Please use a PC Browser to access Register-Tadawul

Should Keysight's Launch of AI-Driven WirelessPro 3GPP Platform Prompt Action From KEYS Investors?

Keysight Technologies Inc KEYS | 208.81 | -2.49% |

- In late September 2025, Keysight Technologies introduced the WirelessPro 3GPP AI Simulation Platform, an advanced software suite integrating AI/ML for modeling and validating next-generation wireless technologies in line with the latest 3GPP standards.

- This launch highlights Keysight's focus on providing unified, cutting-edge simulation tools for engineers as the complexity of 6G and AI-powered wireless networks accelerates.

- We'll explore how Keysight's expanded AI-rich simulation capabilities could influence its position in advanced wireless test solutions.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

Keysight Technologies Investment Narrative Recap

To be a shareholder in Keysight Technologies, you need to believe in the accelerating adoption of AI-driven testing and next-generation wireless networks, where deep investment in R&D and leadership in 6G can help offset industry and macroeconomic headwinds. The recent launch of the WirelessPro 3GPP AI Simulation Platform supports this outlook by expanding Keysight’s software-centric capabilities, yet the impact on key short-term catalysts such as earnings resilience is unlikely to be material without meaningful mitigation of rising cost risks tied to tariffs.

Among recent announcements, Keysight’s upcoming demonstration of 20 advanced AI-enabled 6G solutions stands out as especially relevant to its WirelessPro launch. This highlight adds momentum to the company’s position in cutting-edge wireless standards, underlining the continued importance of software-led innovation as a growth catalyst in the face of external uncertainties.

Yet, in contrast to the high-tech optimism, investors should watch for signs that escalating tariffs could...

Keysight Technologies is projected to reach $6.3 billion in revenue and $1.2 billion in earnings by 2028. Achieving this will require annual revenue growth of 6.5% and an earnings increase of $656 million from the current level of $544 million.

Uncover how Keysight Technologies' forecasts yield a $187.60 fair value, a 7% upside to its current price.

Exploring Other Perspectives

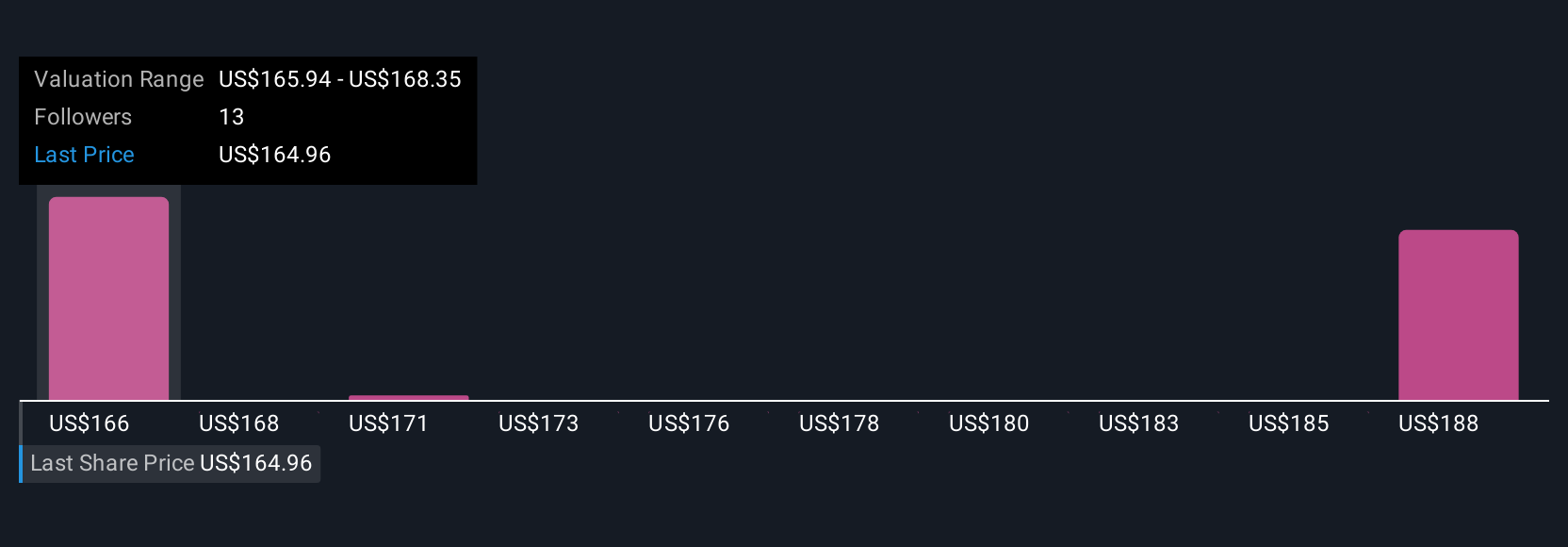

Five fair value estimates from the Simply Wall St Community range from US$152.89 to US$190.01 per share. While many see opportunity in AI-driven wireless growth, rising costs from tariffs remain a key risk shaping the outlook for Keysight’s profit margins and future performance, reminding you that opinions on valuation can be very different and worth exploring in more detail.

Explore 5 other fair value estimates on Keysight Technologies - why the stock might be worth 13% less than the current price!

Build Your Own Keysight Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keysight Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Keysight Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keysight Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.