Please use a PC Browser to access Register-Tadawul

Should Houlihan Lokey’s France-Focused Expansion Shape a Reassessment of Its European Strategy (HLI)?

Houlihan Lokey, Inc. Class A HLI | 168.32 | -0.29% |

- Houlihan Lokey, Inc. recently expanded its European Industrials franchise by hiring Géraud Estrangin as a Paris-based Managing Director focused on aerospace and defence and supporting France-related transactions.

- This appointment, alongside controlling Audere Partners and acquiring Mellum Capital’s real estate capital advisory business, materially deepens Houlihan Lokey’s French and wider European corporate finance footprint.

- We’ll now examine how expanding France-focused corporate finance capabilities could influence Houlihan Lokey’s broader investment narrative.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Houlihan Lokey's Investment Narrative?

To own Houlihan Lokey, you really have to believe in its ability to keep compounding advisory earnings through deal cycles, supported by disciplined capital returns and a premium brand in mid-cap M&A and restructuring. Short term, the key catalyst is the upcoming Q3 2026 result and any commentary on deal pipelines after a period where revenue and earnings have both been growing. The Paris hiring of Géraud Estrangin and the Audere Partners and Mellum Capital moves slot neatly into that story, broadening European Industrials and real estate advisory without obviously shifting the near term earnings picture on their own. They do, however, gently tilt the risk mix toward successful integration and retention of senior talent, on top of an already full valuation and recent share price underperformance versus the market and peers.

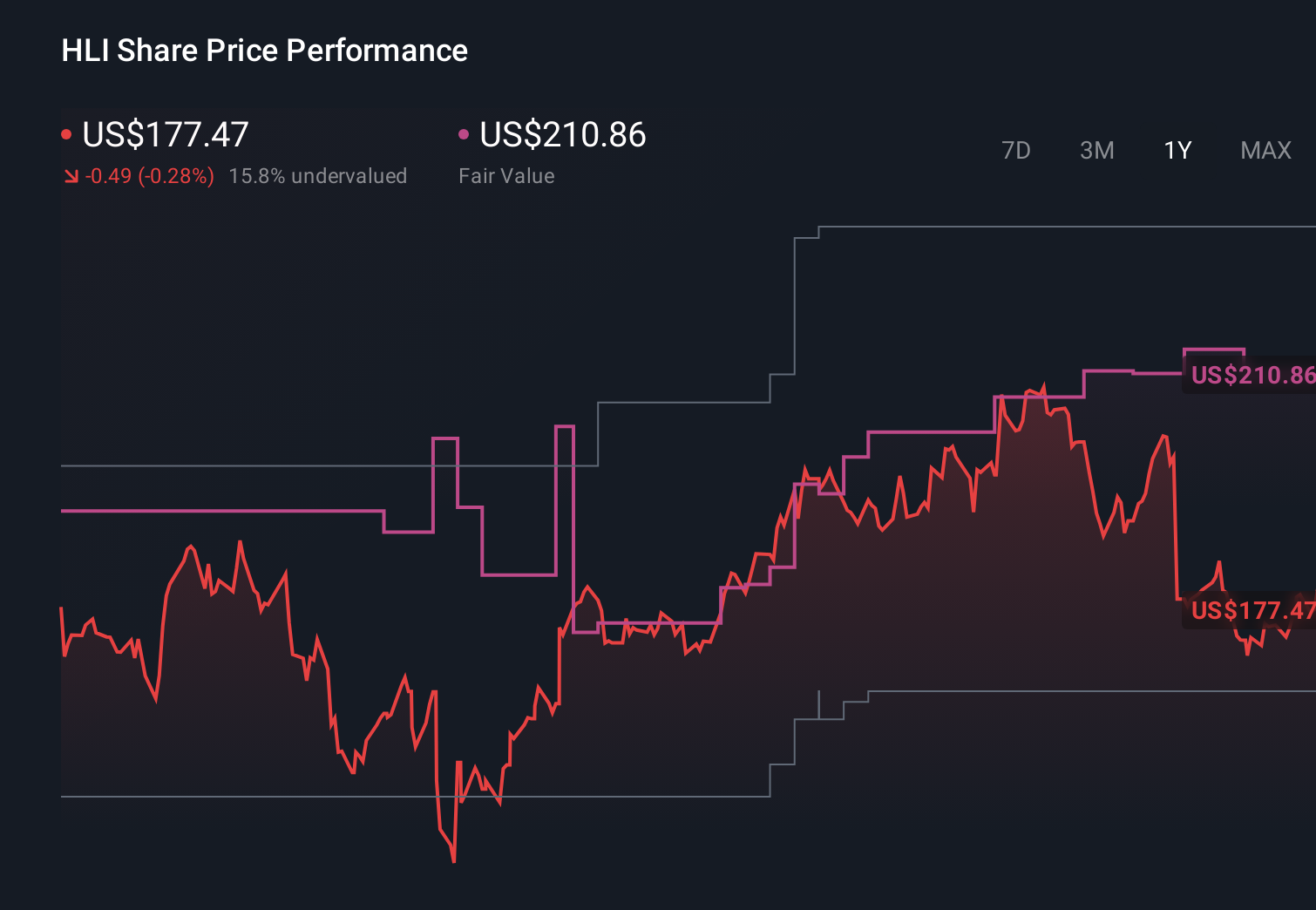

However, investors should be aware of how full the current valuation already looks. Houlihan Lokey's shares are on the way up, but they could be overextended by 13%. Uncover the fair value now.Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$169.52 to US$210.86 per share, showing how differently private investors are framing Houlihan Lokey’s prospects. Set against a business priced above some cash flow estimates and trading on a richer earnings multiple than many peers, these varied views underline why it can pay to weigh several risk and catalyst scenarios before forming a conviction.

Explore 3 other fair value estimates on Houlihan Lokey - why the stock might be worth 11% less than the current price!

Build Your Own Houlihan Lokey Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Houlihan Lokey research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Houlihan Lokey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Houlihan Lokey's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.