Please use a PC Browser to access Register-Tadawul

Should Analyst Upgrades on Pure Storage's (PSTG) AI Momentum Prompt Investor Attention?

Pure Storage, Inc. Class A PSTG | 71.32 71.32 | -6.00% 0.00% Pre |

- In the past week, Pure Storage garnered heightened attention after several major analysts reiterated or upgraded their ratings, pointing to continued growth momentum in AI applications and flash storage services.

- Analysts highlighted optimism around the company's expanding partnerships with hyperscalers and anticipated growth in subscription-based revenue streams, drawing particular interest from investors awaiting upcoming earnings results.

- We’ll examine how this wave of analyst optimism around Pure Storage’s AI-focused growth prospects could affect its investment outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Pure Storage Investment Narrative Recap

To invest in Pure Storage, you need to believe in the company’s ability to drive long-term recurring revenue growth, mainly through increased adoption of AI-powered flash and hybrid storage solutions, while successfully expanding partnerships with hyperscalers. The latest wave of analyst optimism, and recent price target upgrades, may boost short-term confidence ahead of upcoming earnings, but the most material near-term catalyst remains the transition to higher-margin, subscription-based services; meanwhile, uncertainty in closing large hyperscaler contracts continues to represent the business’s biggest risk, which the news does not fundamentally change.

Among recent announcements, Pure Storage’s release of new enhancements for cyber resilience and a public cloud offering within the Azure portal stands out. This move reflects a focus on building out its Enterprise Data Cloud to accelerate customer adoption in cloud and hybrid environments, aligning directly with catalysts that support recurring revenue and margin expansion, especially as the market pays close attention to upcoming financial results.

However, in contrast to this positive momentum, investors should also be aware that uncertainty around the timing and scale of hyperscaler deals could still ...

Pure Storage's narrative projects $5.1 billion in revenue and $571.5 million in earnings by 2028. This requires 15.2% yearly revenue growth and a $432.3 million earnings increase from the current $139.2 million.

Uncover how Pure Storage's forecasts yield a $89.39 fair value, a 5% downside to its current price.

Exploring Other Perspectives

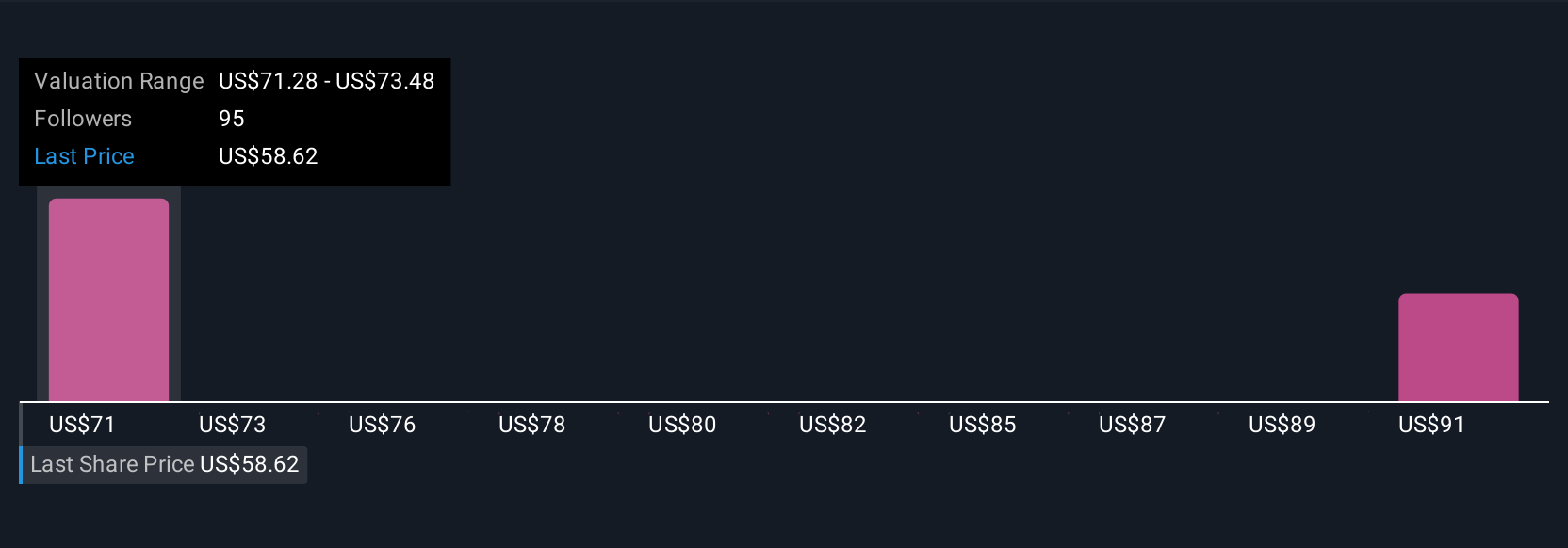

Simply Wall St Community members provided four fair value estimates for Pure Storage, ranging from US$89.34 to US$103.05 per share. While many believe in the recurring revenue opportunity, differing opinions highlight that expectations for large hyperscaler wins remain a key uncertainty, explore these diverse viewpoints to see how they may influence your view of the company’s future.

Explore 4 other fair value estimates on Pure Storage - why the stock might be worth just $89.34!

Build Your Own Pure Storage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pure Storage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pure Storage's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.