Please use a PC Browser to access Register-Tadawul

Should Guardant Health’s (GH) Raised Outlook and Liquid Biopsy Advances Prompt Fresh Attention From Investors?

Guardant Health GH | 105.03 105.03 | -0.29% 0.00% Post |

- Guardant Health recently reported strong second-quarter 2025 results, with revenue rising to US$232.09 million, and lifted its full-year revenue guidance to a new range of US$915 to US$925 million following higher than expected performance across its Oncology, Screening, and Biopharma segments.

- This momentum was further supported by the introduction of innovative Smart Liquid Biopsy applications, key regulatory achievements for its Shield test, and a pivotal study showing Guardant Reveal's predictive value in immunotherapy treatment response.

- We'll explore how Guardant Health's raised revenue outlook and new liquid biopsy innovations could reshape its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Guardant Health Investment Narrative Recap

To be a Guardant Health shareholder, you need to believe in the promise of liquid biopsy technology to transform cancer detection and treatment, with success dependent on expanding clinical adoption and payer coverage. The latest revenue beat and raised 2025 guidance may reinforce confidence in growth potential, but do not fully resolve the biggest current risk: ongoing operating losses and the company’s pathway to positive cash flow. In the short term, while guidance strength may support investor optimism, the impact on the cash burn risk remains material.

Among recent developments, the RadioHEAD study results stand out: Guardant Reveal showed the ability to identify immunotherapy responders and non-responders significantly earlier than conventional methods. This supports one of the company’s main growth catalysts, broadening the adoption of blood-based monitoring for cancer treatment, which could be key to the investment case if supported by further reimbursement wins and integration into clinical guidelines.

However, it’s important not to overlook the risk that, even with strong revenue growth, Guardant’s continued cash burn from scaling new products and delayed shift to free cash flow positive could…

Guardant Health's outlook anticipates $1.4 billion in revenue and $64.3 million in earnings by 2028. This scenario assumes a 22.0% annual revenue growth rate and an earnings increase of $480.8 million from current earnings of -$416.5 million.

Uncover how Guardant Health's forecasts yield a $59.67 fair value, a 35% upside to its current price.

Exploring Other Perspectives

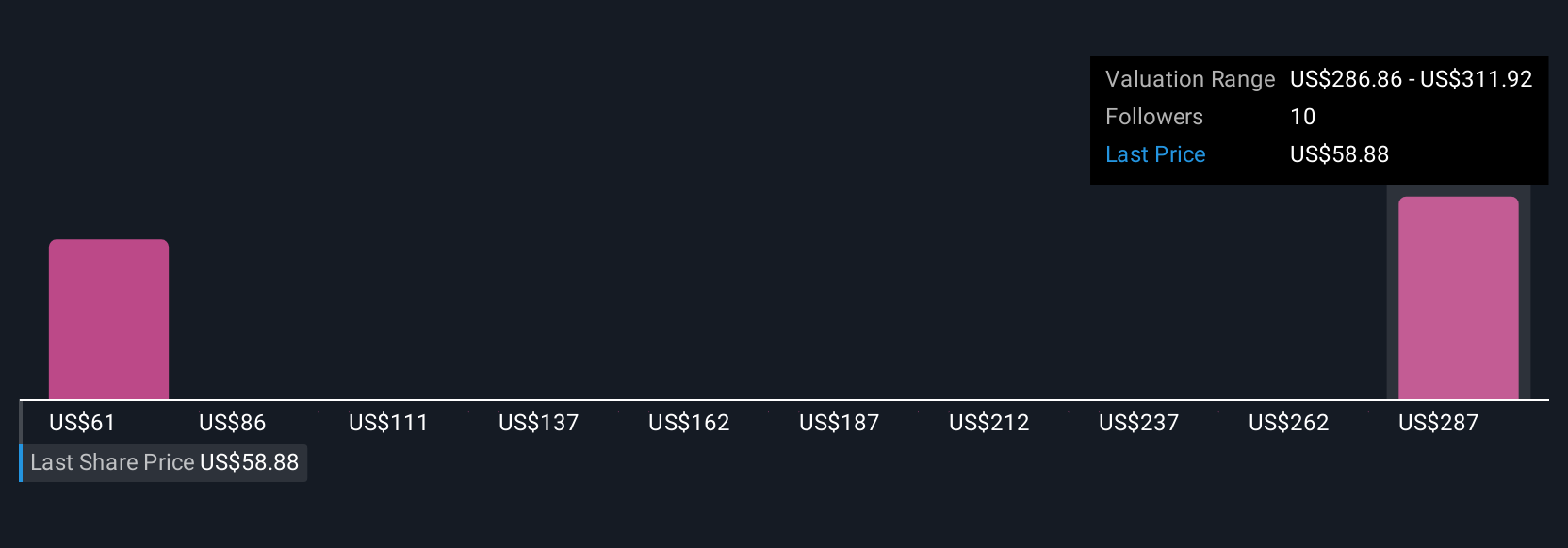

With two Simply Wall St Community fair value estimates ranging from US$59.67 to US$339.62 per share, opinions differ sharply on Guardant Health’s worth. This wide spread reflects ongoing questions about how fast the company can balance revenue growth with sustainable profitability.

Explore 2 other fair value estimates on Guardant Health - why the stock might be worth just $59.67!

Build Your Own Guardant Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guardant Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Guardant Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guardant Health's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.