Please use a PC Browser to access Register-Tadawul

Should BellRing Brands' (BRBR) Buyback and Investigations Shift Investor Focus to Long-Term Growth Risks?

BellRing Brands BRBR | 19.52 | +0.21% |

- BellRing Brands announced in the past week a new share repurchase program authorizing up to US$400 million in buybacks over two years, following the cancellation of a previous buyback plan and recent credit agreement amendment to expand its revolving facility to US$500 million.

- Amid these corporate actions, the company faces scrutiny from multiple law firms investigating potential securities law violations after disclosures of slower sales growth and inventory reductions at key customers.

- We'll look at how these ongoing legal investigations and customer inventory shifts may alter BellRing Brands' future growth expectations.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BellRing Brands Investment Narrative Recap

To be a BellRing Brands shareholder, an investor needs to believe in the ongoing expansion and category leadership of Premier Protein, as well as the broader growth of ready-to-drink protein shakes among US households. The latest news introduces two opposing forces: extended share repurchase support, which could aid sentiment in the near term, and legal investigations tied to inventory reductions and slower sales growth at key customers, which increase headline risk and overshadow the company’s immediate growth catalysts. While the legal reviews do not materially change the fundamental distribution opportunity, any further sales deceleration or adverse findings could impact confidence around topline momentum.

Among the recent announcements, the new two-year US$400 million share repurchase program stands out for its potential influence on share value and capital management. This commitment, following a sizeable buyback and facility expansion, provides the company additional flexibility, which may help counterbalance volatility stemming from retailer inventory actions and muted near-term sales trends.

By contrast, ongoing legal investigations into past disclosures and retailer inventory reductions are risks investors should not overlook, especially as...

BellRing Brands' narrative projects $2.8 billion in revenue and $312.5 million in earnings by 2028. This requires 8.1% yearly revenue growth and an $84.2 million earnings increase from $228.3 million today.

Uncover how BellRing Brands' forecasts yield a $52.50 fair value, a 33% upside to its current price.

Exploring Other Perspectives

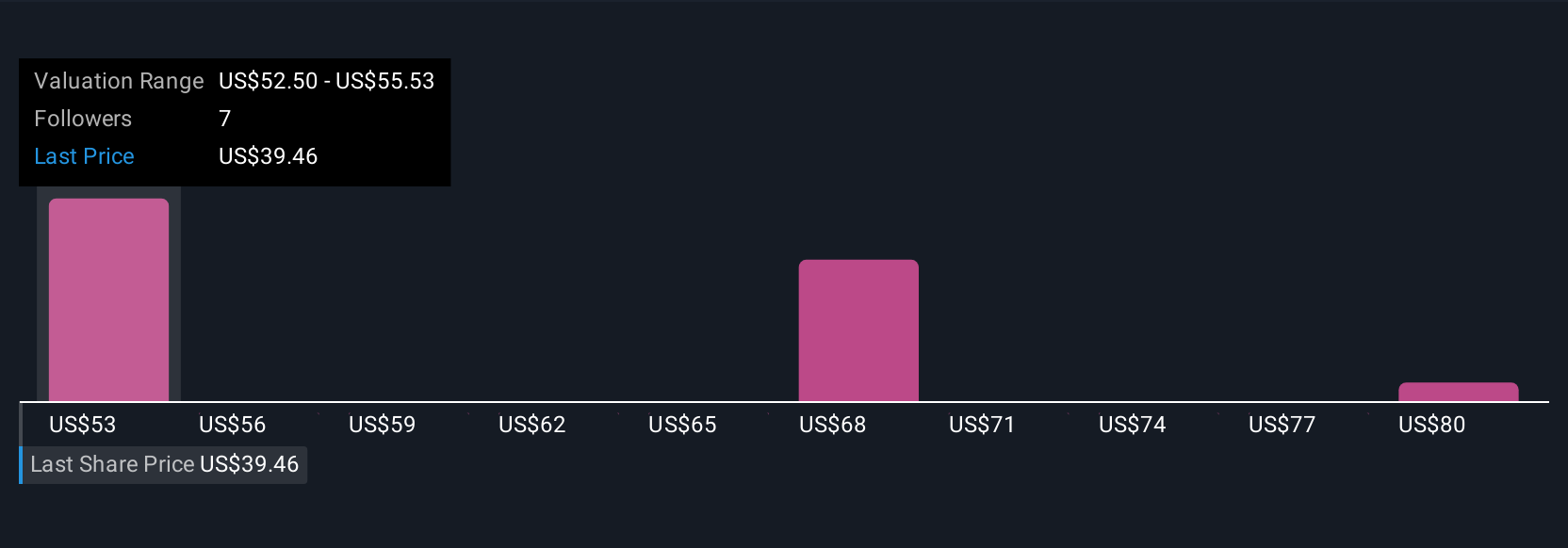

Simply Wall St Community members place BellRing Brands’ fair value between US$52.50 and US$82.83 across four independent models. You will find this wide spread of opinions set against a backdrop of heightened scrutiny from both legal investigations and shifting customer inventories, pointing to a key inflection for the company worth considering from several viewpoints.

Explore 4 other fair value estimates on BellRing Brands - why the stock might be worth just $52.50!

Build Your Own BellRing Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BellRing Brands research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BellRing Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BellRing Brands' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.