Please use a PC Browser to access Register-Tadawul

Should Leer South Mine Delay and Insider Selling Prompt Fresh Analysis by Core Natural Resources (CNR) Investors?

Core Natural Resources Inc. Ordinary Shares CNR | 84.99 84.99 | -2.88% 0.00% Pre |

- Earlier this year, Core Natural Resources reported a 47% year-over-year revenue increase after its formation through the CONSOL Energy and Arch Resources merger, with the Leer South mine restart now scheduled for later in 2025.

- This operational update, paired with substantial insider share sales over the past year and absence of insider buying, raises important questions about alignment and future direction for stakeholders.

- We'll review how the Leer South mine restart timing and insider selling activity now reframe Core Natural Resources' investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Core Natural Resources Investment Narrative Recap

To invest in Core Natural Resources, you need to believe in the company’s ability to drive growth after the merger of CONSOL Energy and Arch Resources, and that the delayed restart of the Leer South mine remains a pivotal near-term catalyst. While the delay does push back anticipated efficiency and cash flow benefits, it does not appear to fundamentally change the biggest risk: dependence on the successful operational turnaround at Leer South and effective cost management at Itmann, especially given recent operational disruptions.

The most relevant recent announcement concerns insider trading activity: insiders sold US$646,000 worth of shares in the last three months, with no purchases recorded. Given the delayed Leer South restart, these sales may add to shareholder concerns about leadership’s confidence, especially when paired with unbroken selling activity in a period marked by both opportunity and risk for operational recovery.

But with this backdrop of operational upside, investors should also be mindful of…

Core Natural Resources' outlook projects $5.1 billion in revenue and $920.4 million in earnings by 2028. This calls for 15.9% annual revenue growth and a $899.8 million increase in earnings from the current $20.6 million.

Uncover how Core Natural Resources' forecasts yield a $94.75 fair value, a 10% upside to its current price.

Exploring Other Perspectives

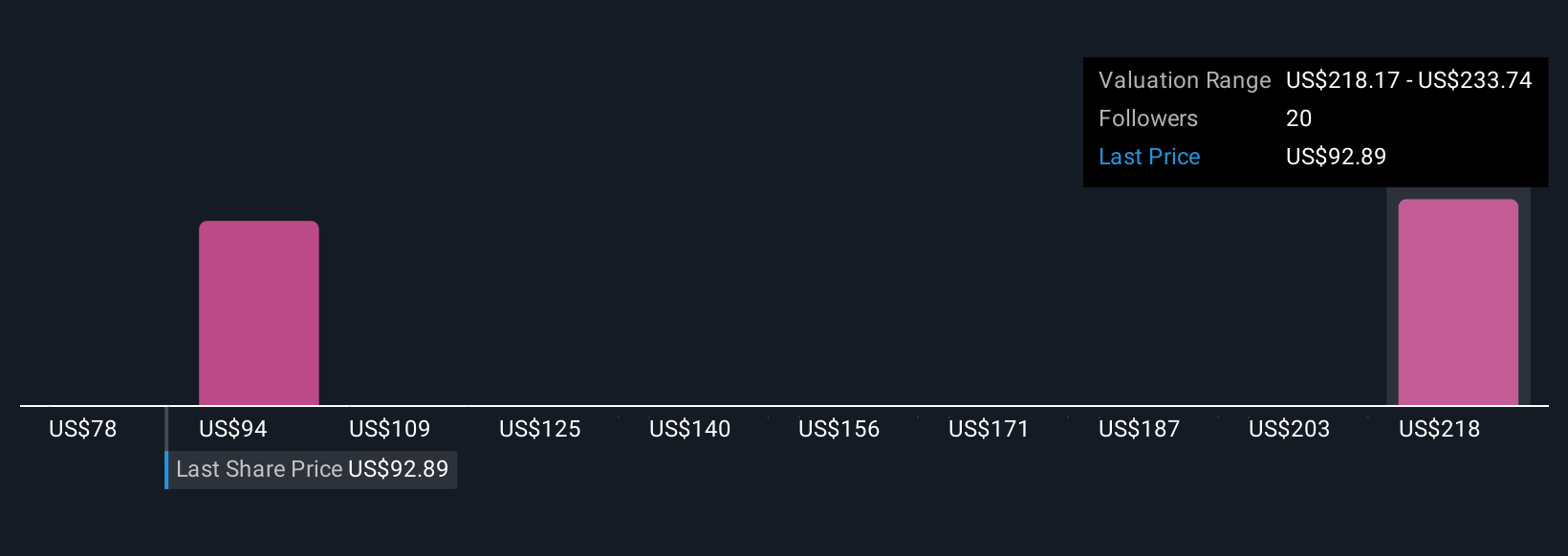

Simply Wall St Community members estimated fair values for Core Natural Resources between US$78 and US$205.75 across four opinions. Compare this span of views with the continued operational risks around the Leer South mine to see how differently market participants weigh near-term recovery versus long-term exposure.

Explore 4 other fair value estimates on Core Natural Resources - why the stock might be worth 9% less than the current price!

Build Your Own Core Natural Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Core Natural Resources research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Core Natural Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Core Natural Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.