Please use a PC Browser to access Register-Tadawul

Should Lawsuits Over ACP Disclosure Shift How Investors View Charter Communications' (CHTR) Risk Profile?

Charter Communications, Inc. Class A CHTR | 248.19 | +4.17% |

- In recent days, several law firms announced class action lawsuits against Charter Communications and certain executives, alleging violations of securities laws related to disclosures about the end of the Federal Communications Commission's Affordable Connectivity Program (ACP) and its impact on customer and revenue declines.

- The lawsuits were triggered after Charter reported its second quarter 2025 financial results, which included declines in internet and video customers and raised concerns about potentially misleading statements regarding the ACP's conclusion.

- We will assess how allegations of inadequate disclosure around the ACP’s end may alter Charter’s investment narrative and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Charter Communications Investment Narrative Recap

To own Charter Communications, you need to believe in its ability to grow revenue and earnings by leveraging its broadband and Spectrum Mobile businesses while managing high leverage and competitive pressures. The recent class action lawsuits focus on alleged disclosure failures linked to the end of the Affordable Connectivity Program (ACP), potentially complicating the narrative around subscriber growth and putting short-term focus on regulatory risk and management credibility. While headline risk is significant, the underlying catalysts, such as Spectrum Mobile momentum and DOCSIS 4.0 network upgrades, may remain intact depending on legal outcomes.

Of the recent announcements, Charter’s second quarter 2025 earnings report stands out: it showed higher year-over-year revenue and net income but also revealed a 117,000 decline in internet customers. Against the backdrop of the lawsuits, this development is particularly relevant because it connects directly to concerns about how customer losses were communicated and could shape near-term management priorities, especially as expanding mobile offerings remains a critical earnings driver.

However, investors should be aware that if Charter’s disclosure practices face greater regulatory or legal scrutiny, the financial flexibility needed to progress on mobile and network upgrades could be at risk...

Charter Communications' outlook anticipates $56.8 billion in revenue and $6.0 billion in earnings by 2028. This scenario reflects a -0.9% annual decline in revenue and a $0.7 billion increase in earnings from the current $5.3 billion.

Uncover how Charter Communications' forecasts yield a $391.90 fair value, a 49% upside to its current price.

Exploring Other Perspectives

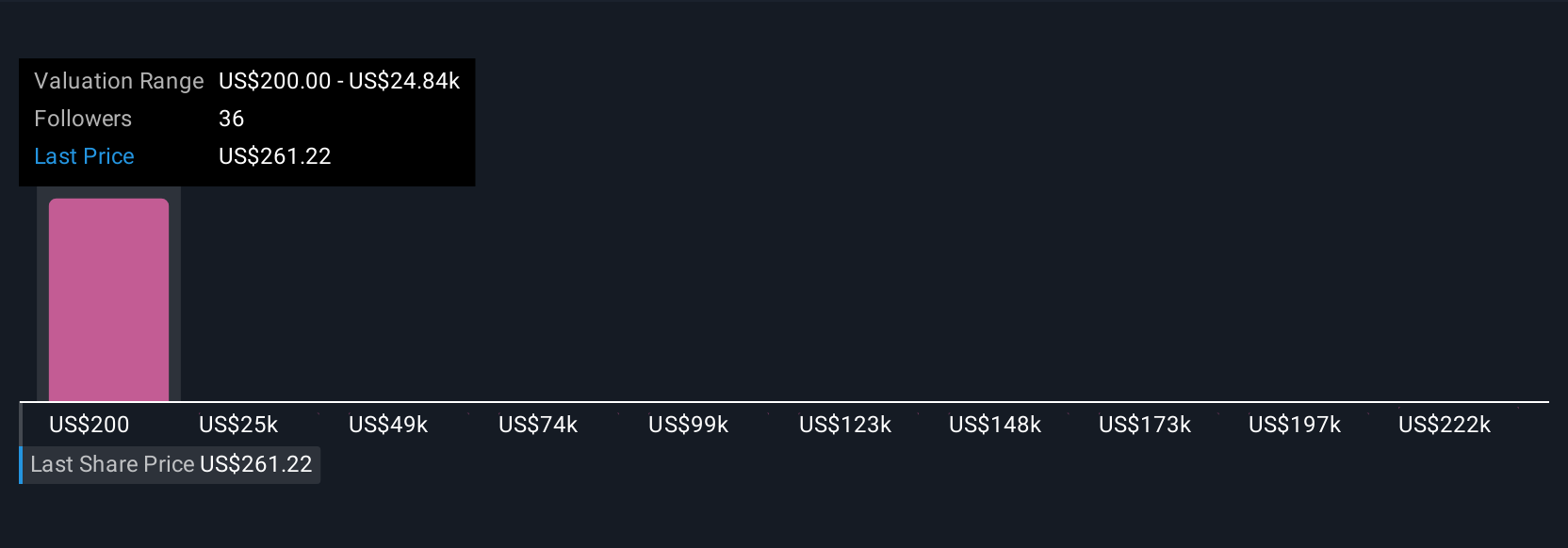

Four members of the Simply Wall St Community placed fair value estimates from US$223 to US$780, revealing almost US$560 of variance. While some see value, customer retention has emerged as a recurring concern that could shape Charter's trajectory and invite even wider differences in market opinion.

Explore 4 other fair value estimates on Charter Communications - why the stock might be worth over 2x more than the current price!

Build Your Own Charter Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charter Communications research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charter Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charter Communications' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.