Please use a PC Browser to access Register-Tadawul

Should Gilead’s (GILD) Partnerships and CDC Support Shift Investor Focus Toward Growth in Oncology and HIV?

Gilead Sciences, Inc. GILD | 120.40 119.61 | -2.28% 0.00% Pre |

- On September 22, Kymera Therapeutics announced an exclusive collaboration with Gilead Sciences to develop a new molecular glue degrader program for oncology, shortly after the US CDC recommended Gilead's Yeztugo for HIV pre-exposure prophylaxis.

- These developments highlight Gilead’s strengthened presence in both preventive HIV medicine and innovative cancer treatment research through external partnerships.

- We'll look at how strengthened research partnerships and the CDC's PrEP guidance shape the outlook for Gilead Sciences' investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Gilead Sciences Investment Narrative Recap

For shareholders, the case for Gilead Sciences rests on growing long-term demand for HIV and oncology therapies, with ongoing innovation helping offset maturing product risks. The recent CDC guidance for Yeztugo (lenacapavir) as pre-exposure HIV prophylaxis and the Kymera partnership highlight near-term opportunities in HIV prevention and cancer, but their impact does not fundamentally change the biggest catalyst, successful portfolio diversification, or the main risk, which is long-term pricing pressure on the HIV business.

The CDC’s recommendation for Yeztugo as PrEP is particularly noteworthy, as it aims to widen Gilead’s HIV prevention reach domestically and abroad. Supporting this, expanded access partnerships and recent EU approval of lenacapavir as PrEP have pushed the product into more global markets. These moves tie directly into the company’s top catalyst: leveraging new launches and access programs to drive revenue and lessen reliance on older drugs.

Yet, against these drivers, investors should not overlook the possibility that increased reliance on HIV therapies opens the company’s earnings up to...

Gilead Sciences' outlook anticipates $32.3 billion in revenue and $10.0 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 3.8% and reflects a $3.7 billion increase in earnings from the current $6.3 billion.

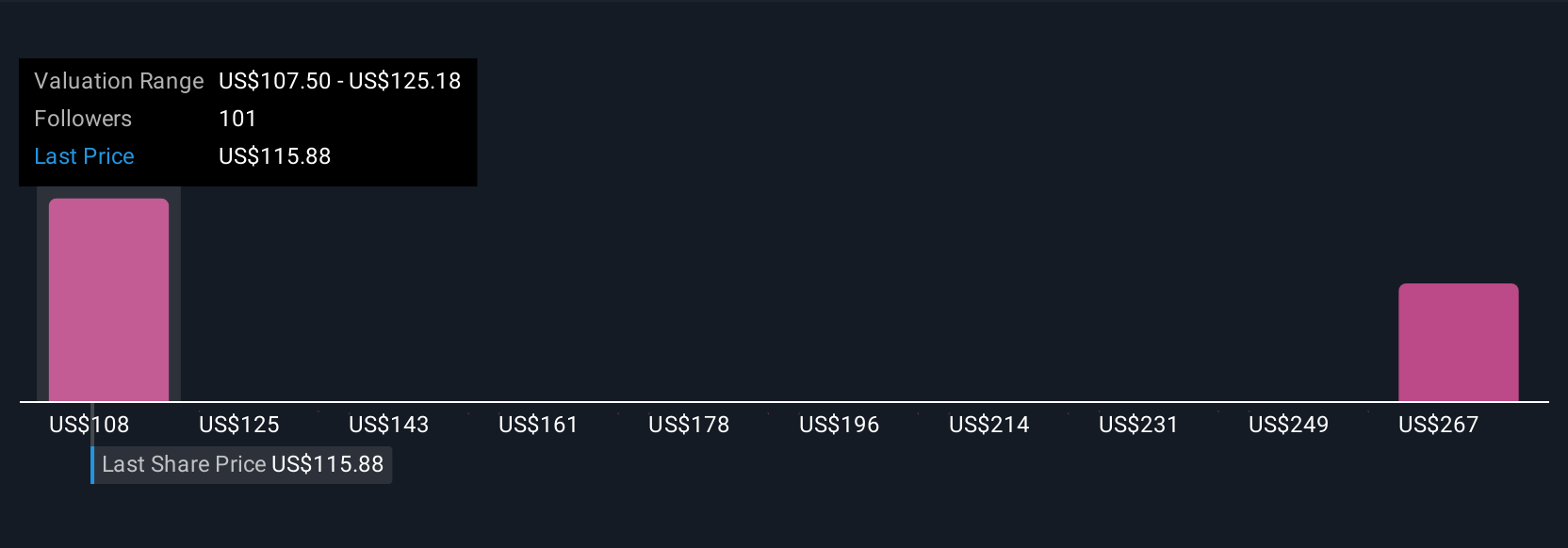

Uncover how Gilead Sciences' forecasts yield a $124.91 fair value, a 13% upside to its current price.

Exploring Other Perspectives

While consensus analysis centers on Gilead’s ability to diversify and manage HIV pricing, the most optimistic analysts were projecting annual revenue could reach US$33.9 billion and earnings of US$10.8 billion by 2028. This highlights just how much your view can depend on whether you see new product launches, like lenacapavir and Trodelvy, truly transforming the company, especially with competition and pricing pressure now in sharper focus after recent developments.

Explore 9 other fair value estimates on Gilead Sciences - why the stock might be worth over 2x more than the current price!

Build Your Own Gilead Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gilead Sciences research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gilead Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gilead Sciences' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.