Please use a PC Browser to access Register-Tadawul

Should BeOne Medicines’ $950 Million Royalty Deal and Pivotal Trial Data Prompt Action From ONC Investors?

BeiGene Ltd ADR ONC | 355.29 | +1.85% |

- In September 2025, BeOne Medicines AG announced a $950 million royalty deal with Royalty Pharma and was featured in major biotechnology conferences, while Barclays initiated new analyst coverage highlighting imminent pivotal trial data as potential growth drivers.

- This combination of clinical milestones and a significant royalty monetization has drawn fresh investor attention to BeOne Medicines’ expanding oncology portfolio and upcoming catalysts.

- We'll examine how the royalty deal and highlighted clinical readouts may influence BeOne Medicines’ investment narrative and growth outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

BeOne Medicines Investment Narrative Recap

To own shares of BeOne Medicines, you need to believe in the company's ability to translate its robust late-stage oncology pipeline into future earnings growth while navigating fierce competition and market concentration risks, particularly as pivotal data for BRUKINSA and zanidatamab approach. The recent $950 million royalty deal with Royalty Pharma could enhance near-term financial flexibility, yet it does not materially reduce dependence on clinical trial outcomes or mitigate single-product exposure, which remains the most pressing risk ahead of pivotal readouts.

Among recent announcements, the sale of royalty rights to Amgen’s IMDELLTRA® stands out for its immediate balance sheet impact, giving BeOne an influx of non-dilutive capital as it prepares to report pivotal trial data in late 2025. While this transaction may support ongoing R&D investment and commercialization efforts, the main share price driver still hinges on upcoming data for zanubrutinib and zanidatamab combinations, which are expected to shape perceptions of BeOne’s near-term growth potential.

In contrast, investors should be aware that even with added capital, the risk of concentrated revenue in BRUKINSA and pipeline setbacks could quickly shift expectations if pivotal trial results disappoint, especially as...

BeOne Medicines' narrative projects $7.6 billion in revenue and $1.3 billion in earnings by 2028. This requires annual revenue growth of 18.6% and an earnings increase of approximately $1.48 billion from current earnings of -$177.6 million.

Uncover how BeOne Medicines' forecasts yield a $367.68 fair value, a 10% upside to its current price.

Exploring Other Perspectives

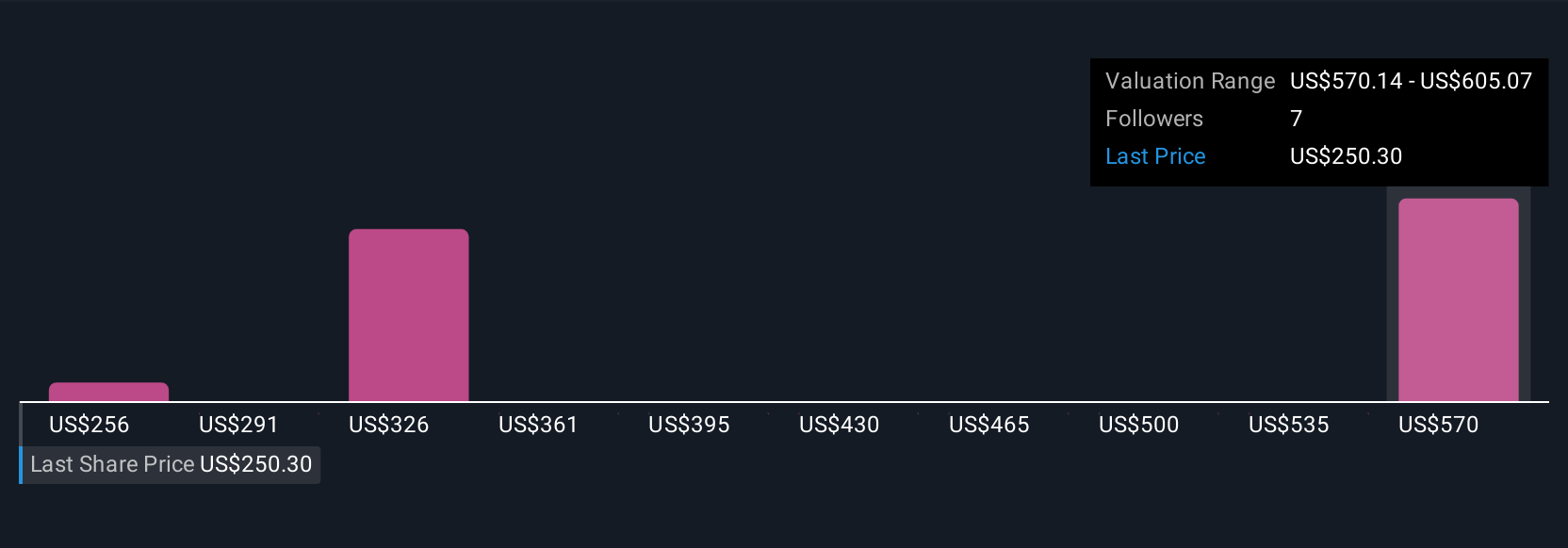

Simply Wall St Community members provided four distinct fair value estimates for BeOne Medicines ranging from US$255.78 to US$770.52 per share. Despite access to new capital from recent royalty sales, potential setbacks in upcoming pivotal clinical trials remain a key issue for future performance. Explore these perspectives and see how your own outlook compares.

Explore 4 other fair value estimates on BeOne Medicines - why the stock might be worth over 2x more than the current price!

Build Your Own BeOne Medicines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BeOne Medicines research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BeOne Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BeOne Medicines' overall financial health at a glance.

No Opportunity In BeOne Medicines?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.