Please use a PC Browser to access Register-Tadawul

Should Hycroft Mining Holding's (HYMC) Complete Debt Repayment Prompt a Rethink of Its Investment Story?

HYCROFT MINING HOLDING CORPORATION HYMC | 13.40 | +8.41% |

- Hycroft Mining Holding Corporation recently announced that it has fully repaid all of its remaining debt, including the repurchase of US$120.8 million in senior secured notes at a 9% discount and settlement of its first-lien credit agreement.

- This use of proceeds from recent equity offerings results in the company becoming debt-free, significantly improving its balance sheet strength.

- We’ll explore how Hycroft’s move to eliminate debt using discounted note repurchases may reshape its investment narrative moving forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Hycroft Mining Holding's Investment Narrative?

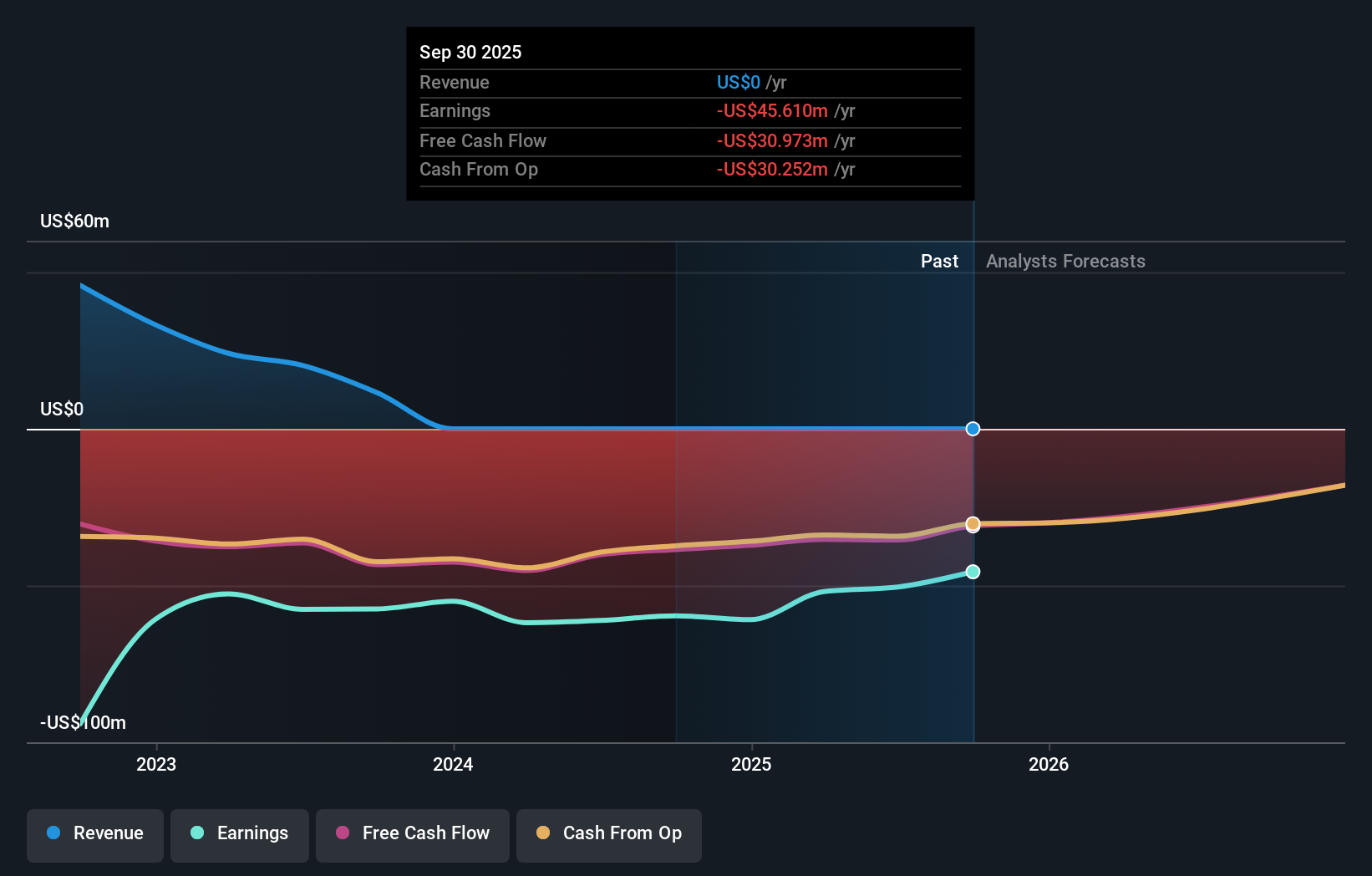

For anyone considering Hycroft Mining today, the investment story increasingly centers not just on exploration potential, but on the fundamental shift brought by the company’s newly announced debt-free status. With the entire US$125.5 million debt repaid through a timely mix of discounted note repurchases and recent equity offerings, Hycroft has removed a key financial overhang that weighed on the share price and restricted operating flexibility. This is a major reset for the balance sheet, and near-term catalysts, like upcoming drill results and next-phase metallurgical studies, may now play a bigger part in the narrative since interest outflows and solvency risks have been dramatically lowered. However, this move has not erased all risk: dilution from significant new share issuances, negative equity, and ongoing unprofitability remain central concerns. Investors will want to watch how Hycroft converts its improved financial footing into revenue, especially in light of no operating income yet.

But with increased share count, dilution risk is even more real after this debt payoff.

Exploring Other Perspectives

Explore 4 other fair value estimates on Hycroft Mining Holding - why the stock might be worth 49% less than the current price!

Build Your Own Hycroft Mining Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hycroft Mining Holding research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Hycroft Mining Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hycroft Mining Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.