Please use a PC Browser to access Register-Tadawul

Should Caesars Entertainment's (CZR) Multi-State WSOP Online Expansion Prompt a Rethink of Its Digital Strategy?

Caesars Entertainment Corporation CZR | 24.53 | +1.78% |

- Caesars Entertainment recently announced the domestic schedule for the WSOP Online 2025 fall series, marking the first time the fall online poker event will operate with pooled player liquidity across Nevada, New Jersey, Pennsylvania, and Michigan, and featuring 33 bracelet events with buy-ins ranging from $250 to $3,200.

- This multi-state liquidity expansion enables Caesars to connect a much broader player base, potentially driving higher participation and engagement across its digital gaming segment.

- We'll examine how the launch of pooled multi-state online poker could influence Caesars Entertainment's evolving digital business narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Caesars Entertainment Investment Narrative Recap

To feel confident as a shareholder in Caesars Entertainment, you need to believe that the company can successfully execute its digital expansion to offset any potential long-term softness in traditional Las Vegas revenue. The recent WSOP Online 2025 fall series announcement, with its expanded multi-state poker liquidity, could be a meaningful catalyst for digital growth, but its impact on the company’s most pressing challenge, a reliance on legacy hospitality demand and ongoing debt obligations, is not immediately material for the short term.

Among the recent company news, the launch of Caesars’ branded live dealer studio for online gaming is especially relevant. By introducing more engaging digital content to a broader player base, this move aligns with the digital segment’s growth ambitions and complements the pooled online poker initiative, further strengthening Caesars’ push for recurring high-margin revenues through online channels.

But in contrast, investors should be aware of how heavy promotional spending and rising customer acquisition costs could still pressure returns over time if...

Caesars Entertainment's outlook anticipates $12.6 billion in revenue and $540.9 million in earnings by 2028. This projection assumes a 3.4% annual revenue growth rate and a $735.9 million increase in earnings from the current level of -$195.0 million.

Uncover how Caesars Entertainment's forecasts yield a $41.00 fair value, a 60% upside to its current price.

Exploring Other Perspectives

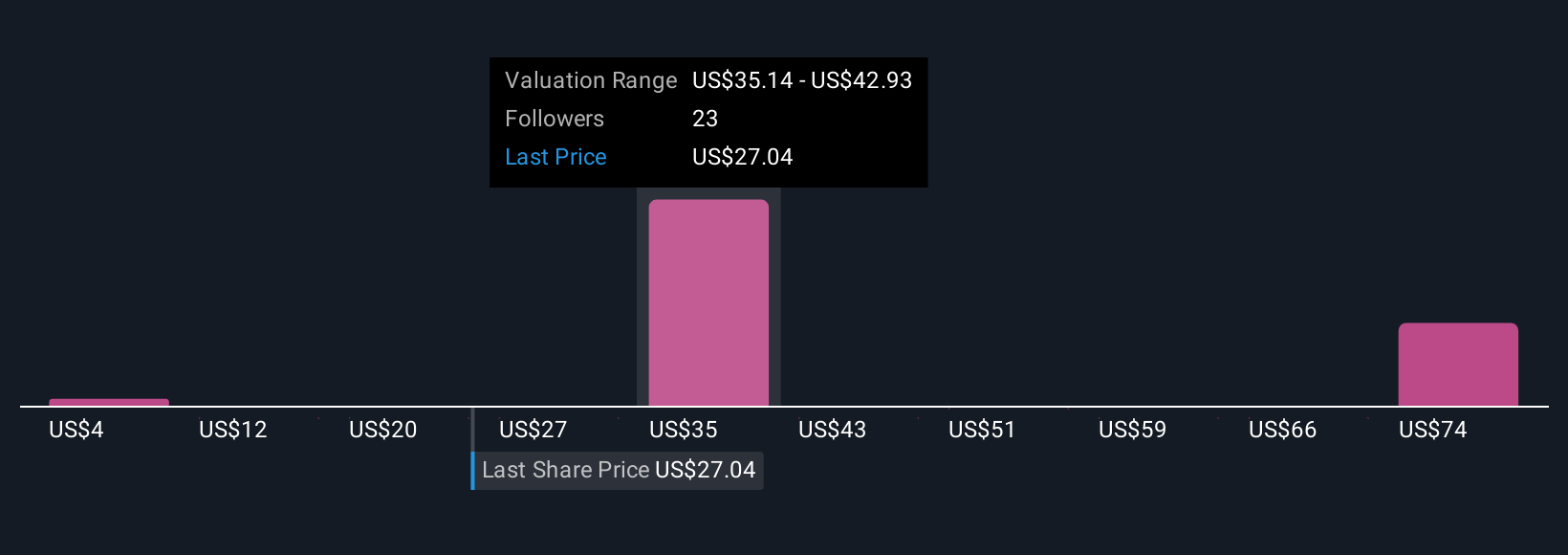

Fair value estimates from six Simply Wall St Community members span US$4 to US$81.40, spotlighting both deep skepticism and optimism. Some analysts flag Caesars’ ongoing resort and hospitality risks, so you may want to compare multiple viewpoints before forming your own outlook.

Explore 6 other fair value estimates on Caesars Entertainment - why the stock might be worth less than half the current price!

Build Your Own Caesars Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caesars Entertainment research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Caesars Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caesars Entertainment's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.