Please use a PC Browser to access Register-Tadawul

Should Falling Freight Rates Signal a Shift in Matson (MATX) Investors' Long-Term Outlook?

Matson, Inc. MATX | 119.39 119.39 | -2.59% 0.00% Pre |

- In late September 2025, Jefferies analysts expressed caution on the container shipping industry, highlighting that freight rates have fallen below break-even levels for key operators, including Matson, for the first time since 2023.

- This signals a shift in industry sentiment, as even companies with robust balance sheets now face persistent earnings pressure and a more challenging outlook.

- We’ll explore how analyst concerns about falling freight rates may impact Matson’s long-term outlook and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Matson Investment Narrative Recap

To be a shareholder in Matson, you need to believe in the company’s ability to generate stable long-term cash flows from its protected US shipping routes, even when industry cycles turn negative. The recent warning from Jefferies about freight rates falling below break-even levels highlights persistent near-term earnings pressure, which could weigh on sentiment and makes freight rate recovery the key catalyst, while the biggest risk now is sustained industry-wide price weakness. If freight rates stay soft for a prolonged period, this could materially impact Matson’s earnings and its narrative as a consistent compounder; otherwise, if rates recover, the headlines will matter less than trade flow trends in Matson’s core markets.

With Jefferies’ call coming just after Matson revised its third quarter outlook, the company's recent Q2 guidance, which flagged lower year-on-year Ocean Transportation earnings due to reduced rates and volumes, directly aligns with current concerns. While this guidance had already reset near-term expectations, the latest analyst caution spotlights the real-time volatility that continues to challenge even the best-positioned operators like Matson.

In contrast, the risk that increasingly volatile spot rates and industry overcapacity could continue to pressure margins is something shareholders should be watchful for...

Matson's outlook anticipates $3.4 billion in revenue and $289.2 million in earnings by 2028. This assumes a 0.3% annual revenue decline and a $204.9 million decrease in earnings from the current $494.1 million.

Uncover how Matson's forecasts yield a $115.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

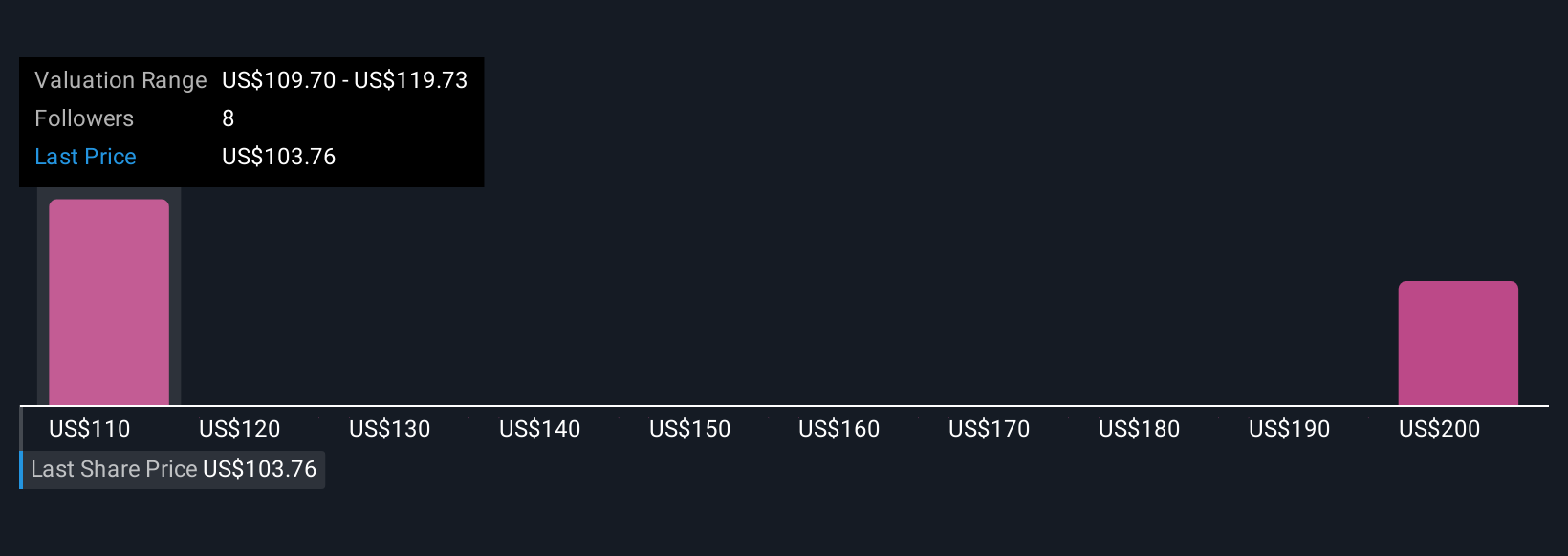

Seven Simply Wall St Community members estimate Matson’s fair value between US$92 and US$210 per share. While some anticipate robust upside, recent warnings on industry-wide freight rates falling below profitable levels could change the foundation of these valuations, make sure to compare multiple viewpoints before deciding your stance.

Explore 7 other fair value estimates on Matson - why the stock might be worth 7% less than the current price!

Build Your Own Matson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Matson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Matson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Matson's overall financial health at a glance.

No Opportunity In Matson?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.