Please use a PC Browser to access Register-Tadawul

Should Atlassian's (TEAM) AI Integration and Buybacks Change How Investors View Its Growth Narrative?

Atlassian Corp Class A TEAM | 160.87 160.87 | +1.58% 0.00% Pre |

- Atlassian Corporation recently reported its fiscal first-quarter 2026 results, showing US$1.43 billion in revenue and a net loss of US$51.87 million, while also confirming the completion of an additional share buyback tranche worth US$249.96 million between July and September 2025.

- Despite beating revenue expectations and advancing its integration of AI and cloud offerings, investor sentiment was tempered by ongoing concerns about how emerging AI tools could affect long-term demand for software developer seats, which impacts Atlassian’s growth outlook.

- We'll examine how the tension between strong cloud growth and AI-driven developer demand concerns is influencing Atlassian’s investment thesis.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Atlassian Investment Narrative Recap

To remain confident as an Atlassian shareholder, you need a strong belief in the ongoing value creation from enterprise cloud migration and expanding AI-powered workflows, balanced against the risk that generative AI could blunt developer seat demand. The latest quarterly results showed robust cloud momentum and improved profitability, while the recent share buyback was substantial but does not materially shift the key short-term catalyst, which is continued adoption among large enterprise customers, especially those completing complex migrations to Atlassian’s cloud.

Among the most relevant recent announcements, Atlassian’s authorized share repurchase program of up to US$2,500 million stands out, underlining management’s ongoing commitment to capital return. This move may capture investor attention, but meaningful outperformance in the coming quarters is still most likely to be driven by successful execution on cloud migration and uptake of AI-featured product suites, both of which underpin long-term growth expectations.

Yet, even with positive signs from seat expansion, investors should be alert to what could happen if AI adoption …

Atlassian's narrative projects $8.7 billion revenue and $310.2 million earnings by 2028. This requires 18.7% yearly revenue growth and a $566.9 million increase in earnings from the current -$256.7 million.

Uncover how Atlassian's forecasts yield a $244.75 fair value, a 55% upside to its current price.

Exploring Other Perspectives

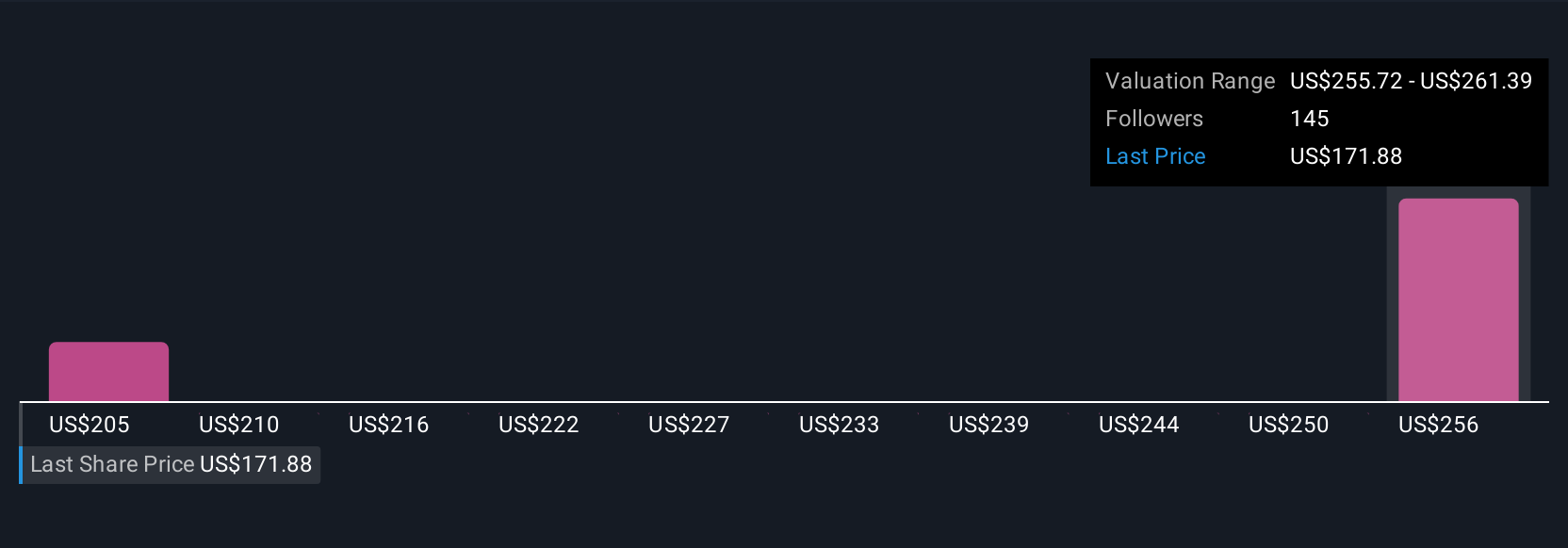

Six private investors in the Simply Wall St Community estimate Atlassian’s fair value between US$204.74 and US$248.60 per share. While confidence in cloud-driven growth is high, diverging views highlight the risk that rapid AI advancement could reshape core demand, urging readers to explore several alternative viewpoints.

Explore 6 other fair value estimates on Atlassian - why the stock might be worth just $204.74!

Build Your Own Atlassian Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlassian research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Atlassian research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlassian's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.