Please use a PC Browser to access Register-Tadawul

Should Hub Group’s Shift From Volume To Pricing Power Require Action From Hub Group (HUBG) Investors?

Hub Group, Inc. Class A HUBG | 43.27 | +3.67% |

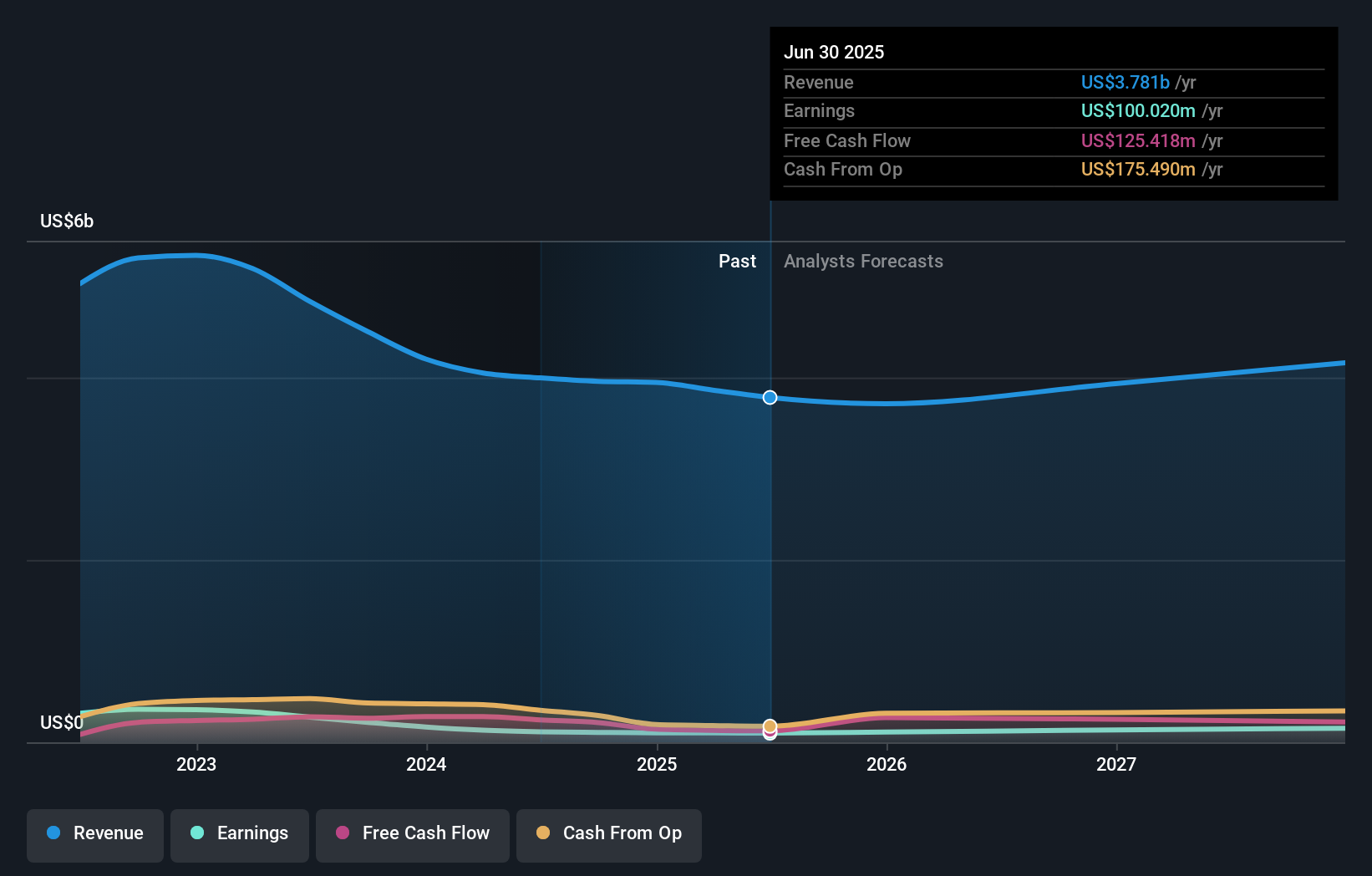

- In recent coverage, Hub Group has been reported as struggling to grow sales volumes over the past two years, instead leaning on price increases to support revenue.

- At the same time, a sharp annual drop in earnings per share and weaker returns on capital suggest the company’s earlier profit pools are becoming harder to sustain.

- Next, we’ll examine how Hub Group’s reliance on pricing rather than volume growth reshapes its investment narrative for investors and analysts.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is Hub Group's Investment Narrative?

To own Hub Group today, you have to believe the company can transition from defending margins with price to restoring genuine volume growth, without eroding already pressured returns on capital. The recent update, highlighting two years of weak volumes, a steep earnings per share decline and softer returns, puts more weight on the upcoming Q4 2025 result and 2026 outlook as near term catalysts. Guidance around demand trends, contract renewals and pricing discipline may now matter more than headline revenue growth, especially given the shares have already climbed strongly over the past quarter. At the same time, a relatively new management team, insider selling and a valuation above logistics peers all become more acute risks if earnings momentum disappoints. In that sense, the latest news does not feel immaterial at all.

However, one risk now stands out that investors may not fully appreciate. Hub Group's shares have been on the rise but are still potentially undervalued by 27%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Hub Group - why the stock might be worth 7% less than the current price!

Build Your Own Hub Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hub Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hub Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hub Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.