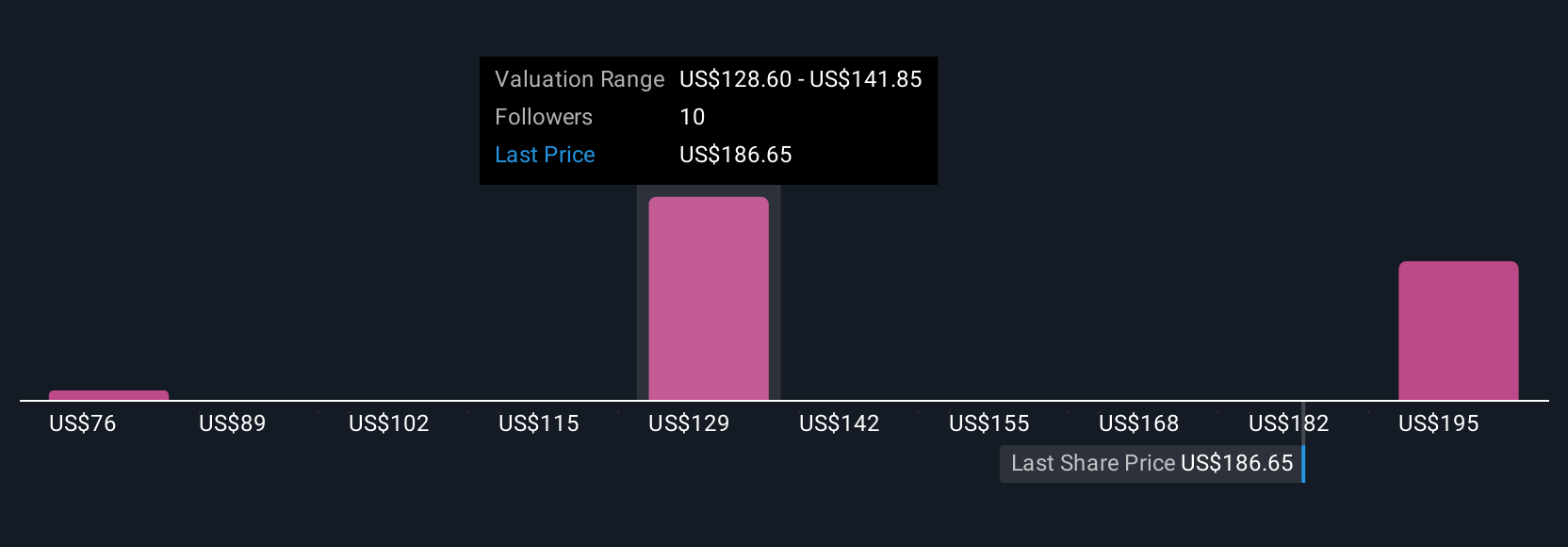

Simply Wall St Community members have published fair value estimates for Commvault Systems ranging from US$75.61 to US$208.09, based on four distinct independent valuations. While some see significant upside, others emphasize the risk of margin compression as SaaS revenue expands, pointing to different views on future earnings potential.

Explore 4 other fair value estimates on Commvault Systems - why the stock might be worth as much as 21% more than the current price!

Build Your Own Commvault Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commvault Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Commvault Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commvault Systems' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.