Please use a PC Browser to access Register-Tadawul

Should BlackRock's (BLK) $80 Billion Citi Wealth Partnership Mark a Turning Point in Its Advisory Strategy?

BlackRock, Inc. BLK | 1089.09 | -1.16% |

- Citi Wealth recently announced it selected BlackRock to oversee approximately US$80 billion in assets and to launch Citi Portfolio Solutions powered by BlackRock for its clients, combining Citi's advisory strengths with BlackRock's investment management and technology capabilities.

- This partnership not only significantly expands BlackRock’s client reach but also introduces its Aladdin Wealth technology platform to Citi’s global investment professionals, marking a major operational milestone for both firms.

- We'll examine how BlackRock’s expanded mandate to manage US$80 billion for Citi Wealth could reshape its investment narrative.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

BlackRock Investment Narrative Recap

Being a shareholder in BlackRock often means believing in the company's ability to leverage its global scale, technology, and partnerships to drive durable growth across asset and wealth management. The Citi Wealth mandate, bringing approximately US$80 billion in new assets and expanding Aladdin Wealth’s reach, is a high-profile win for BlackRock, but does not significantly alter the most pressing short-term catalyst: ongoing adoption of its technology and alternative investment platforms. Fee compression across the industry remains a key risk and is not materially altered by this announcement.

Another recent announcement that ties directly to BlackRock’s role as a technology partner is the collaboration with RepRisk to integrate advanced risk data onto the Aladdin platform. This reinforces BlackRock’s focus on technology-enabled solutions, supporting its efforts to cross-sell and grow tech-based revenue streams, important for offsetting pressure from lower fees in traditional products and maintaining client retention.

However, despite this progress, investors should pay close attention to the risk that persistent industry fee compression could still pressure BlackRock’s margins and earnings...

BlackRock's narrative projects $28.7 billion in revenue and $8.9 billion in earnings by 2028. This requires 9.9% yearly revenue growth and a $2.5 billion earnings increase from current earnings of $6.4 billion.

Uncover how BlackRock's forecasts yield a $1167 fair value, a 4% upside to its current price.

Exploring Other Perspectives

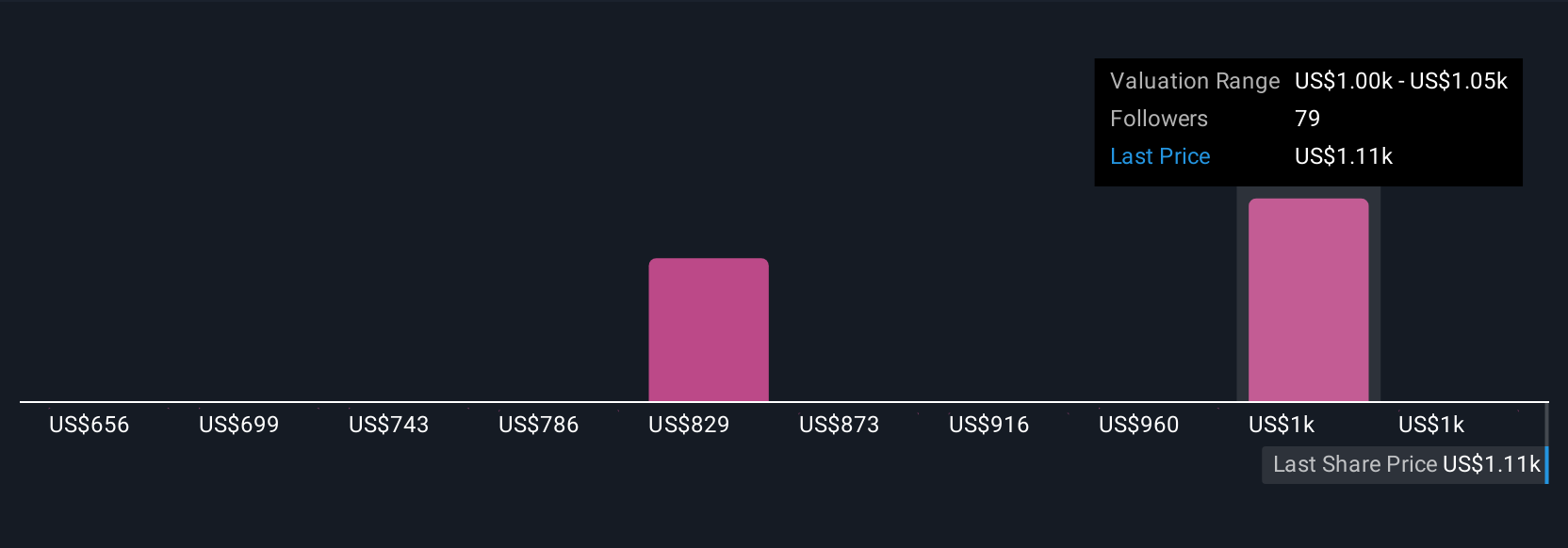

Simply Wall St Community members provided 17 fair value estimates for BlackRock, spanning from US$679.55 to US$1,391.79 per share. While this crowd sees broad possibilities, the ongoing growth of BlackRock’s technology and alternative platforms may be a key differentiator shaping future results.

Explore 17 other fair value estimates on BlackRock - why the stock might be worth 40% less than the current price!

Build Your Own BlackRock Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackRock research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BlackRock research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackRock's overall financial health at a glance.

No Opportunity In BlackRock?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.