Please use a PC Browser to access Register-Tadawul

Should Globant's (GLOB) AI Interoperability Breakthrough Influence Investors’ Views on Its Growth Prospects?

Globant SA GLOB | 66.00 | -2.09% |

- In July 2025, Globant announced a major upgrade to its proprietary AI platform, Globant Enterprise AI (GEAI), which now features support for Model Context Protocol and Agent2Agent Protocol, expanding interoperability with enterprise tools and leading AI models across platforms like Salesforce, Azure, Amazon, and Google Cloud.

- This development is enabling dramatic efficiencies for organizations, with users reporting significantly reduced legacy system modernization times and cost savings in software development.

- We'll explore how Globant's advanced AI platform interoperability and new capabilities are shaping its broader investment narrative and growth outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Globant Investment Narrative Recap

To own Globant stock, investors generally need confidence in the company’s strategy of leveraging enterprise AI innovation to drive efficiency for global clients and maintain a competitive edge in digital transformation services. The recent GEAI platform upgrade may influence short-term sentiment by underscoring Globant’s ability to expand AI interoperability, though the key catalyst remains execution on AI-driven revenue growth, while the primary risk continues to be margin pressure from ongoing technology investments and challenging pricing environments.

Of Globant’s recent initiatives, the launch of AI Pods in June is highly relevant, offering subscription-based, scalable AI solutions powered by the same Enterprise AI technology just upgraded. This introduces more predictable revenue streams and enhances operational flexibility, which may support growth as Globant’s clients increasingly adopt interoperable AI solutions; however, delivering sustained earnings improvements still hinges on how effectively Globant manages investment in talent and technology.

In contrast, investors should be aware that rising investment in advanced AI tools could pressure net margins if not managed...

Globant's narrative projects $2.9 billion revenue and $272.9 million earnings by 2028. This requires 5.8% yearly revenue growth and a $121.6 million earnings increase from $151.3 million today.

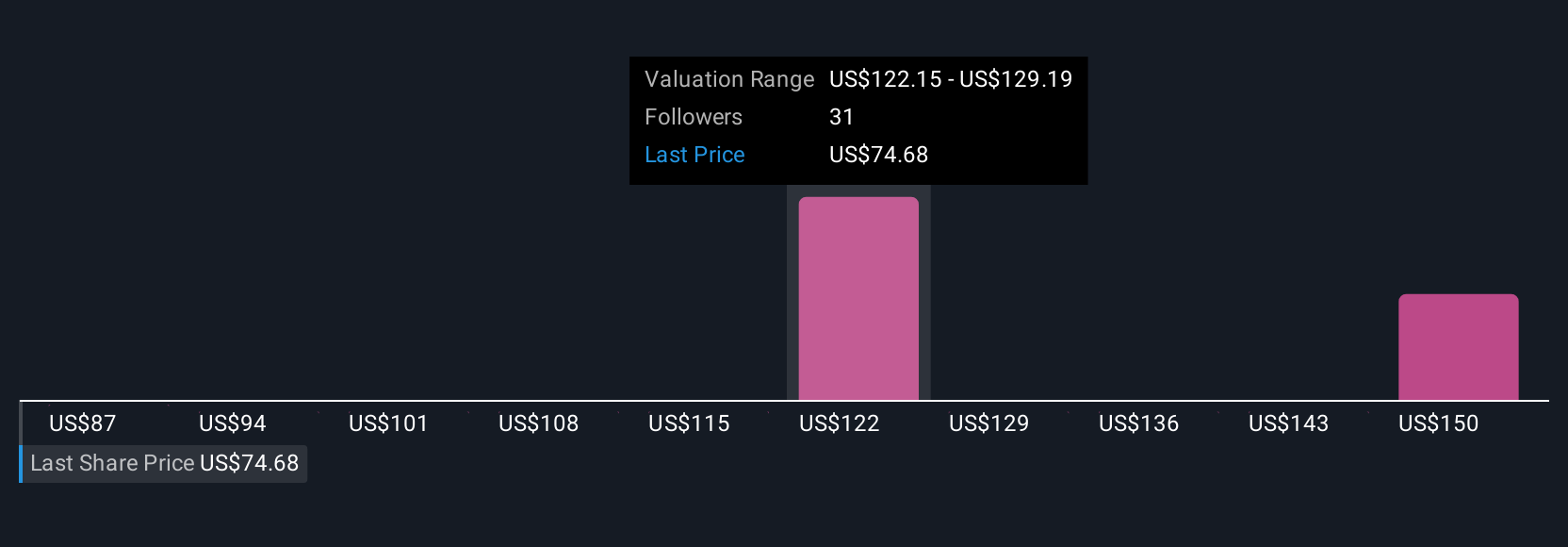

Uncover how Globant's forecasts yield a $126.85 fair value, a 67% upside to its current price.

Exploring Other Perspectives

Three community valuations for Globant range from US$87 to US$156.42, reflecting significant variation in expected fair value. While many see upside linked to AI innovation, margin risks remain a focal point for future performance, dig deeper into these alternate views to broaden your consideration.

Explore 3 other fair value estimates on Globant - why the stock might be worth just $87.00!

Build Your Own Globant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globant research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Globant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globant's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.