Please use a PC Browser to access Register-Tadawul

Should Kings Landing Ramp Up and UBS Spotlight Require Action From Kinetik Holdings (KNTK) Investors?

Kinetik Holdings Inc. Class A KNTK | 45.56 | +1.90% |

- Kinetik Holdings Inc. recently presented at the UBS Global Energy & Utilities Winter Conference in Park City, Utah, following the Kings Landing gas processing project entering full commercial service in New Mexico.

- The combination of a major infrastructure milestone and increased attention from Wall Street highlights how Kinetik’s growing processing footprint is shaping investor expectations.

- Next, we’ll examine how the Kings Landing commercial ramp and recent analyst upgrade may influence Kinetik’s existing investment narrative.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Kinetik Holdings Investment Narrative Recap

To own Kinetik, you generally need to believe its Permian midstream footprint can translate new processing capacity into steadier cash flows despite commodity and basin specific risks. Kings Landing reaching full commercial service looks supportive for the near term volume and earnings ramp, while the largest ongoing concern remains high capital intensity and leverage at 3.6x, which could tighten financial flexibility. The UBS conference appearance and analyst upgrade do not materially change that core risk reward balance.

The Kings Landing commercial start up is the clearest link between the recent news and Kinetik’s existing catalysts, since it directly adds processing capacity in the Northern Delaware Basin that underpins the long term infrastructure thesis. Coupled with Raymond James’ upgrade and US$46 price target, the project’s ramp is drawing fresh attention to how effectively Kinetik can convert new volumes into sustainable cash flows, while still managing cost inflation in power and compression and the heavy spend required for growth projects.

Yet against that opportunity, investors should also keep a close eye on how Kinetik’s leverage and substantial ongoing capital needs could affect...

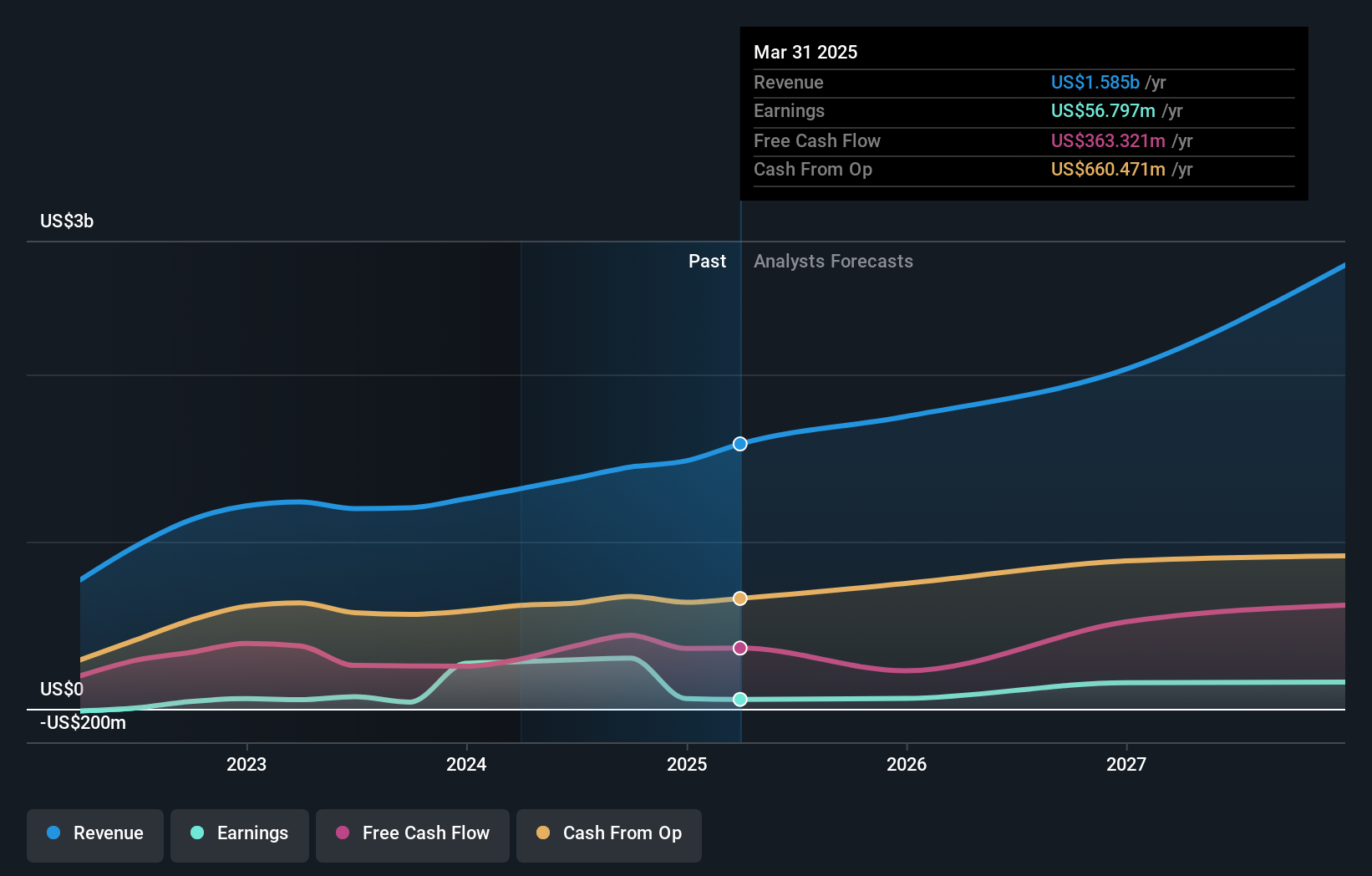

Kinetik Holdings' narrative projects $2.8 billion revenue and $167.1 million earnings by 2028. This requires 19.0% yearly revenue growth and a $122.6 million earnings increase from $44.5 million today.

Uncover how Kinetik Holdings' forecasts yield a $44.77 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community value Kinetik between US$44.77 and US$106.98 per share, highlighting very different expectations. Against that spread, Kinetik’s capital intensive growth program and 3.6x leverage leave plenty of room for differing views on how project execution might shape future performance, so it is worth comparing several perspectives before deciding where you stand.

Explore 3 other fair value estimates on Kinetik Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Kinetik Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinetik Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kinetik Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinetik Holdings' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.