Please use a PC Browser to access Register-Tadawul

Should Celsius’ Leadership Shake-Up and Strong Margins Require Action From Celsius Holdings (CELH) Investors?

Celsius Holdings, Inc. CELH | 48.32 | +9.49% |

- Celsius Holdings has recently reported roughly US$2.00 billion in trailing revenue, alongside operating margins near 20%, reflecting rapid category expansion and tighter cost control across convenience, fitness, and mass retail channels.

- The company’s enhanced leadership bench, including a new CMO and a PepsiCo-linked board member, underscores a push to sharpen brand execution as competition in energy drinks intensifies.

- With these leadership moves and expanding distribution reshaping Celsius’s fundamentals, we’ll now examine what this means for its broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Celsius Holdings' Investment Narrative?

To own Celsius today, you have to believe the brand can turn its rapid expansion into durable, profitable volume, not just a fast-growing label in a crowded cooler. The latest news, with shares up strongly over the past month and fresh attention on earnings expectations, mainly reinforces existing short term catalysts rather than creating new ones: execution on PepsiCo distribution, integration of Rockstar, and proving that roughly US$2.00 billion of trailing revenue can flow through to healthy, repeatable margins. At the same time, premium valuation multiples and still-thin net margins, flattered by one off items and a young management team, keep execution risk front and center. The market’s recent enthusiasm raises the bar for upcoming results rather than lowering it.

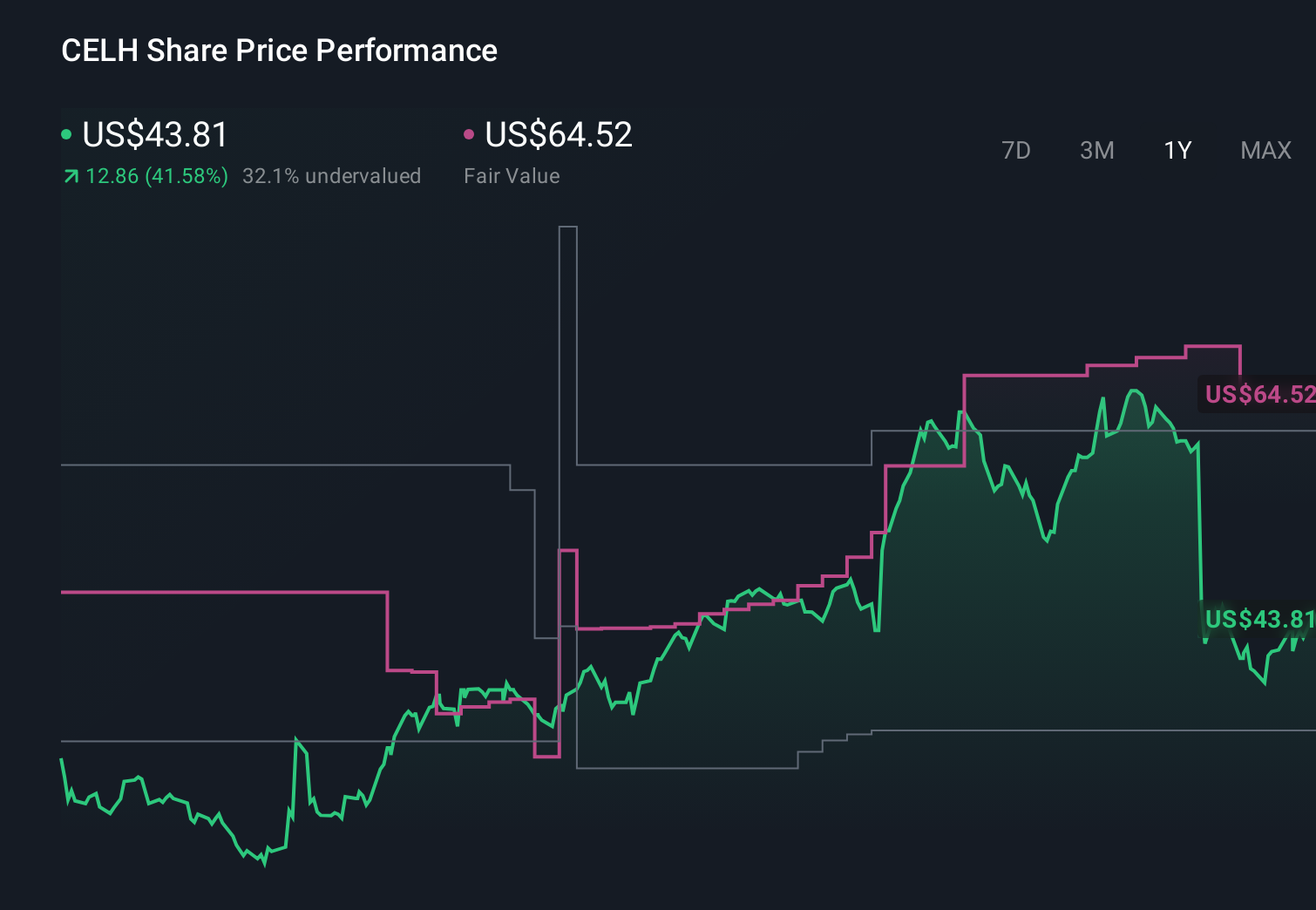

However, investors should be aware of how much has to go right to justify today’s pricing. Celsius Holdings' shares have been on the rise but are still potentially undervalued by 21%. Find out what it's worth.Exploring Other Perspectives

Explore 26 other fair value estimates on Celsius Holdings - why the stock might be worth 32% less than the current price!

Build Your Own Celsius Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celsius Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Celsius Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celsius Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.