Please use a PC Browser to access Register-Tadawul

Should Applied Optoelectronics' (AAOI) AI-Driven Network Upgrades Prompt a Closer Look From Investors?

Applied Optoelectronics, Inc. AAOI | 32.06 | -11.73% |

- Earlier in September 2025, Applied Optoelectronics announced four new software modules for its QuantumLink HFC Remote Management solution, enhancing network visibility, predictive diagnostics, automated alarms, and asset tracking capabilities.

- This expansion leverages AI and real-time analytics to optimize broadband performance and streamline maintenance, positioning the company to address increasing demands for network intelligence and operational efficiency.

- We’ll explore how the launch of AI-driven predictive diagnostics could influence Applied Optoelectronics' investment narrative and growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Applied Optoelectronics Investment Narrative Recap

To believe in Applied Optoelectronics as a long-term investment, shareholders will need confidence in its ability to leverage new product innovation, such as AI-driven software modules, to capture growing demand in broadband and datacenter networking. The September 2025 launch of enhanced QuantumLink modules strengthens Applied Optoelectronics’ offering in network automation, a positive for customer stickiness and margin ambitions, but by itself is unlikely to address the near-term risk of heavy customer concentration.

The July 2025 certification of Applied Optoelectronics’ 1.8GHz amplifiers and QuantumLink software by Charter Communications is most relevant here, providing validation of their technology and access to a sizable cable customer pipeline. This aligns with the near-term catalyst around increasing revenue diversity in the CATV segment, supported by a forecast $300–350 million pipeline across multiple customers that could reduce volatility tied to its largest accounts.

By contrast, investors should be aware of the ongoing risk that over 85% of revenue still depends on just two customers, meaning...

Applied Optoelectronics' outlook forecasts $1.3 billion in revenue and $111.0 million in earnings by 2028. This assumes a 51.5% annual revenue growth rate and a $266.7 million earnings increase from the current earnings of -$155.7 million.

Uncover how Applied Optoelectronics' forecasts yield a $27.20 fair value, a 11% downside to its current price.

Exploring Other Perspectives

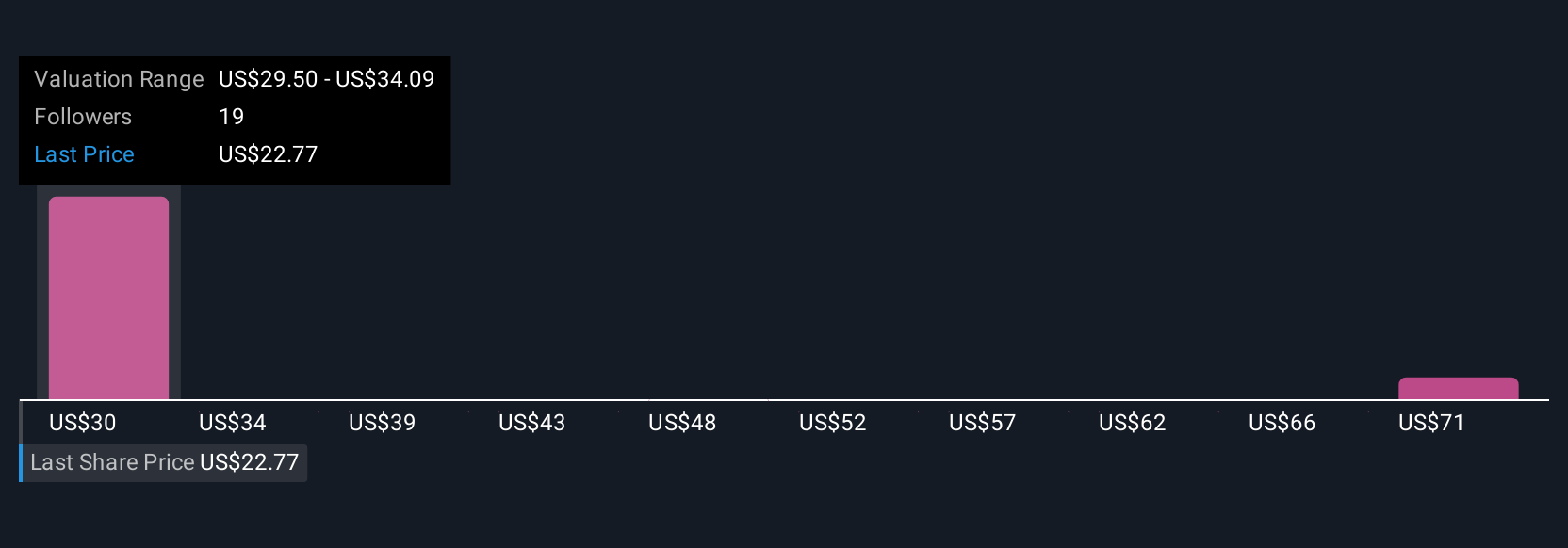

Fair value estimates from the Simply Wall St Community range from US$27.20 to US$75.38 across 7 viewpoints. Alongside this broad spread in expectations, the ongoing challenge of customer concentration remains a key issue for the company’s long-term stability, compare these different outlooks and form your own view.

Explore 7 other fair value estimates on Applied Optoelectronics - why the stock might be worth over 2x more than the current price!

Build Your Own Applied Optoelectronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Optoelectronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Applied Optoelectronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Optoelectronics' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.